Bullish factors

- Uncertainty about the viability of budget targets for 2024 may increase investors’ risk premium requirements for Brazilian assets and decrease foreign investments, weakening the BRL.

Bearish factors

- Disclosure of more moderate data for the American economy can reinforce the perception that the interest rate level in the country has already reached its peak and contribute to weakening the USDBRL.

- Disclosure of data on the Chinese economy can reinforce the perception of a faster rebound, favoring the performance of currencies from commodity-exporting countries like Brazil.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

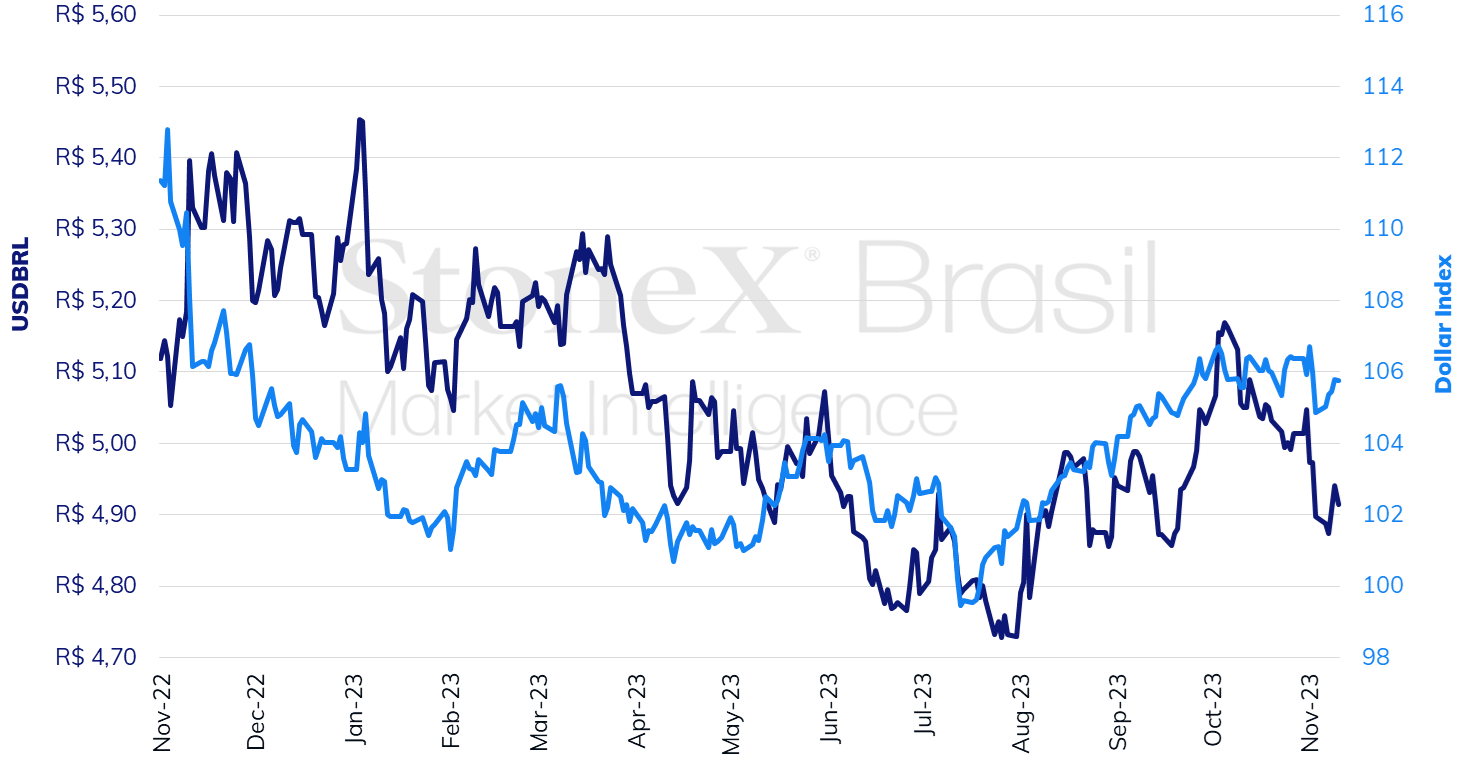

The USDBRL ended the week higher, closing Friday's session (10) at BRL 4.914, a weekly increase of 0.3%, but a monthly decrease of 2.7% and an annual decrease of 6.9%. The dollar index closed Friday's session at 105.8 points, a change of +0.8% for the week, -0.2% for the month, and +2.4% for the year. The trade reacted to statements from Federal Reserve authorities about American monetary policy, the release of IPCA in Brazil, and the progress of the economic agenda in Congress.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

HIGHLIGHTS: Fiscal target and LDO

Expected impact on USDBRL: bullish

The focus of investors this week should be the discussion about the credibility of the fiscal targets for 2024. Last week, the Mixed Budget Committee (CMO) approved the Budget Guidelines Law Bill report for the 2024 Budget, maintaining the original target of zero primary deficit, just like in approving the new fiscal framework. Nonetheless, the debate about a change in this objective remains open without eliminating investors' insecurity about a possible relaxation in managing the federal government's public accounts. The rapporteur, Congressman Danilo Forte (União-CE), established a deadline of Thursday (16) for the presentation of amendments to the project, so there is still the possibility of changes before the project is considered in the Plenary scheduled for the week of November 20. While some sectors of the Administration advocate for an immediate change in the target to a deficit of 0.5% of the Gross Domestic Product, other groups argue for its maintenance at this time, with a possible modification in March. What seems consolidated, however, is the unwillingness to cut expenses to adjust the fiscal result to the established fiscal objectives, and this is the origin of the greatest perceptions of fiscal risks to Brazilian assets, which can increase the demand for risk premiums by investors and weaken the BRL.

