Advanced trading strategies

Options trading strategies

Improve your options trading with these effective strategies.

- Introduction to options trading strategies

- Straddle options strategy

- Strangle options strategy

- Covered call options strategy

Introduction to options trading strategies

There are a variety of options trading strategies that you can employ. But before you can delve into specifics, you’ll need an understanding of how options work.

If you don’t, we’d suggest heading over to our beginners’ guide to leveraged instruments.

Options form the base of many strategies because of their flexibility for holders. If markets move in your favour, you can execute the option. But if conditions are unfavourable, you can leave it to expire worthless.

They’re also popular due to the ability to take advantage of options premiums – the income sellers receive for taking on the risk of unlimited downside.

We’re going to look at three of the most popular options strategies: strangles, straddles and covered calls. The first two are more focused on trading volatility rather than direction, while the third takes advantage of the options premium that sellers are paid.

Straddle options strategy

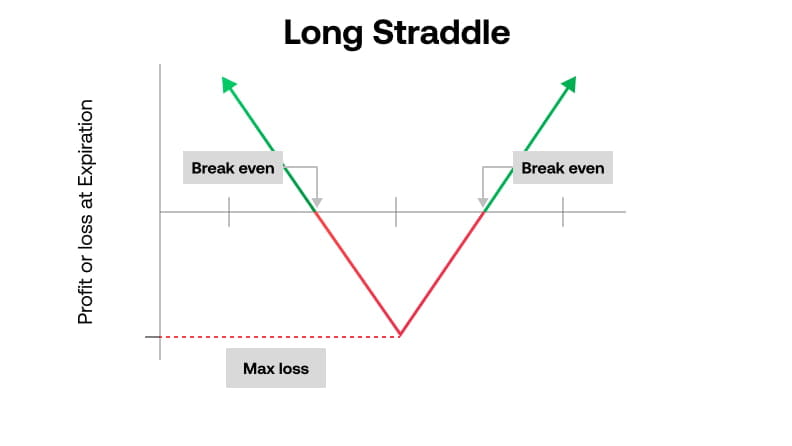

A straddle is a strategy that involves the simultaneous buying of a call and put option with the same strike price and expiration date. You can use a straddle to take advantage of both high and low volatility by going either long or short.

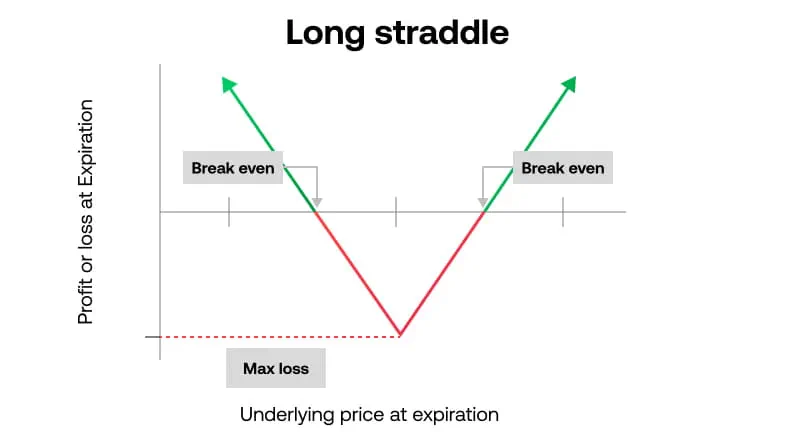

Long straddle (buying a straddle)

A long straddle is created by purchasing a put and a call option on the same underlying security with the same strike prices and expiry dates.

Typically, a trader will buy a straddle if they think the market will be volatile but are unsure of the direction the market will take.

You would make a profit if the underlying price moves, either up or down, by more than the premium you paid for the strategy. In the right market conditions, a long straddle can potentially be very rewarding.

Plus, the maximum you can lose is the premium paid for the two options and so the straddle has what is known as ‘limited risk’.

