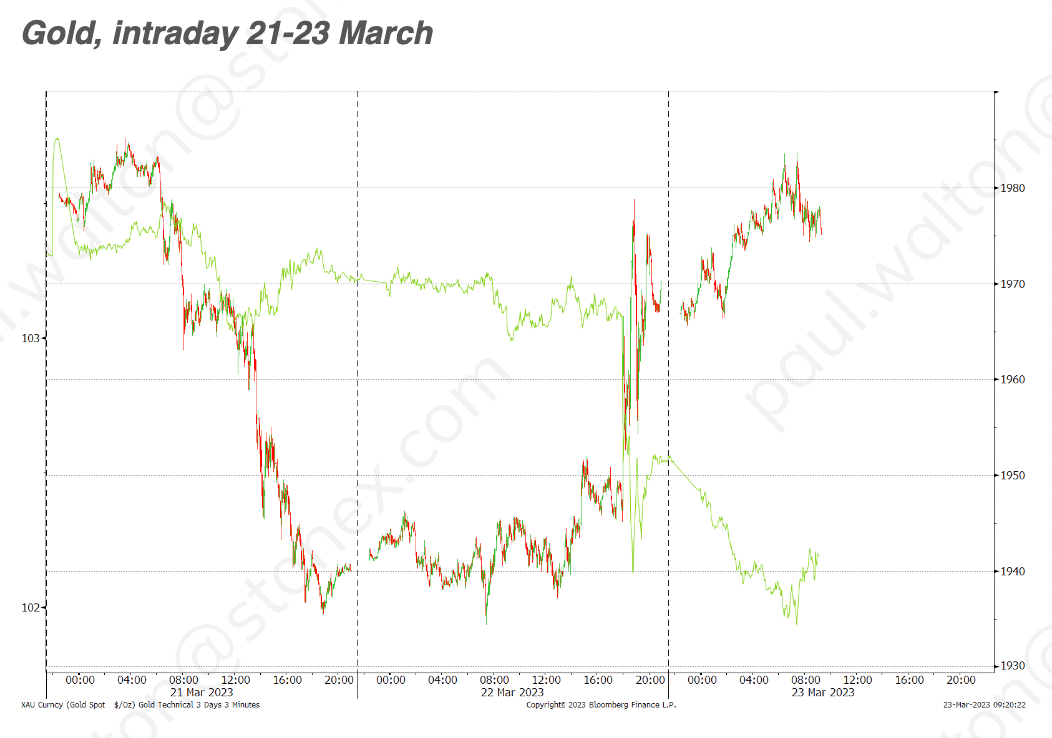

Gold edged higher before and during yesterday’s FOMC meeting, closing on the $2,000 per ounce level last seen in august 2020, and 14% up year-to-date. Gold will end the year at $2,070 per ounce in the view of Rhona O'Connell, StoneX Head of Commodity Market Analysis for EMEA & Asia.

During Jay Powell’s Press Conference yesterday, gold prices moved higher, as the market parsed hints that the Fed is concerned about underlying risks. The Fed indicated that it is alert to the possibility of further issues in the banking system, and the downside risks that could accrue from commercial banks’ needs to safeguard their liquidity. Powell noted the potential impact of “tighter credit conditions on economic activity, the labor market, and inflation, and our policy decisions will reflect that assessment”.

FOMC highlights

- Financial markets were expecting at least a 25-point rate hike from the Fed this month, which they duly received

- The FOMC is expecting the peak interest rate to be 5.1%, unchanged from its previous target

- Powell said the banking system is safe, bank flows have stabilized, and deposits are protected

- Nonetheless, the Fed undertaking a “through internal review” that will identify where it can strengthen regulation and supervision

- Credit tightening can be seen as equivalent to a rate hike in terms of the impact on the economy, and consumer activity in particular

FOMC Statement

The FOMC softened the tone of the accompanying statement. In February, they continued to use the words: “The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals” and “ongoing increases in the target range will be appropriate”.

In March, the tone was softer; the reference to cumulative tightening was still there, but a more flexible approach was suggested, in that “some additional policy firming may be appropriate”. The tense changed from “will” to “may”.

Confidence was promoted: “The US banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”

Source: Bloomberg, StoneX

Taken from analysis by Rhona O’Connell, Head of Commodity Market Analysis for EMEA & Asia (rhona.oconnell@stonex.com). Forecasts made in this article represent the views of the StoneX Metals and Energy teams and not necessarily those of FOREX.com or City Index analysts.