- How to trade cryptocurrencies

- How cryptocurrency markets work

- What moves cryptocurrency markets?

- Cryptocurrency trading examples

- Summary

Cryptocurrencies, or cryptos, were first made popular by the likes of Bitcoin. Now, there are thousands of cryptocurrencies, with the most popular to trade being Bitcoin, Ethereum, Litecoin, and Ripple.

Trading cryptocurrency requires a firm commitment to learning about a new and evolving market. Here, we'll break down the crypto market into manageable sections, so you have all the necessary information to start trading cryptocurrency CFDs with City Index.

How to trade cryptocurrencies

There are two ways to trade cryptocurrencies:

1. Crypto trading via an exchange

Here, you buy a cryptocurrency or a fraction of a cryptocurrency outright via an exchange. The full purchase price is required upfront, and you hold it in a digital wallet with the hope that the price appreciates.

2. Crypto trading via CFDs

When trading cryptocurrencies as CFDs, you do not own the underlying asset. Instead, you are speculating on the price movement of the cryptocurrency, and you do not need a digital wallet. If you think that the price of the cryptocurrency will increase, you buy - or go long. If the price moves in your favour, you make a profit. However, if the price declines, you make a loss.

Perhaps the most significant difference between buying cryptocurrencies through an exchange and storing your coins in a wallet compared to trading cryptos through CFDs is the ability to go short.

Interested in cryptocurrency trading? Get started today by opening an account with City Index.

Making money in a falling market

If you think that the price of the cryptocurrency will decline, you open a sell trade* - also known as going short. Should the price of the cryptocurrency decline, you make a profit. However, should the price go against you and increase, you make a loss.

The ability to go long or short at any time is very useful when trading a volatile asset like cryptocurrencies, particularly as analysts are divided as to where cryptocurrency prices are going. Using CFDs, you can trade the price swings on a short-term basis, instead of just purchasing at a price and holding long term, hoping for the price to appreciate. This means you have more flexibility with your trading.

* check on the website for details on which cryptocurrencies you can short

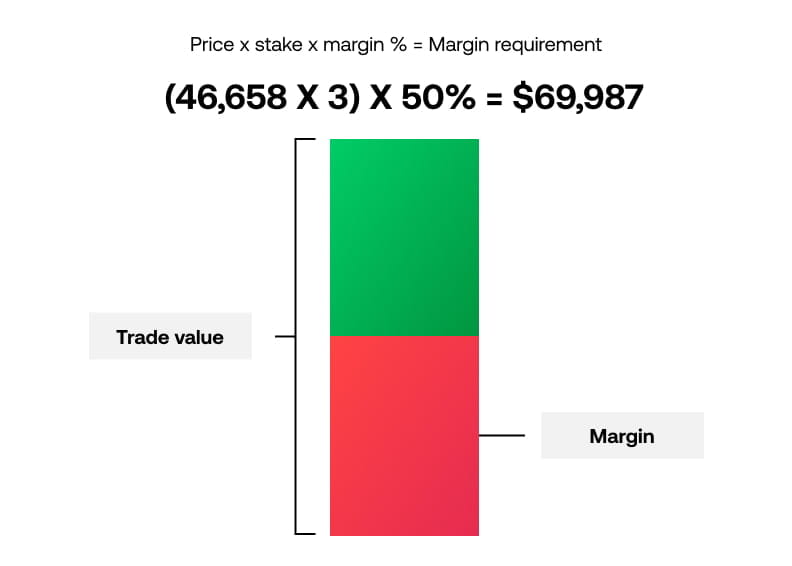

Trading on margin

Trading using margin and leverage can be more flexible than buying cryptocurrencies outright. This is especially the case when trading the more expensive cryptocurrencies, such as Bitcoin.

Trading using margin means that your gains are magnified; however, your losses are as well. Instead of depositing the entire value of the trade to open the position, you put forward a smaller percentage, known as margin. Trading using margin means that your gains are magnified. However, your losses are as well. Remember: increased leverage means increased risk.

Using orders

Finally, trading cryptocurrencies through CFDs enables you to use orders to enter, exit or protect a trade. These risk management tools are not available if you buy through an exchange. However, they can be extremely useful to protect positions in volatile markets. It is not unusual for cryptocurrencies to move over 10% in a day.

5 Steps to trade cryptocurrency CFDs

- Select which cryptocurrency you want to trade

- Do your research – understand what moves the crypto you are trading

- Decide to go long or short – do you think the market will rise or fall?

- Plan your exit strategy – set your stop loss level and a profit target

- Place your trade

How cryptocurrency markets work

Before starting crypto trading, it is important to understand how cryptocurrency markets work and what moves them.

Cryptocurrency is a digital currency that is transferred between two parties. Transactions are then recorded on the blockchain. There is no middleman and it is decentralised. This means that it is controlled by its users and computer algorithms, unlike fiat currencies which are controlled by a central bank.

Cryptocurrencies are "mined". This is the process by which transactions are verified and added to the blockchain ledger. The supply of cryptocurrencies is controlled, and most have maximum total supply.

Cryptocurrencies are also traded like stocks or fiat currencies. Like other currencies, the value of cryptocurrencies is measured by what they are worth against other currencies such as the dollar, the euro or the pound.

What moves cryptocurrency markets?

There are many factors that can affect the price of a cryptocurrency and very quickly. Here is a list:

- Software upgrades

- Public hype

- Wallet improvements

- Platform applications

- Government regulation

- Support from big industry players

Cryptocurrency trading examples

Below, are two examples of how to trade cryptocurrencies and the possible outcomes.

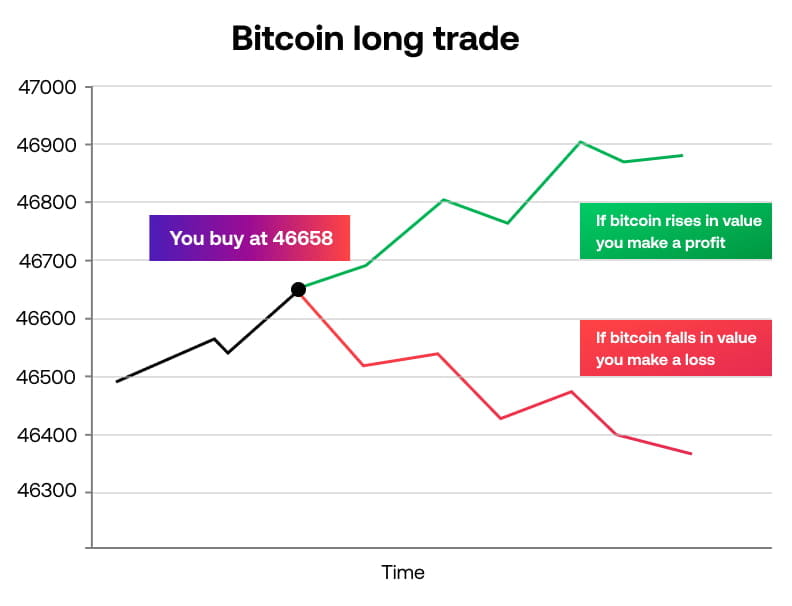

Example 1: Buying (going long) Bitcoin

Bitcoin/USD is trading at:

46358 (to sell) 46658 (to buy)

Let’s suppose that you think that the value of Bitcoin will increase. You decide to take a long position. You buy 2 Bitcoin CFDs at the buy price of 46658.

The value of your trade is 2 x 46658 = $93,316

Suppose the margin requirement for Bitcoin is 50%. You will need to have $46,658 in your account in order to open the position, excluding trading costs.

Bitcoin price rises

The price of Bitcoin then rises 120 points and you sell your position to close. You make a profit. This is calculated as:

120 (points in your favour) x 2 CFDs = $240 profit

Bitcoin price falls

Had the price of Bitcoin moved against you and dropped 100 points to 46558 (sell price), you would have made a loss. This would be calculated as:

100 (points against you) x 2 CFDs = $200 loss

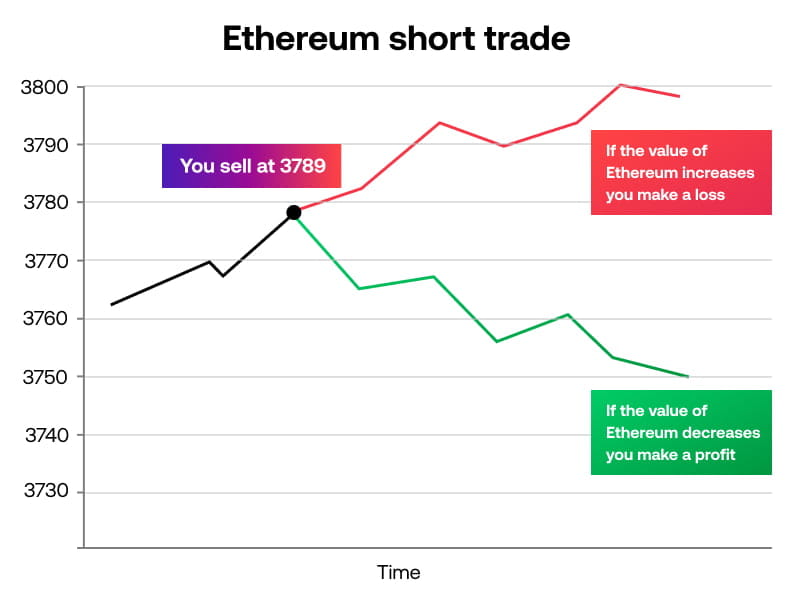

Example 2: Selling (going short) Ethereum

Ethereum is trading at:

3789 (to sell) 3795 (to buy)

In this example, you believe that the value of Ethereum will decline against the US dollar. You decide to short Ethereum, selling 1000 CFDs to open at the sell price of 3789.

Ethereum price falls

After placing your trade, the price of Ethereum falls. You buy to close at the buy price of 3779. You profit is calculated as:

10 (points in your favour) x 1000 CFDs = $10,000

Ethereum price rises

Had you made a wrong call and the price of Ethereum moved against you, you would have made a loss. Imagine Ethereum rose to a buy price of 3799. Your loss would be calculated as:

10 (points moved against you) x 1000 CFD’s = -$10,000.

Summary

Crypto trading has grown in popularity since exploding onto the scene in 2017. Whilst there are now thousands of cryptocurrencies, the most popular are Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Ripple.

Cryptocurrencies can be traded via an exchange or through CFDs. Trading cryptocurrencies through CFDs enables you to:

- Make money in rising or falling markets

- Trade using leverage

- Use orders, trade alerts and stop losses to protect your position

Cryptocurrencies are notoriously volatile and should be traded using a sound risk management strategy.