US economic data

Expected impact on USDBRL: bearish

This week will also see the release of October indicators for the United States. The Consumer Price Index (CPI) should maintain the moderation trend from previous months, with a median expectation of a 0.1% increase for the overall index and a 0.3% increase for the core indicator, excluding the volatile components of food and energy. On the other hand, retail sales are expected to ratchet down their pace of expansion, remaining stable in the overall indicator and growing 0.3% in the core. Reading can reinforce that the American economy is experiencing a "soft landing," gradually tempering its inflation and maintaining a stable pace of growth, even though authorities remain cautious about the prospects for the coming months.

Last week, Federal Reserve (Fed) Chairman Jerome Powell gave a harsh rating regarding the inflationary picture for the United States. In addition to repeating that it is still too early to believe that the battle against inflation is won and that the Fed will not hesitate to raise interest rates more times if the data justifies such measures, Powell stated that he is "not confident" that the current level of monetary tightening is enough to bring price indices to the institution's continuous 2% target and that it is necessary to consider both the risks of being deceived by a few months of favorable data and the risks of excessively slowing down the economy.

Additionally, Powell declared that the "disinflation" that has occurred so far has been relatively painless and driven by supply items, such as the normalization of the logistics chain and the fall in prices of industrial goods and commodities. Nonetheless, he expects these contributions to be coming to an end so that the fall in prices from now on will need to be achieved through a reduction in aggregate demand, caused, in turn, by tightening financial conditions.

China economic data

Expected impact on USDBRL: bearish

This week, data on manufacturing, retail sales, and the unemployment rate for October will be released. Other indicators of the month have shown a mixed performance so far, not providing a consistent reading on the country's economic activity pace. Thus, this week's data can offer financial market agents a more updated reading of the country's situation and economic dynamism.

