- What is Bitcoin

- How does Bitcoin work

- Benefits of Bitcoin trading

- Risks of Bitcoin trading

- How to trade Bitcoin

- What is the City Index policy on Bitcoin forking

What is Bitcoin?

Bitcoin is a decentralised cryptocurrency or peer-to-peer digital payment system which is used as a method of investment as well as transaction for other currencies, services or products.

Initially launched in 2009 by an anonymous internet user or group known only as “Satoshi Nakamoto,” the virtual currency has grown rapidly since its inception.

The value of early Bitcoin transactions was negotiated by miners on the bitcointalk forums with each Bitcoin at the time worth an estimated $0.06.

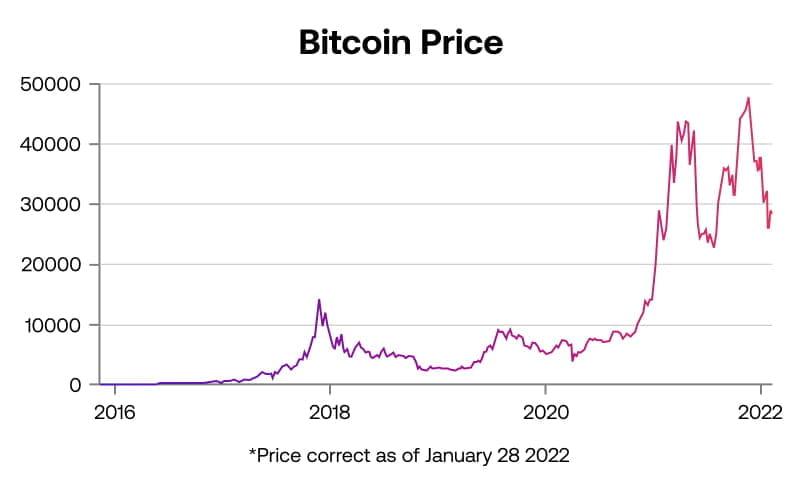

As Bitcoin has become more widely used and as greater quantities of Bitcoin have been mined, the price has risen sharply.

How does Bitcoin work?

Bitcoin transactions are managed by a network of independent computers using the blockchain which acts as a decentralised, digital public ledger for all Bitcoin transactions.

The information stored in the blockchain is open to anyone and because of the high level of transparency makes Bitcoin transactions exceptionally secure. Records stored using blockchain cannot be altered retroactively and must be confirmed and collaboratively authenticated by a community of Bitcoin “miners”- or the overall network majority.

Benefits of Bitcoin trading

Bitcoin is a cryptocurrency and as a decentralised asset, it is free from interference by a single country, macro events or natural disasters which can impact more traditional asset classes. Because Bitcoin is not traded on an official exchange, you can trade 24 hours a day (excluding weekends).

When you trade Bitcoin CFDs:

- You can take advantage of Bitcoin price volatility without owning coins

- Markets are open during FX market hours, which means that you can trade 24/5

- Unlike when you buy Bitcoin on an exchange, when you trade with City Index, you can also go short to profit from falling prices

- You’ll be able to use our advanced risk management tools to help protect yourself from losses

Risks of Bitcoin trading

Bitcoin is also a highly volatile market, and as demand surges for a finite number of bitcoins (there are 21 million available), prices can experience dramatic and significant surges.

The price of Bitcoin has surged several million percent since its inception, and one of the biggest risks to traders is this extreme volatility. Bitcoin is currently much more volatile than most other assets, and when prices crash, you can be faced with significantly larger losses than in other markets.

Because there are a limited amount of reputable digital asset exchanges and no single reliable price source, this could, in theory, cause the price to tumble sharply. Remember, Bitcoin is also a new asset, so there is limited evidence of how it may perform in a major financial crisis. Nobody knows whether it will become globally accepted or even whether it may one day disappear or be overtaken by other cryptocurrencies.

It is also possible that certain governments may ban its citizens from holding Bitcoin, causing prices to crash.

Furthermore, there is a possibility for large-scale cyber-attacks on digital asset exchanges which are likely to have a strong, short-term impact on the price of Bitcoin.

Investors involved in Bitcoin trading should also be aware of the potential for a so-called “51 percent attack”. A 51 percent attack refers to one centralised Bitcoin mining operation gaining over 50% control of the blockchain, which would allow the operation to reverse transactions making the entire blockchain unusable and the future of Bitcoin uncertain.

Remember that while this heightened volatility in the Bitcoin market brings opportunity, it also means a greater degree of risk, so understanding the market and managing your risk carefully with the use of stops and limits is crucial when trading Bitcoin. Like with any market, make sure you do your research and understand how and why the price of Bitcoin moves before you start trading.

How to trade Bitcoin

You can trade Bitcoin with City Index as a CFD. When you do this, you do not own any underlying Bitcoin assets and do not need a virtual wallet. Instead, you are speculating on price movements between Bitcoin and USD. Our pricing is based on the underlying price from multiple, reputable exchanges.

When you trade Bitcoin with City Index, you are trading on leverage, and this means you can gain a larger exposure to the market than might be possible by purchasing actual bitcoins. This means that you can open a position without tying up a lot of your capital and benefit from sharp market movements.

Remember, Bitcoin can be extremely volatile and sharp market movements can mean that you have the potential to suffer significant losses quickly, and in some cases, losses that are more than you initially invest. We strongly recommend that you understand the risks of trading Bitcoin and ensure that your strategy incorporates strong risk management tactics.

Should you have any further questions regarding trading on Bitcoin, please see our FAQ page.

Interested in Bitcoin trading? Get started today by opening an account with City Index.

What is the City Index policy on Bitcoin forking?

In the event that the current bitcoin splits into two, new bitcoins are created; this is known as a hard fork. We will generally follow the bitcoin that has the majority consensus of cryptocurrency users and will therefore use this as the basis for our prices. In addition, we will also consider the approach adopted by the exchanges we deal with, which will help determine the action we take.

We reserve the right to determine which cryptocurrency unit has the majority consensus behind it.

As the hard fork results in a second cryptocurrency, we reserve the right to create an equivalent position on client accounts to reflect this. However, this action is taken at our absolute discretion, and we have no obligation to do so.

If the second cryptocurrency is tradeable on major exchanges, which may or may not include the exchanges we deal with, we may choose to represent that value, but have no obligation to do so. We may do this by making the product available to close based on the valuation, or by booking a cash adjustment on client accounts.

If, within a reasonable timeframe, the second cryptocurrency does not become tradeable, then we may void positions that had previously been created at no value on client accounts.

Over periods of substantial price volatility around fork events, we may take any action as we consider necessary in accordance with our terms and conditions including suspending trading throughout if we deem not to have reliable prices from the underlying market.