US futures

Dow futures -1.1 % at 32466

S&P futures -1.1% at 4057

Nasdaq futures -1.1% at 12418

In Europe

FTSE -2.3% at 7506

Dax -1.78% at 14158

Euro Stoxx -2.5% at 3729

Learn more about trading indices

Jobless claims rise to 10 week high

Stocks sold off steeply in the previous session, with the Nasdaq closing over 4% lower and the Dow dropping 1100 as inflation and slowing growth fears roiled the market.

Today stocks are set to extend those declines as stagflation fears mount. Yesterday the impact that rising costs were having on company profits spooked the market, sending stocks tanking lower. Today weak data is highlighting the slowing growth narrative.

Jobless claims rose to 218k, up from 197k and well ahead of forecasts of 200k. This was the highest level for initial claims in 10 weeks, suggesting that the slowdown could be starting to affect the labour market.

The Philadelphia Fed manufacturing index also plunged lower to 2.6, its lowest level since June 2020 and a much larger than expected drop from 17.6.

The reality is no matter which way your turn, warnings signs are flashing.

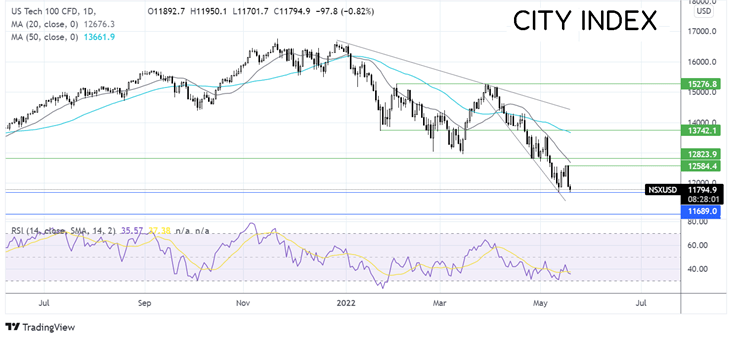

Where next for the Nasdaq?

The Nasdaq has been forming a series of lower highs and lower lows. After running into resistance just short of the 20 sma at 12580, the price tumbled lower. The RSI supports further downside. Sellers need to break below 11700, the year-to-date low, in order to extend the downtrend toward 10960, the November ’20 lows. Any recovery would need to retake 12580 to form a higher high.

FX markets USD drops, GBP, EUR rebound.

USD is falling after strong gains in the previous session. While safe-haven flows lifted the greenback yesterday, today, the USD is tracking treasury yields lower.

GBP/USD is rebounding after yesterday’s steep 1.2% selloff, following data that showed that inflation jumped to 9% YoY.

EUR/USD is rising after ECB minutes were on the more hawkish side of the fence. Policymakers expressed concern about surging inflation, and some wanted to act without delay. Expectations are rising that the June meeting will be used as a platform for a July rate hike.

GBP/USD +0.6% at 1.2413

EUR/USD +0.5% at 1.0520

Oil falls on growth slowdown fears

Fears of a global economic slowdown are pulling oil prices lower on Thursday. Although Shanghai relaxing some lockdown restrictions kept losses limited.

With earnings starting to show the impact of rising input costs, fears of a global slowdown in growth have magnified. Slower growth means weaker oil demand pulling the price lower.

Even so, oil remains comfortably above $100, the key psychological level as the EU continues to try to get approval for its proposed Russian oil ban, with Hungary still critical of the plan.

US inventories fell last week in an unexpected drawdown.

WTI crude trades -1.04% at $105.50

Brent trades -1.3% at $106.50

Learn more about trading oil here.

Looking ahead

15:00 US Existing home sales

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade