- What is the Dow Jones?

- Dow Jones companies

- How to trade the Dow Jones

- Dow Jones trading hours

- How is the Dow Jones calculated?

- What moves the Dow Jones price?

- Average returns of the Dow Jones

- Dow Jones companies by share price

- Dow Jones FAQ

What is the Dow Jones?

The Dow Jones Index is a stock index that tracks the performance of 30 blue-chip companies listed on US exchanges. It is a key gauge of financial market strength and one of the world’s most quoted equity benchmarks.

Dow Jones is short for Dow Jones Industrial Average (DJIA). On the City Index platform the Dow Jones index is called Wall Street.

Created in 1896 with a published average of 40.94, the Dow Jones is one of the oldest indices in the world. Today, it is run and managed by S&P Dow Jones Indices, the same company that runs the S&P 500, as well as several other leading US indices

Dow Jones companies

Many people assume that the companies on the Dow Jones are the 30 biggest public companies in the United States, but that isn’t the case. Instead, a committee handpicks each constituent to try and give an overall picture of the US stock market.

Each company, though, is a blue-chip stock that is a leader in its field. These include:

- Apple

- Goldman Sachs

- Boeing

- McDonald's

- Home Depot

- UnitedHealth Group

- Salesforce

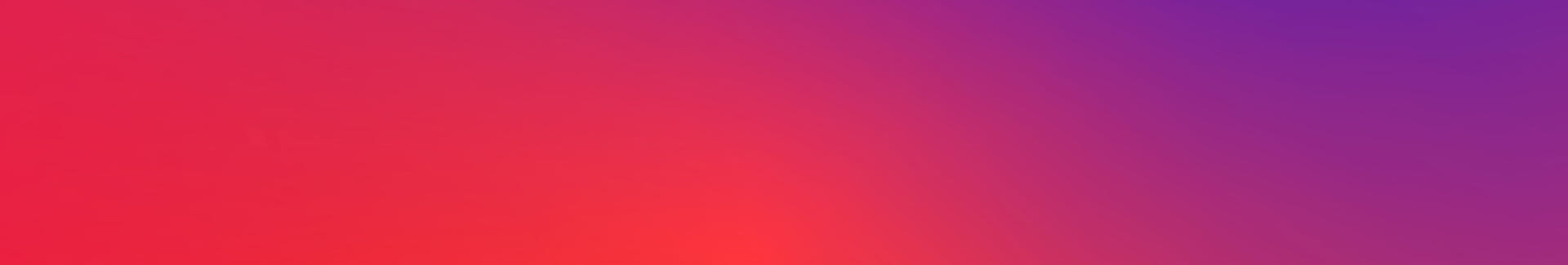

Here’s how the Dow Jones sector composition looked as of May 14 2021.

How to trade the Dow Jones

There are several different ways to trade the Dow Jones. Popular methods include CFDs, spread betting, futures, options and ETFs. Which you choose will depend on your trading style and goals.

You can’t trade or invest in the Dow Jones directly, as there’s no asset to trade – the DJIA is a number that represents the share prices of several companies. But several derivatives and funds will enable you to get exposure to all 30 companies with a single trade.

Dow CFDs

CFDs are contracts in which you agree to exchange the difference in the Dow’s price from when you open your position to when you close it. You can go long or short, and trade using leverage.

Learn more about CFDs

Dow Jones spread betting

Spread betting on the Dow works similarly to CFDs. But instead of trading a contract, you’re betting on whether the Dow will go up or down. You profit if it moves in your chosen direction. If it doesn’t, you make a loss.

Learn more about spread betting.

DJIA futures and options

Futures and options both enable you to trade the Dow on a set date in the future at a set price. With futures, you have an obligation to make the trade. With options, you don’t.

Learn more about options with City Index

Dow stocks and ETFs

Instead of using derivatives, you could trade the Dow by buying all its constituent shares. Or you could buy a Dow ETF – a fund that contains all 30 companies.

Learn more about shares and ETFs.

Dow Jones trading hours

The Dow Jones has the same trading hours as the broader US stock market: 09:30 to 16:00 Eastern time (13:30 to 20:00 UTC), Monday to Friday.

However, there is also pre-market trading. This can open as early as 04:00 and goes through to the standard market open at 09:30. Additionally, after-hours sessions may span from 16:00 to 20:00.

You can trade the Dow Jones with a City Index account 24 hours (with breaks) a day.

Read more on indices market hours.

How is the Dow Jones calculated?

The Dow Jones is calculated using a price-weighted system. This means its value is calculated differently from, say, the German DAX or the FTSE 100, which are weighted by market cap. In the case of the Dow, the value of the index is derived from the share price of its constituents.

The individual prices of its constituent stocks are added together and then divided by the ‘Dow divisor’, a figure designed to account for the potentially anomalous impact of stock splits or modifications to the index.

Some believe that the Dow’s less reliable than its US rival the S&P 500, because it weights stocks by their share price instead of market cap. However, over the years the two indices have largely moved in step.

What moves the Dow Jones price?

The Dow Jones is intended to act as an overall indicator of the health of the US stock market. If US stocks are in an upswing, the Dow should follow. In lean times for US business, the Dow should fall.

