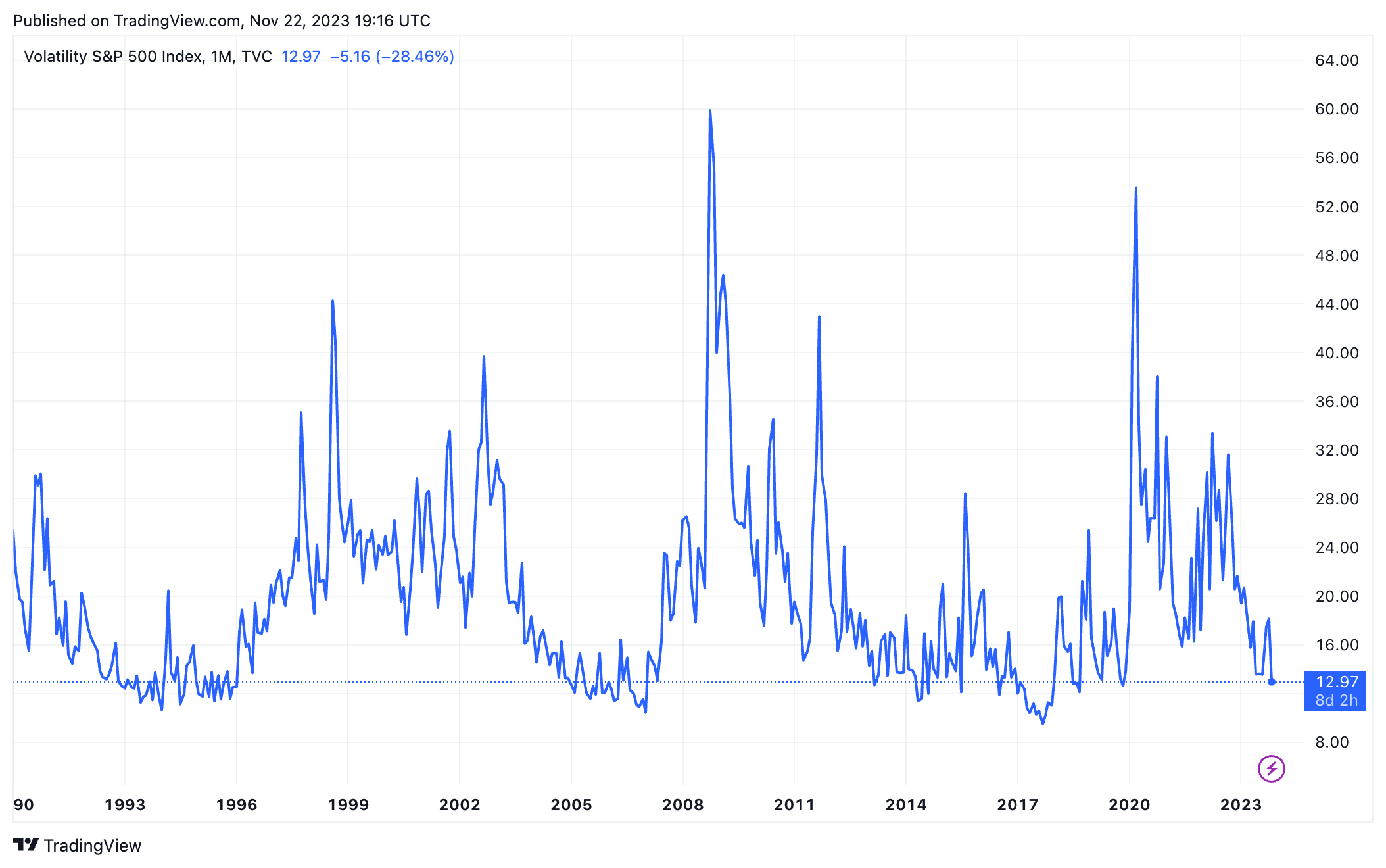

Equity markets acknowledge little risk in coming months, judged by the Vix, Wall Street’s fear index, which dipped to a decade low of 12.9. Whether this is bullish, bearish, or has no real message is unclear. Elsewhere, the Russell 2000 and Nasdaq were up 0.7%, the dollar rallied, and Gold held above the $2,000 mark. Oil prices fell 1.0% despite the likelihood that OPEC+ will extend supply cuts.

TODAY’S MAJOR NEWS

VIX low suggests equity investors are relaxed

The VIX index calculates the risk appetite of option investors based on the implied volatility of options on S&P 500 stocks, moving higher or lower during bearish or bullish periods, respectively. Implied volatility is a measure of stock price variance or risk, and it's used to price share prices or index options. Hence the short-hand description: Wall Street’s fear index.

