Metals trading

-

Go long or short

Profit from falling as well as rising prices on precious metals

-

Hedging opportunities

Hedge against falling indices and periods of market turbulence

-

Range of markets

Trade copper, palladium, platinum and other metals markets

Metal prices are driven by many factors, including geopolitical risk, and some are seen as safe-haven markets during times of heightened market volatility. You can buy (go long) or sell (short the market) depending on whether you think the price of a metal will rise or fall.

-

Diversify your portfolioMetals and commodities are often used by traders as part of their portfolio diversification to mitigate risk.

-

Go long or shortWhen you trade metals with us, you can profit from both rising and falling markets.

-

Take advantage of leverageYou only put up a fraction of the value of the trade to open a position. Leverage can magnify your profits and your losses.

-

Trade anytime, anywhereOur multi-award-winning platform gives you instant access to metals and thousands of other tradable instruments.

Competitive pricing

Major metals market news

Latest research

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

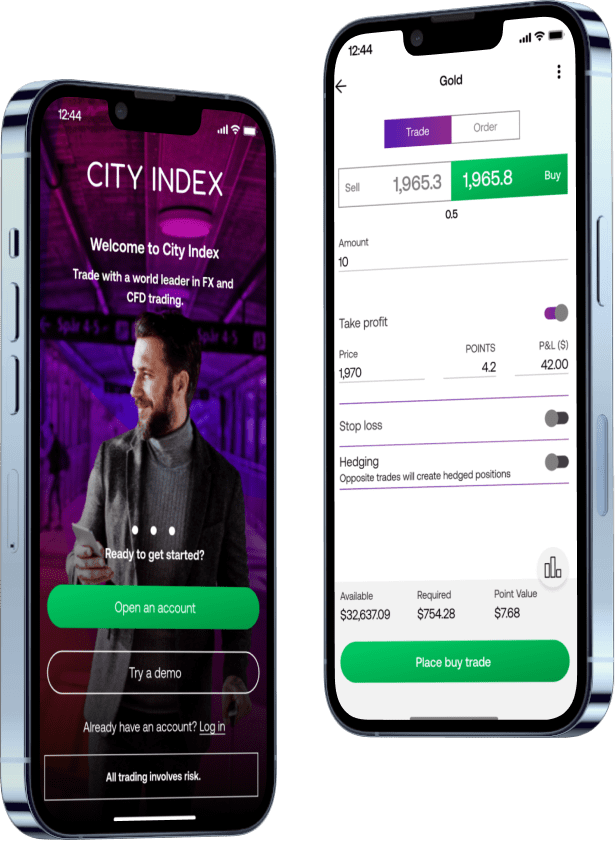

Mobile trading app

Seize trading opportunities with our easy-to-use mobile apps, with simple one-swipe trading, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charting

Complete with in-chart trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access insightful data on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade metals with City Index

- Choose a market

- Choose the direction

- Add a stop loss

- Monitor and close your trade

Decide which market you want to trade on using CFDs and use our intuitive TradingView charting with advanced indicators and drawing tools to identify your next trading opportunity.

Buy if you think your market will increase in value or sell if you think it will fall

Manage your risk with an optional stop loss, which closes your position out if the market reaches your predetermined level

See your profit and loss updated in real time. Exit your trade by clicking the 'close trade' button

How to trade gold

Discover what gold trading is, what moves the value of gold and how to trade gold futures, options, spot prices and stocks.

How to trade silver

Learn everything you need to know about trading the precious metal, a popular alternative to gold trading.

What moves the price of gold?

Gold is prized for its stability – when other markets fall, gold can retain its value. But that doesn’t mean it’s free from volatility.