Advanced trading strategies

Advanced technical indicators

Some technical indicators are suitable for beginners, but others require more in-depth knowledge. In this lesson, we’ll cover some more complex indicators that can help boost your analysis.

- What is advanced technical analysis?

- Fibonacci retracement and ratios

- Ichimoku Cloud indicator

- Heikin Ashi candlesticks

What is advanced technical analysis?

Advanced technical analysis is the practice of employing complex indicators requiring advanced knowledge of market theory, often using multiple indicators at once, to predict price movements.

Before you can perform advanced technical analysis strategies, you’ll need to understand the basics of using charts and indicators. A good place to start would be taking a look at our introduction to technical analysis course.

Advanced technical indicators

Let’s look at three popular indicators that fall into the advanced category, due to the complexity of their equations and their tendency to give false signals.

While false signals might seem like an immediate red flag, it just means you’ll need to confirm them with other indicators. This is why they’re called ‘multi-indicator strategies’.

Fibonacci retracement and ratios

Fibonacci retracements are one of the most popular tools for identifying support and resistance levels. They typically help traders find the best points for stop-loss orders and price targets.

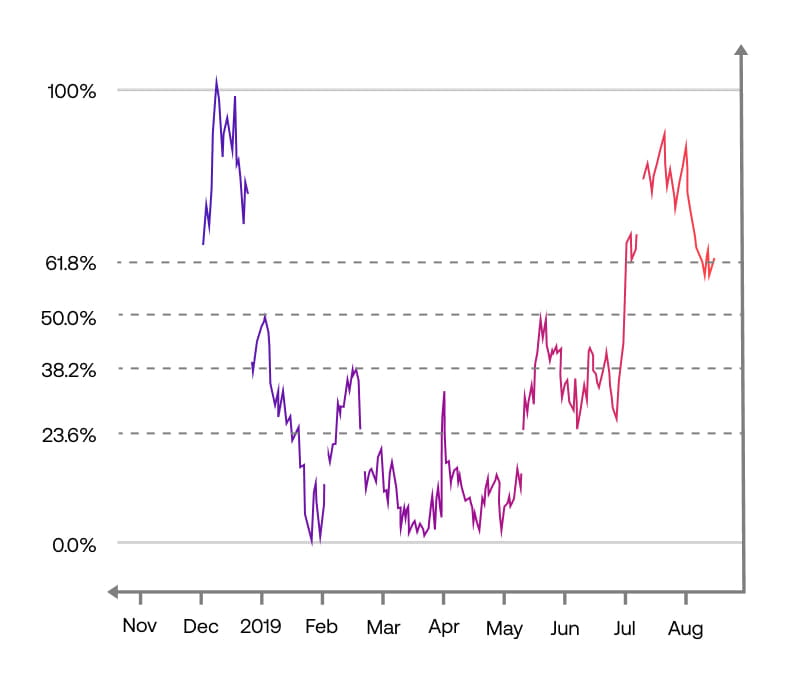

The tool is based on the mathematical sequence identified by Leonardo Fibonacci in the 13th century. The ratios between each of the numbers in his sequence are the most important part for traders, which are: 23.6%, 38.2%, 50%, 61.8% and 100%.

Fibonacci retracements are calculated by taking two price extremes on a chart and dividing the vertical distance between them by these ratios, as shown on the chart below.

Once these lines are in place, they can be used to determine where an asset’s momentum is more likely to decrease and so find the key areas where its price could reverse. Another way to look at their function is that they reveal potential support and resistance levels.

The idea is to place a stop loss at the key level that has just been broken and a take profit at the next retracement level in anticipation that the market may exhaust itself at that point.

For example, if the market rises back to the 38.2% level from its previous fall, then the expectation is for the 50% retracement to be the next resistance level or profit target. You will want to confirm bullish pressure before entering the market and place a stop loss at 38.2%.

Once the market breaks through that 50% retracement level, then 61.8% would be the new target and 50% would be the new stop loss level. This pattern will continue until the market reverses the direction of the trend.

Fibonacci lines are used as a confirmation tool, so they form one part of a multi-indicator strategy. For example, many traders will combine Fibonacci lines with the MACD or stochastic oscillator and look for points where the indicators cross over Fibonacci levels as confirmation of a trend shown by one indicator.

Although considered to be a more advanced tool due to its mathematical origin, most trading platforms do the calculations automatically for you, making Fibonacci retracements more accessible. On the City Index trading platform, you can select Fibonacci lines from the drawing tool menu on the lefthand side of your workspace, then select the beginning and end of the movement you want to trade.

For example, for an uptrend, select the price low and high on your chart and the tool will mark the ratios for you. If you wanted to trade a downtrend, you’d do the reverse: first selecting a price high and then selecting the low.

Learn more about our advanced indicators and drawing tools.