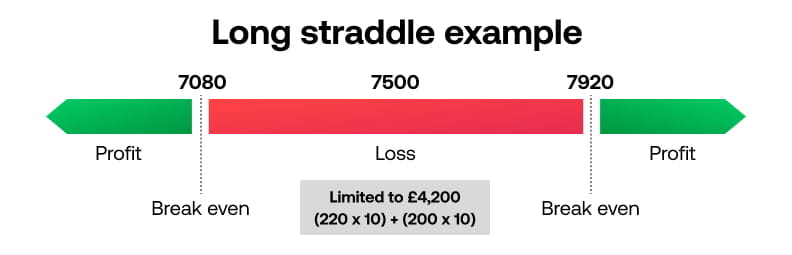

Long straddle example

Let’s say you’re looking to trade UK 100 volatility. You buy 10 UK 100 Dec 7500 put options at 220, for £2200, and 10 UK 100 Dec 7500 call options at 200, for £2000.

You’ll break even if the UK 100 reaches 7080 (220+200 points below 7500) or 7920 (220+200 points above 7500) before the expiry date. At this point, you’d start to earn a profit.

If the UK 100 remains anywhere between 7080 and 7920, your loss will be limited to £4200 (220 x 10) + (200 x 10).

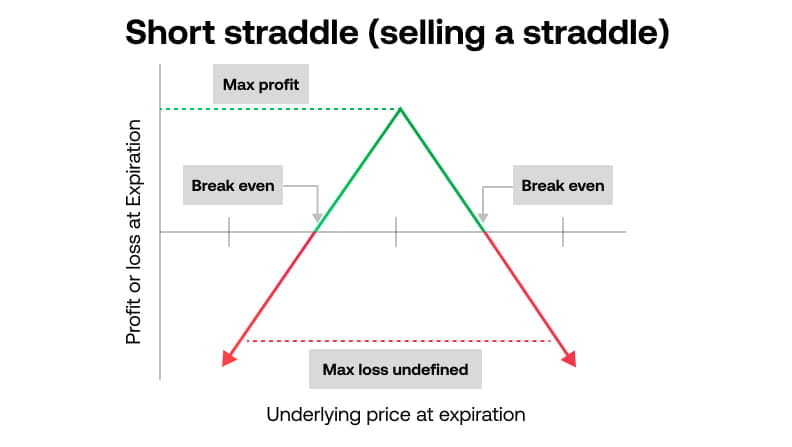

Short straddle (selling a straddle)

A short straddle is the sale of both a put and a call option on the same underlying security with the same strike prices and the same expiry dates.

Typically, this strategy is used by traders who want to profit in low volatility or rangebound markets.

Selling a straddle works just like selling an option – you earn a profit from the premium if the option buyer chooses not to execute their option (or executes it at a loss). The premium is the maximum amount of profit you could receive, while losses are potentially unlimited.

Strangle options strategy

A strangle also involves buying an equal number of put and call options, but unlike a straddle strategy, they’ll have different strike prices. You can use a strangle to take advantage of both high and low volatility by going either long or short.

Long strangles (buying a strangle)

Long strangles are created by purchasing a lower-strike put option and a higher-strike call option on the same underlying security with the same expiry dates.

For example, if the market price was £100, you might buy a put option with a strike at £95 and a call option with a strike at £105.

You’d then profit if the market is volatile and moves by more than a certain amount in either direction. The profit is potentially considerable, and the maximum loss is capped at the total premium paid for the two options.

So, say the premium for each option in the previous example was £2.50 - giving you a combined value of £5 - you would break even if the market rose above £110 or fell below £90.

Your max loss would be capped at the price paid for the premium, so £250 (£2.50x100 shares in each options contract) per option, or if both options failed to break even, you’d lose £500.

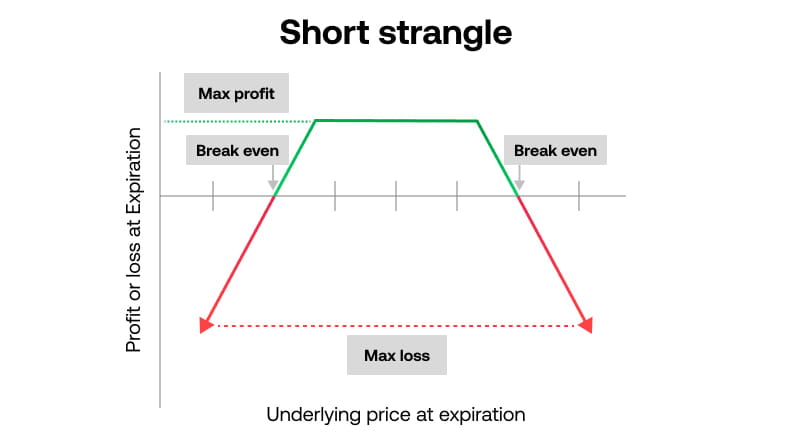

Short strangle (selling a strangle)

Short strangles involve the sale of a low strike put option and a high strike call option on the same underlying security with the same expiry dates.

