US futures

Dow futures -0.01 % at 34580

S&P futures -0.02% at 4437

Nasdaq futures -0.08% at 13906

In Europe

FTSE -0.24% at 7594

Dax +0.11% at 14077

Euro Stoxx -0.25% at 3822

Learn more about trading indices

Corporate earnings and housing data

US stocks are set for a muted start to trade with earnings in focus and a quiet economic calendar after a quiet session on Monday.

US indices have been on the back foot across recent weeks amid rising expectations of a more hawkish Federal Reserve and amid uncertainty surrounding the Ukraine war, which appears to have entered a new phase with Russia attacking hard in the east.

Investors will now focus on corporate earnings to see whether the concerns in the market are being translated into weakness in quarterly results.

On the economic calendar, US housing data suggested that the US housing market remained solid with building permits rising to 1.873 million, ahead of forecasts and housing starts rose 1.793 million, also ahead of expectations.

In corporate news:

Earnings seasons ramp up a gear today with Johnson & Johnson, Hasbro, and the Travelers Companies reporting earnings ahead of the open.

Netflix is due to report after the close and comes after weak subscriber growth forecasts last quarter and as attention shifts to content spending as competition heats up. Data released today in the UK showed that streaming subscription cancellations were rising as the squeeze on disposable income mounts.

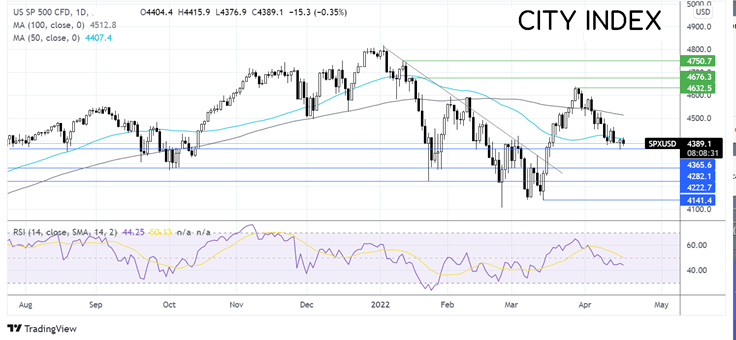

Where next for the S&P500?

The S&P500 ran into resistance at 4623 and rebounded lower falling below the 50 & 100 sma. The losses appear to have run out of steam and the price is consolidating between 4360 last week’s low and 4410 the 50 sma. The RSI is also just south of 50 suggesting consolidation. Buyers will want to see a move over 4410 to expose the 100 sma and round number at 4500. Sellers will look for a move below 4360 to open the door to 4285.

FX markets USD pares gains, JPY crumbles

USD is holding steady, paring earlier gains. US dollar index had rallied earlier extending gains from yesterday after Fed James Bullard talked of a rate hike of 75 bp as a possibility for May but not a base case scenario.

USD/JPY rose to a 20-year high above 128.00 on central bank divergence as the BoJ remains firmly dovish. Rising energy costs are also hurting the outlook for Japan.

EUR/USD is edging higher back towards 1.08 in quiet trade. The USD is driving the pair in otherwise quiet trade with not high-impacting EZ data.

GBP/USD +0.03% at 1.3011

EUR/USD -0.14% at 1.0874

Oil remains volatile

Oil prices edge lower after gains yesterday as volatility in the oil market shows no signs of easing. Concerns over Russian supply remain, and the outage in Libya are keeping prices supported above $100 per barrel. China remains in lockdown, with some signs of easing in restrictions.

However, the GDP downward revision from the World Bank by almost 1% and expectations that the IMF will follow suit is hurting the demand outlook today, dragging on prices. Weak global growth would mean weaker demand.

WTI crude trades -2.27% at $104.98

Brent trades -2.5% at $109.74

Learn more about trading oil here.