Ichimoku Cloud indicator

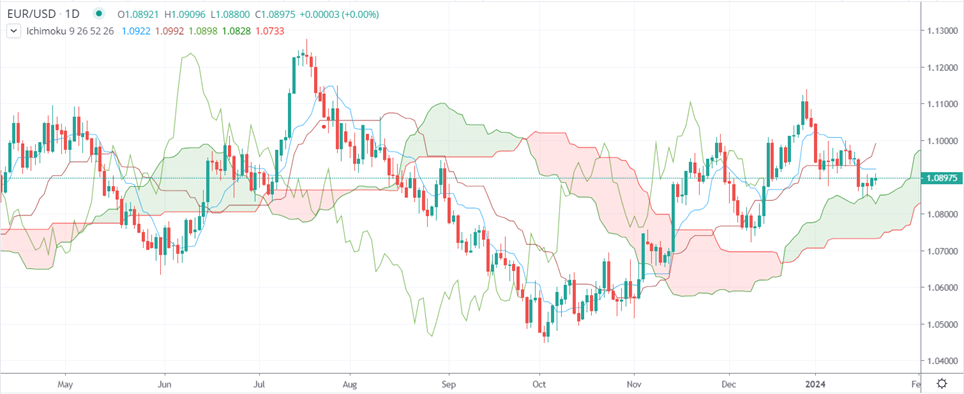

The Ichimoku Cloud is a collection of indicators that show support and resistance lines, as well as momentum and trend.

It’s been a popular choice among Asian traders for years, and it’s becoming more widely used among international traders. The indicator is known as the ‘one glance’ indicator because it gives an overall view of the market when used on a chart.

The ‘cloud’ consists of five lines:

- Tenkan Sen (light blue)

- Kijun Sen (dark red)

- Senkou Span A (dark green)

- Senkou Span B (light red)

- Chinkou Span (light green)

The colors of these lines may change depending on your trading platform.

The Tenkan Sen is the light blue line on the chart. It represents the average of the market’s highest high and lowest low over the last nine periods—for example, this is a daily chart, so it’ll show the high/low over nine days. It’s the shortest timeframe in the Ichimoku cloud, so it’s often where the first sign of change in the market appears.

The Kijun Sen is the dark red line. It represents the average of the highest high and lowest low over the last 26 periods—making it slower to indicate change than the Tenkan Sen. It’s thought to identify nearby support and resistance levels, so it’s commonly used to place stop loss orders.

NOTE: The Tenkan Sen crossing above the Kijun Sen line is a buy signal; and the crossing of the Tenkan Sen below the Kijun Sen is a sell signal. This is similar to signals produced by the fast and slow moving averages used by simple indicators like the MACD.

The Senkou Span A is the average value of the Tenkan and Kijun plotted 26 periods ahead, and the Senkou Span B is the average of the highest high and lowest low over 52 periods, also plotted 26 periods ahead.

Senkou Span A is represented by the dark green line and Senkou Span B is represented by the light red line. These two lines will always border the Ichimoku Cloud.

The space between these two lines is known as the Ichimoku Cloud, which is the area on the chart that is either shaded green (for an uptrend) or red (for a downtrend). Because the lines are plotted ahead, the Cloud extends past the latest live price and acts as an indicator for future prices.

The Cloud also acts as a zone of long-term support and resistance. The longer the trend continues in a certain direction, the wider the cloud becomes. This means the price will have to significantly reverse to overcome the support or resistance area that has formed.

The light green line is the Chinkou Span, which represents the closing price of the current candlestick plotted 26 periods into the past. The line will trail behind all the other lines because those are focused on present and future price action. If the end of the Chinkou Span is below the Ichimoku Cloud, it indicates a downtrend, if it’s above the Cloud, an uptrend is underway.