Short strangles enable you to potentially profit when market volatility is low or a market is rangebound. However, your profits are limited to the premium of the strangle and losses are potentially unlimited.

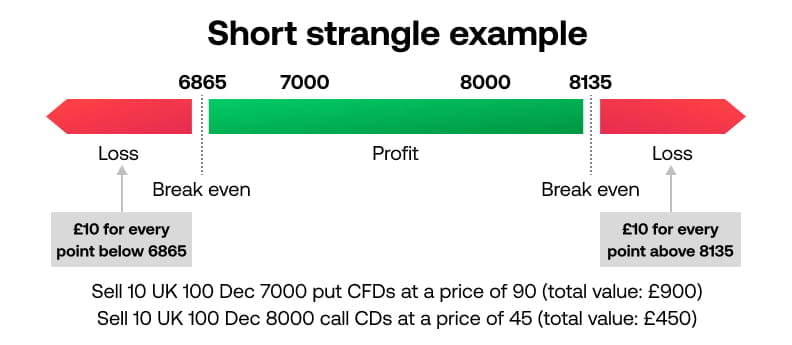

Short strangle example

Let’s imagine you think the UK 100 is rangebound. You decide to take advantage of the low volatility by selling 10 UK 100 Dec 7000 put options at a price of 90 for £900 and 10 UK 100 Dec 8000 call options at a price of 45 for a total value of £450.

If the UK 100 expires between 7000 and 8000, you could make a profit of £1350 (90 x 10) + (45 x 10). You’ll break even if the UK 100 expires at 6865 (90 + 45 points below 7000) or at 8135 (90 + 45 points above 8000).

If the UK 100 falls well below 6865 or rallies well above 8135, your loss will be equal to £10 for every point that the UK 100 expires below 6865 or above 8135. For example, if the UK 100 expires at 6700, your loss will be £1,650 ([7000 - 6700] x 10 [90 + 45] x 10.

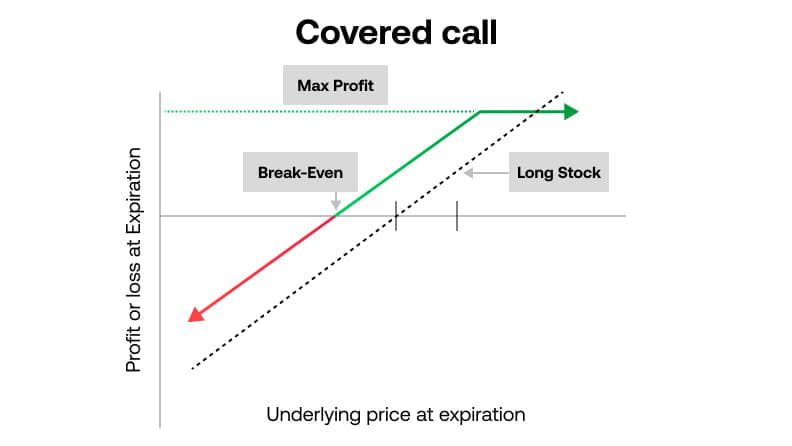

Covered call options strategy

A covered call strategy is a way of generating income from your investments or long positions when you don’t expect the market to rise much in the near future by selling a call option against it.

If the price of the underlying instrument stays the same or increases to the strike price, the covered call strategy will give you a profit equal to the premium (price x stake) of the call option. This profit could be smaller than if you hadn’t sold the option and merely held onto your asset.

Your ideal scenario is that the stock moves up to the strike price, so that your long position generates a profit, but doesn’t move beyond the strike price – meaning the buyer of the option is unlikely to execute the position. You would keep your stock holding and earn the option premium.

If the underlying instrument falls in price and you have decided to use a covered call, you will have reduced your losses by adding the premium to your income.