AUD/USD rises amid an improved market mood, hotter Chinese inflation

AUD/USD is heading higher, snapping a two-day losing run. The risk-sensitive Aussie is benefitting from an improved perspective in the market.

Reports that Ukraine is no longer insisting on NATO membership, one of the reasons that Russia invaded in the first place, and the fact that there are more peace talks planned for tomorrow is helping to buoy risk sentiment.

Hotter than expected, Chinese inflation is also lifting the Chinese proxy. Chinese CPI inflation rose to 0.9% YoY, and PPI was 8.8% ahead of the 8.7% forecast.

Less dovish comments and cautious optimism from RBA’s Lowe add to the upbeat mood towards the Aussie, despite a national emergency owing to local floods.

Meanwhile, stronger risk sentiment is keeping the safe-haven US dollar under pressure for a second straight session.

Russia Ukraine headlines will continue to be the dominant driving force.

The economic calendar is relatively quiet, with US JOLTS job openings expected to confirm a tight jobs market.

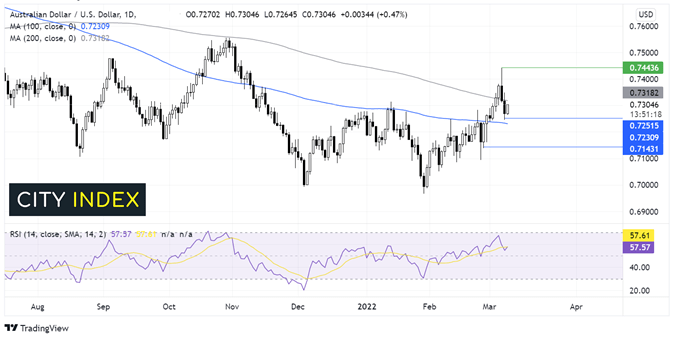

Learn more about forex market hoursWhere next for AUD/UsD?

AUD/USD has seen a wild start to the week, rising to 0.7445, 2022 high, before heading lower and finding support at 0.7250.

The uptrend from late January remains intact, and the RSI is also supportive of further upside.

Buyers will look for a move over the 200 sma at 0.7320 for further upside towards 0.74.

Sellers will look for a move below the 100 SMA at 0.7230 to negate the near-term uptrend and target 0.7160 the February 28 low.

DAX surges higher ahead of more peace talks tomorrow

The German DAX is charging higher as European equities kick off the session on the front foot, shrugging off surging oil prices.

Whether this is just another dead cat bounce or the start of a more meaningful recovery is largely dependent on Russia Ukraine headlines. Still, the markets adopt a more positive tone at the beginning of trading on Wednesday, as more peace talks are set for tomorrow.

The economic calendar is light across the board, leaving risk sentiment in the driving seat.

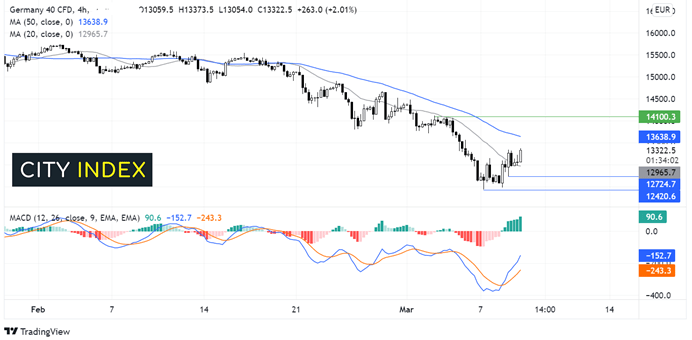

Learn more about trading the DAXWhere next for the DAX?

The DAX is extending its rebound from 12420; the 2022 low struck earlier this week. The recovery has moved above the 20 SMA, which, combined with a bullish crossover on the MACD, keeps buyers hopeful of further upside and a move over the 50 sma at 13650. It would take a move over 14100 for buyers to turn the bias bullish, which could require a tremendous amount of momentum.

Panning out the broad trend is still bearish. Sellers will be looking for a move below the 20 SMA at 12950 to bring yesterday’s low of 12725 into play and 12420 the 2022 low into view.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.