Let's take a look at three key factors to watch out for:

1. Monetary and economic releases

Federal Reserve monetary policy often has a notable impact on the DJIA. Accommodative monetary policy from the Fed, which boosts credit higher while reducing interest rates, tends to help stocks. This should see the Dow rise.

Additionally, economic data releases can have a large influence on trading decisions. Inflation is one measure that can hit stock indices as it can erode profit margins across sectors. For example, in May 2021 data showing an accelerating rate of inflation caused the Dow Jones to fall by 681 points.

2. Dow Jones weighting

The calculation method of the Dow Jones has a significant impact on its price, as companies with large share prices have a higher weighting than companies that are worth more by market cap.

The largest constituents of the index by weighting include healthcare giant UnitedHealth Group, investment bank Goldman Sachs and home improvement retailer Home Depot. UnitedHealth Group’s weighting is over three times larger than that of the most valuable company in the world, Apple.

3. Market moving events

Over the course of its history, the Dow Jones has tended to move mostly in one overall direction – up. Hence why it started out at 40 and is at over 30000 today.

Some events, however, change that trajectory dramatically. Six months after the 2008 financial crisis, the Dow hit a 12-year low. In Q1 2020, the index fell 23% thanks to the fallout of the coronavirus pandemic and an oil price war.

While such drivers may be expected to move the index in a certain direction, there is no guarantee that the move will play out, so traders should consider how determining factors work together rather than simply isolate any one factor.

Average returns of the Dow Jones

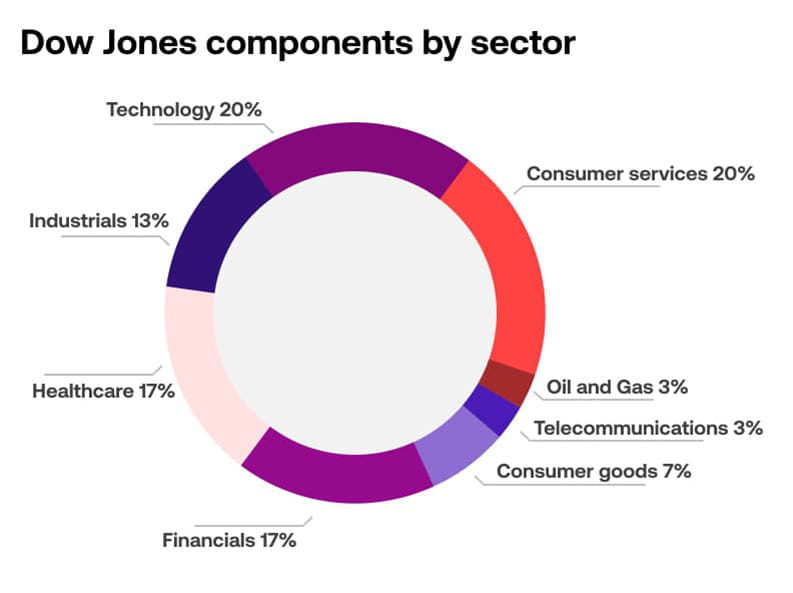

The average return of the Dow tells you how much an investor would have made if they’d invested directly in the Dow over a set period of time. From 2011 to 2020, the Dow returned an average annual return of 10.7%.

It fell overall in just two years: 2015 and 2018.

Dow Jones companies by share price

Here are the Dow Jones companies ranked by weighted share price, correct as of May 23 2022. Source: Dow Jones.

Rank |

Ticker |

Company name |

Weighting |

|---|---|---|---|

| 1 | UnitedHealth | UNH | 10.14% |

| 2 | Goldman Sachs | GS | 6.22% |

| 3 | Home Depot | HD | 5.90% |

| 4 | Microsoft | MSFT | 5.43% |

| 5 | McDonald's | MCD | 4.89% |

| 6 | Amgen | AMGN | 4.88% |

| 7 | Caterpillar | CAT | 4.19% |

| 8 | Visa | V | 4.06% |

| 9 | Honeywell | HON | 3.71% |

| 10 | Johnson & Johnson | JNJ | 3.60% |

| 11 | American Express | AXP | 3.56% |

| 12 | Boeing | BA | 3.40% |

| 13 | Salesforce | CRM | 3.38% |

| 14 | Travelers | TRV | 3.38% |

| 15 | Apple | AAPL | 3.15% |

| 16 | Procter & Gamble | PG | 3.15% |

| 17 | Chevron | CVX | 3.05% |

| 18 | Walmart | WMT | 3.04% |

| 19 | 3M | MMM | 2.88% |

| 20 | IBM | IBM | 2.69% |

| 21 | Nike | NKE | 2.48% |

| 22 | JPMorgan Chase | JPM | 2.45% |

| 23 | Disney | DIS | 2.32% |

| 24 | Merck | MRK | 1.65% |

| 25 | Dow | DOW | 1.32% |

| 26 | Coca-Cola | KO | 1.28% |

| 27 | Cisco | CSCO | 1.00% |

| 28 | Verizon | VZ | 0.97% |

| 29 | Intel | INTC | 0.91% |

| 30 | Walgreens Boots Alliance | WBA | 0.88% |