‘Buy on the rumor, sell on the news’ appears to be the operative phrase on Wall Street today, with the Russell 2000 off 1.2% and Gold off 0.5% after rallies leading up to and on the announcement of the Fed’s interest rate outlook this week. A statement by the New York Fed President brought a bit of reality to the markets with skeptical comments on any near-term rate cuts.

TODAY’S MAJOR NEWS

New York Fed President pours cold water on immediate rate cuts

New York Fed President John Williams said: “We aren't really talking about rate cuts right now," on CNBC today. “We're very focused on the question in front of us, which as Chair Powell said…is, have you gotten monetary policy to a sufficiently restrictive stance?”

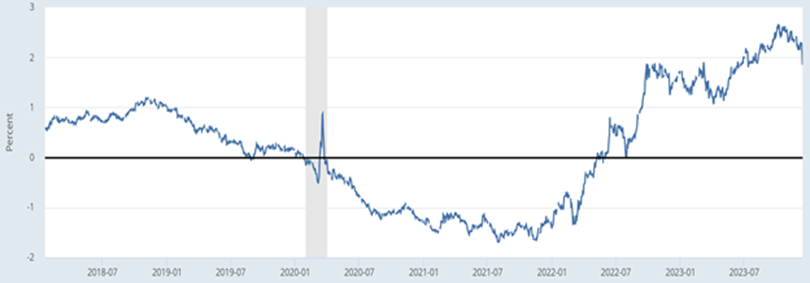

Real interest rates fall sharply, potentially boosting asset prices

The yield on 10 year TIPS, Treasury Inflation-Protected Securities (TIPS), has seen a remarkable fall in the past few days and is down from a peak of 2.5% at end of October to 1.7% today. That’s a big move in a short period of time. The Fed’s announcement that rate cuts are possible next year, as inflation is tamed, is the best explanation for this rally. If inflation falls towards 2%, TIPS yields could in theory fall further. The Treasury will be auctioning more of the existing 5-year TIPS on December 21, and a new 10-year TIPS on January 18, 2024. These auctions could spark investor demand and result in much lower real yields.

Why is this important? Finance theory would argue that all assets should be priced on the real interest rate, which is what TIPS represent, and the lower this rate is the more valuable equities, bonds and real estate become. TIPS yields have ranged between -1.75% and +2.5% in the past few decades. When TIPS provided a negative real return, the start of 2020 and to mid-2022, the impact on US equity markets was electrifying. The Nasdaq 100 index doubled, for example. Real interest rates closer to 1% than 2% would be very supportive for equity market valuations.

TIPS 10 year real interest rate

Source: St. Louis Fed, 10-Year 0.5% Treasury Inflation-Indexed Note, Due 1/15/2028.

Could Ukraine join the EU?

European Union leaders released a statement yesterday that the economic bloc is committed to facilitating the export of Ukrainian grain agricultural products and to provide funds to repair its damaged port infrastructure. Will Ukraine membership of the European Union actually occur? Reuters did an in-depth analysis this summer that was insightful, revealing the details of an internal EU study done in July. Ukraine’s membership would authorize it to get 96.5 billion euros ($106 billion) in aid under the bloc’s Common Agriculture Policy over seven years, and another 61 billion euros under the EU’s cohesion policy, aimed at equalizing EU living standards. In total, Ukraine would be eligible to get 186.3 billion euro in the seven-year budget, meaning that many countries that are now net recipients of EU funds would become net contributors, while other current net contributors would have to pay even more.

Ukraine has an estimated 41 million hectares of arable land, compared to 30 million in France. Becoming a member would necessitate the free movement of all agricultural products across the border into Europe, swamping markets and increasing the backlash of farmers in other European countries. Acceptance of Ukraine’s membership application would also make the EU’s labor market open to millions of lower paid Ukrainian workers, as when Poland joined. That’s part of what led to the eventual exit of Britain from the EU. Membership would also require members to contribute to Ukraine’s security “by all means in their power,” increasing their financial obligations. This question of membership will likely draw out for years and is likely to be very contentious.

TODAY’S MAJOR MARKETS

Traders take profits, Russell 2000 suffers

- The Dow Jones, S&P 500, and Russell 2000 all sold-off today, the latter down 1.2%, while the Nasdaq was unchanged

- The Nikkei 225 rallied, up 0.7% overnight, while the FTSE 100 was down 1.0% and the DAX was unchanged

- The VIX, Wall Street’s fear index, was unchanged at 12.5

Bonds rally, Dollar strengthens

- 10-year TIPS index-linked yields held steady at 1.71% yield

- 2- and 10-year yields were also unchanged, at 4.39% and 3.93% yields, respectively

- The dollar index rose 0.7% to 102.6, reversing its recent weakness

- Versus the dollar, the Euro and Sterling were off 0.8%, while the Yen was off 0.2%

Oil prices rally, gold sees profit taking

- Oil prices rallied rose 0.3% to $71.8 per barrel, continuing its recovery

- Gold prices saw profit-taking after hitting all-time highs, off 0.5% to $2,034 per ounce, while Silver prices fell 1.1% to $24.1 per ounce

- The grain and oilseed sector was mixed and also saw profit-taking

Analysis by Arlan Suderman, Chief Commodities Economist: Arlan.Suderman@stonex.com

Market outlook by Paul Walton, Financial Writer: Paul.Walton@StoneX.com