Since its introduction in the early 1990s, the VIX has traded as low as 9.34 (October 2017) and close to 85.5 (October 2008), but the monthly data in the chart shows a monthly average highpoint of 60. The VIX most often trades in the 14-24 range, indicating an optimistic investor outlook and modest sell-off risk.

But, and it's an essential qualification, the VIX is, at best, an indicator of current market conditions. It conveys little, if any, information about the future movement of share prices. There have been periods – the end of the 1990 tech boom, in the 2007-08 credit crisis, and during the early days of the Covid pandemic in 2020 – when the VIX trebled or quadrupled as equity markets sold off. There have been other periods when the VIX has drifted higher in periods when equity markets were uneventful. Judging by the pricing of S & P 500 index options, investors are pretty relaxed.

VIX Index

Source: TradingView.

OPEC delays meeting to discuss supply cuts

As we approach a critical OPEC+ meeting at which supply reductions are expected to be extended or increased, confirming an era in which OPEC policy is for ‘price-driven’ oil to achieve a targeted high price rather than one driven by fundamental balances. Ominously, Saudi Araba pushed back Sunday’s meeting by a week, and traders believe they are buying time to approve further production cuts.

StoneX energy analyst Harry Altham believes supply and demand are close to equilibrium, and prices accurately reflect that reality. Further supply cuts would be a shock. “To be clear, we see OPEC+ as most likely extending their production cuts (including voluntary ones) into January 2024, which could extend to the end of Q1. In the event of a supply change, we believe there is a heavy skew towards additional cuts rather than a relief to them, particularly with recent demand-side data from China amid price pressure from producers such as Saudi Arabia.”

Jobless claims switch back to tightening trend

Today’s jobless claims numbers suggest a tightening job market, reversing the recent trend.

- First-time jobless claims fell to 209,000 in the week ending November 18, below analyst expectations of 225K and down from 233,000 the previous week

- The four-week moving average fell slightly to 220,000 claims

- Continuing claims for the week ending November 11 fell 22K to 1.84 million, while the four-week moving average rose by 14,250 to 1.837 million

Durable goods orders flat ex transport

Core capital goods were flat in October, reflecting no deterioration in business sentiment.

- Durable goods orders fell 5.4% in October, worse than the expected 3.2% decline, while the September number was revised to 4.0% gains, down from the 4.7% initially reported

- However, durable goods orders minus transportation were flat in October, pretty much as expected, and down from 0.2% growth last month

- Core capital goods orders, a key measure of business sentiment, fell 0.1% in October, versus an expected 0.2% increase, but better than the revised 0.2% contraction in September

Chinese property developers continue to default

Wanda, a Chinese commercial property developer, is delaying payment on a dollar debt of $600 million due in January, it reported to the Hong Kong Stock Exchange on Tuesday. The company also has two other loans due in 2025 and 2026, totaling $800 million. China’s property sector has witnessed more than $100 billion worth of bond defaults in three years. A Goldman Sachs report said the default rate for high-yield property bonds has reached 42.2 % this year, following a record-high ratio of 46.8% last year. There is little sign of a revising trend in sluggish property sales in November, with some industry observers expecting even weaker property sales in November. This will do little help to those cash-short property developers, leaving China’s economy at greater risk if the downturn can't be revised soon.

China and Saudi make critical currency deal

China and Saudi Arabia continue to develop closer financial links, signing a currency swap deal worth 50 billion yuan ($6.98 billion), valid for the next three years, to facilitate trade between the two countries. Saudi Arabia joins contracts with the United Arab Emirates, Qatar, and Egypt in Chinese agreements designed to promote business; increasing the yuan over the US dollar is playing the long game to displace the dollar with the yuan.

TODAY’S MAJOR MARKETS

Stocks rally

- The Nasdaq and Russell 2000 rose 0.7% in morning trade, with the S&P 500 up 0.5%

- The Dax and Nikkei 225 were up 0.3%, while the FTSE 100 fell 0.2%

- The VIX, Wall Street’s fear index, fell to 12.9

Dollar rallies

- 2- and 10-year yields were a shade higher at 4.90% and 4.43%, respectively

- The dollar index was up 0.4% to 103.9

- Versus the dollar, Sterling and the Euro were off 0.4% and 0.2%, respectively, while the Yen fell 1.0%

Gold holds 2K, oil sees profit-taking

- Oil prices fell 1.0% to $77.0 per barrel

- Gold prices held above $2,000 per ounce, up 1.1%, while Silver prices fell 1.1% to $23.6 per ounce

- Grain and oilseed prices were mixed in morning trade

- Soybeans were modestly lower after a couple of private estimates calling for record production in Brazil

- Wheat got a bounce from a sale to China, helping to support corn prices

Analysis by Arlan Suderman, Chief Commodities Economist: Arlan.Suderman@StoneX.com

Market outlook by Paul Walton, Financial Writer: Paul.Walton@StoneX.com