Heikin Ashi candlesticks

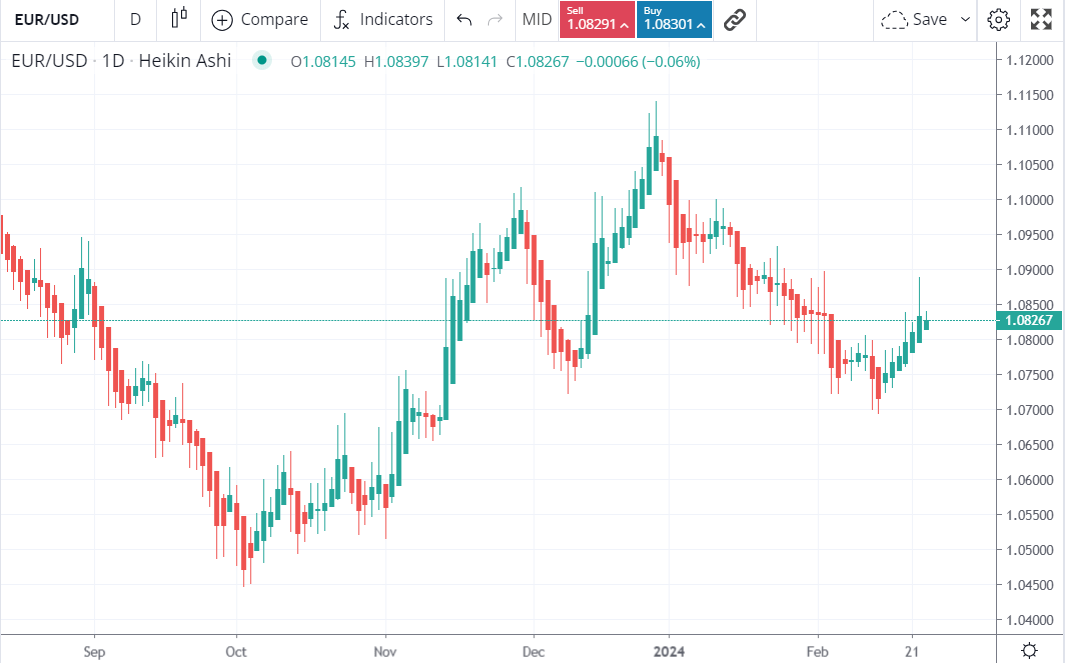

Heikin Ashi candlesticks are a variation of the traditional candlestick chart, with the Heikin Ashi chart having a smoother, more trend-focused appearance.

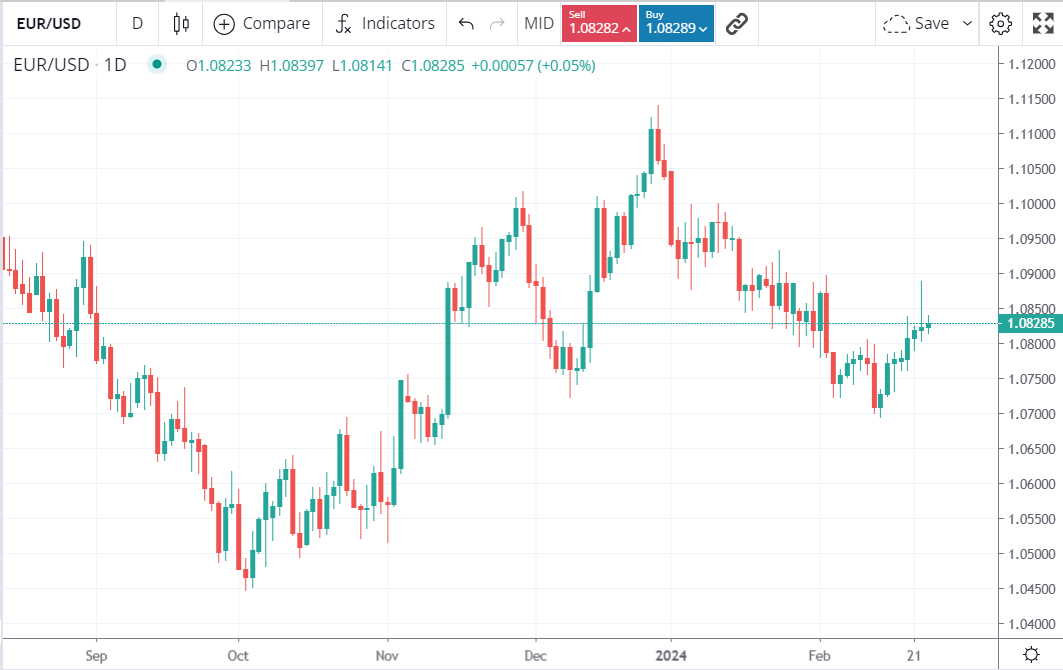

Traders use the Heikin Ashi chart aiming to identify trends more easily. As you’ll notice in the comparison of Heikin Ashi and regular candlesticks below, the former colors its candlesticks in groups of red and green depending on the overarching trend of the period. Regular candlesticks, by comparison, are individually colored green or red depending on the price movement of the period they cover.

The Heikin Ashi chart uses averages, meaning the price shown may not exactly match the real price the market is trading at. This is done to smooth out trends, and it explains why each candlestick begins at the middle point of the last one.

Traditional candlestick chart example:

Heikin Ashi chart example:

There are five primary signals to look out for when using Heikin Ashi charts.

- Green candles represent an uptrend in the market

- Green candles with no lower wick signify a strong uptrend

- Red candles indicate a downtrend

- Red candles with no upper wick signify a strong downtrend

- Candles with small bodies and long upper and lower wicks demarcate a trend change

The visual signals provided by Heikin Ashi candlesticks make spotting trends and trading opportunities easier than when using traditional candlestick charts. However, Heikin Ashi should be used with indicators like moving averages, Bollinger bands or the RSI to confirm trends and reversals before executing trades.