US futures

Dow futures -0.8% at 31667

S&P futures -0.6% at 3864

Nasdaq futures -0.4% at 12218

In Europe

FTSE +0.21% at 7349

Dax -0-% at 14725

Learn more about trading indices

Credit Suisse rises, First Republic Bank drops

US stocks are pointing to a lower open as investors digest the latest developments surrounding Credit Suisse and the stronger-than-expected jobless claims report.

Credit Suisse was thrown a lifeline by the Swiss National Bank, which has agreed to loan the troubled bank up to $54 billion to ensure liquidity. The move has restored confidence in the sector sending the Credit Suisse share price and European banking shares higher.

This appears to have stemmed worries in Europe for now and has prevented a deeper selloff in the sector, but it may not be the end of this crisis which threatens to be a slow burner while banks hold huge bond portfolios which have been hit by sharply rising interest rates.

US major banks are pushing higher. However, regional banks remain under pressure as First Republic Bank sees its share price drop 30% on reports that it is weighing up its option. This is hitting confidence across regional banks.

Meanwhile, jobless claims fell by more than expected, dropping from 212k, the 5-month high hit last week to 192k, below forecasts of 205k. This points to a strong labour market and the Fed hiking rates further.

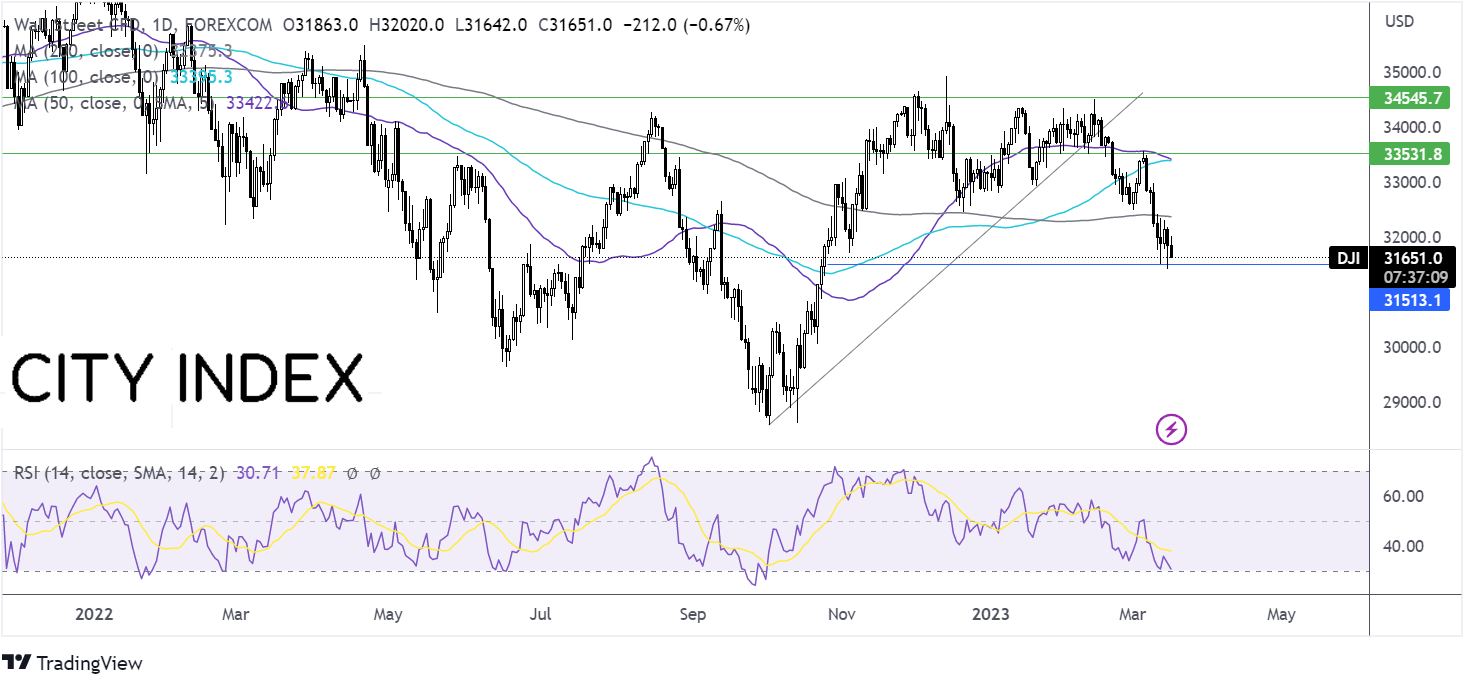

Where next for the Dow?

The Dow Jones hit support at 31425 and has pushed higher but remains below the multi-month rising trendline, the 50, 100 and 200 sma. The 50 sma is crossing below the 100 sma in a bearish signal. The RSI also supports further downside while it remains out of oversold territory. Sellers will look for a break below 31425 the YTD low, to extend the bearish trend towards 31000, the round number.

FX markets – USD falls, EUR tumbles

The USD is falling as the market mood improves. Investors shrug off stronger-than-expected jobless claims. PPI and retail sales data yesterday supported a less aggressive stance from the Fed.

EUR/USD is rising after the ECB raised interest rates by 50 basis points in line with expectations. Attention is now turning towards the press conference.

GBP/USD is edging higher as investors continue digesting Chancellor’s Budget, which sees the UK economy avoiding a recession, but the GDP is expected to contract 0.2% across 2023. Inflation is also forecast to fall to 2.9% by the end of the year. The Budget aims to bring more people back to the labour market, which is currently tight, keeping upward pressure on wages.

EUR/USD -1.3% at 1.0583

GBP/USD -0.8% at 1.2053

Oil steadies below $70

Oil prices are rising slightly after steep losses in the previous session, picking up slightly from a 15-month low.

Oil tumbled below $70 on fears that a financial crisis could hurt the demand for oil. Today’s news that the SNB will shore up the bank has eased feared and is helping oil prices higher.

Oil is also finding support from the upwardly revised oil demand outlook from OPEC and the EIA both citing China’s reopening as reasons for the upward revision.

Gains are limited as investors continue to weigh up inventory data which showed that US crude stock piles rose to 1.6 million, well ahead of the 1.2 million expected.

WTI crude trades -1.5% at $70.45

Brent trades at -1.2% at $76.10

Learn more about trading oil here.

Looking ahead

15:00 US inflation expectations