Key features

GSLOs are a great way to protect your positions from slippage or gapping, caused by unexpected market movements, and close trades at a limit you define. Adding GSLOs to your trades can be a prudent risk management strategy in trading.

Key features include:

Guaranteed closeout

Your trade is guaranteed to close at the price you set up front, making it limited risk.

Free to place

GSLOs are free to place and you’ll only be charged a small premium if the GSLO level is reached.

Amendments

You can amend your GSLO during market hours without incurring additional fees.

Minimum distance

Order levels must be placed at a minimum distance from the current quoted price.

Availability

Offered on a range of our 6,300+ markets, GSLOs provide a cost-effective method of managing your risk.

What are the costs involved?

Stop premium

If your trade reaches the guaranteed stop level and the GSLO is triggered, you’ll be charged a small premium to cover the guaranteed closeout. This is known as the ‘GSLO premium’ and varies by market.

For example, if you bought 2 Australia 200 CFDs (where the stop premium is 1x quantity of CFDs/stake) and placed a GSLO, then your stop premium would be 1 x 2 = $2. You would only be charged this amount if your stop was triggered. You can see the stop premiums on our most popular markets below.

Margin requirement (Professional clients only)

For professional clients, GSLOs enable you to trade with a lower margin requirement than you would with a normal position, as you determine your maximum risk when setting your trade size and GSLO level.When trading using GSLOs, margin is calculated as follows:

Trade size x stop distance

Stop distance is the distance between the opening price and the stop price.

Popular markets

Available across thousands of global markets, see GSLO premiums on our most heavily traded markets below.

| Indices | Premiums (charged upon trigger) |

|---|---|

| Germany 40 | 0.7 x CFDs or stake* |

| Australia 200 | 1 x CFDs or stake* |

| Wall Street | 1.8 x CFDs or stake* |

| UK 100 | 0.4 x CFDs or stake* |

| Equities | Premiums (charged upon trigger) |

|---|---|

| Apple | 0.25% of notional trade value |

| Commonwealth Bank of Australia | 0.5% of notional trade value |

| Deutsche Bank AG (EUR) | 0.25% of notional trade value |

| Rio Tinto (AUD) | 2% of notional trade value |

| Commodities | Premiums (charged upon trigger) |

|---|---|

| Gold | 3 x CFDs or stake * |

| Silver | 2 x CFDs or stake * |

*Charged in base currency of the market and then converted to the base currency of the account.

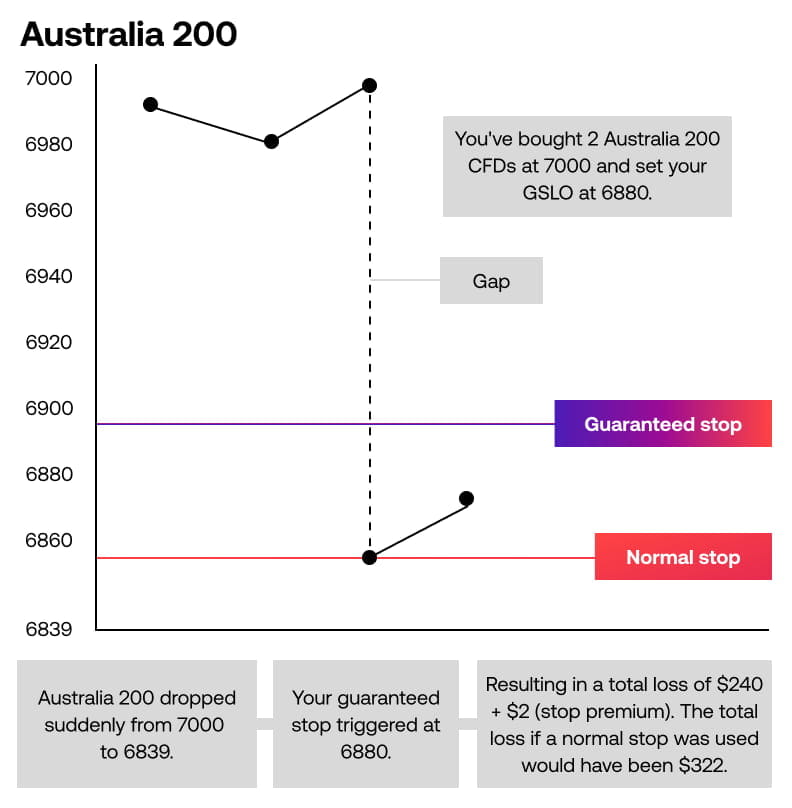

Example of a GSLO trade

You believe the Australia 200 market price is going to rise, so you buy 2 Australia 200 CFDs with an opening price of 7000.

You place a GSLO at 6880, which means the maximum loss on the trade would be (7000 – 6880 = 120) x 2 = $240.

The stop premium for the Australia 200 is 1 x the quantity of CFDs and would therefore be 2 x 1 = $2 if your GSLO was triggered.

The required margin is calculated as follows:

Trade Size x Stop Distance

In this example, your margin requirement would be: 2 x 120 = $240.

As a result of high volatility, the price of the Australia 200 moves against you and unexpectedly drops from 7000 to 6839.

Despite market gapping, your trade closes automatically at your specified GSLO price of 6880.

Your total loss on the trade is therefore $240 (maximum risk) + $2 (stop premium) = $242.

If you had used a standard stop, then your position would have closed at 6839 and resulted in a loss of $322.