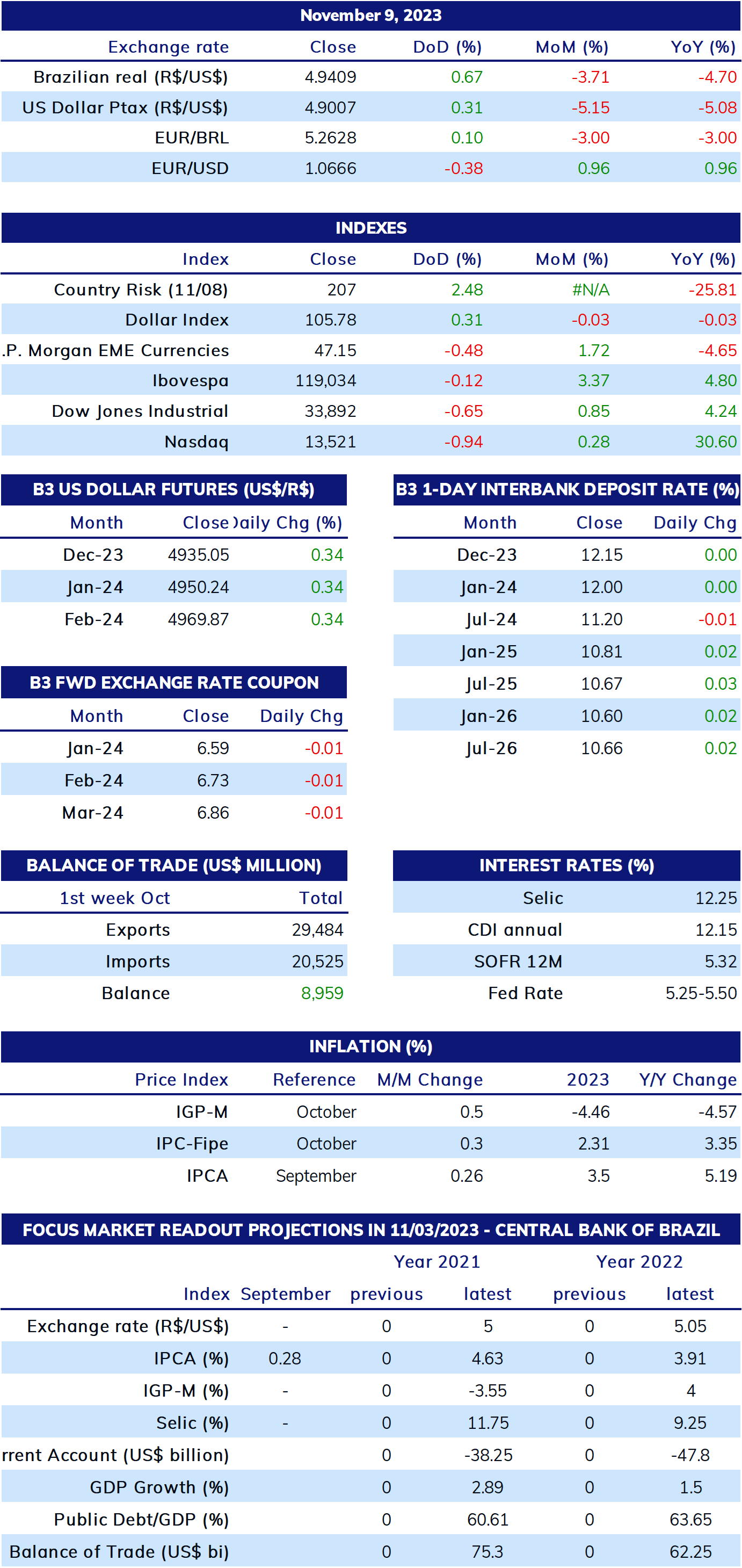

Key Indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos (leonel.mattos@stonex.com), Alan Lima (alan.lima@stonex.com), and Vitor Andrioli (vitor.andrioli@stonex.com).

Translation by Rodolfo Abachi (rodolfo.abachi@stonex.com).

Financial editor: Paul Walton (paul.walton@stonex.com).