Looking for something specific? Jump ahead using these links:

- Big Tech earnings calendar

- Big Tech stocks overview

- Big Tech: where is the value?

- What to expect from Big Tech this earnings season

- Alphabet

- Microsoft

- Meta

- Apple

- Amazon

Big Tech earnings calendar

Big Tech earnings season kicks off on Tuesday October 25. Click to find out more about earnings season and how to read earnings reports.

|

Company |

Quarter |

Earnings Date |

|

Alphabet |

Q3 |

Tuesday October 25 |

|

Microsoft |

Q1 |

Tuesday October 25 |

|

Meta |

Q3 |

Wednesday October 26 |

|

Apple |

Q4 |

Thursday October 27 |

|

Amazon |

Q3 |

Thursday October 27 |

Big Tech stocks hammered in 2022

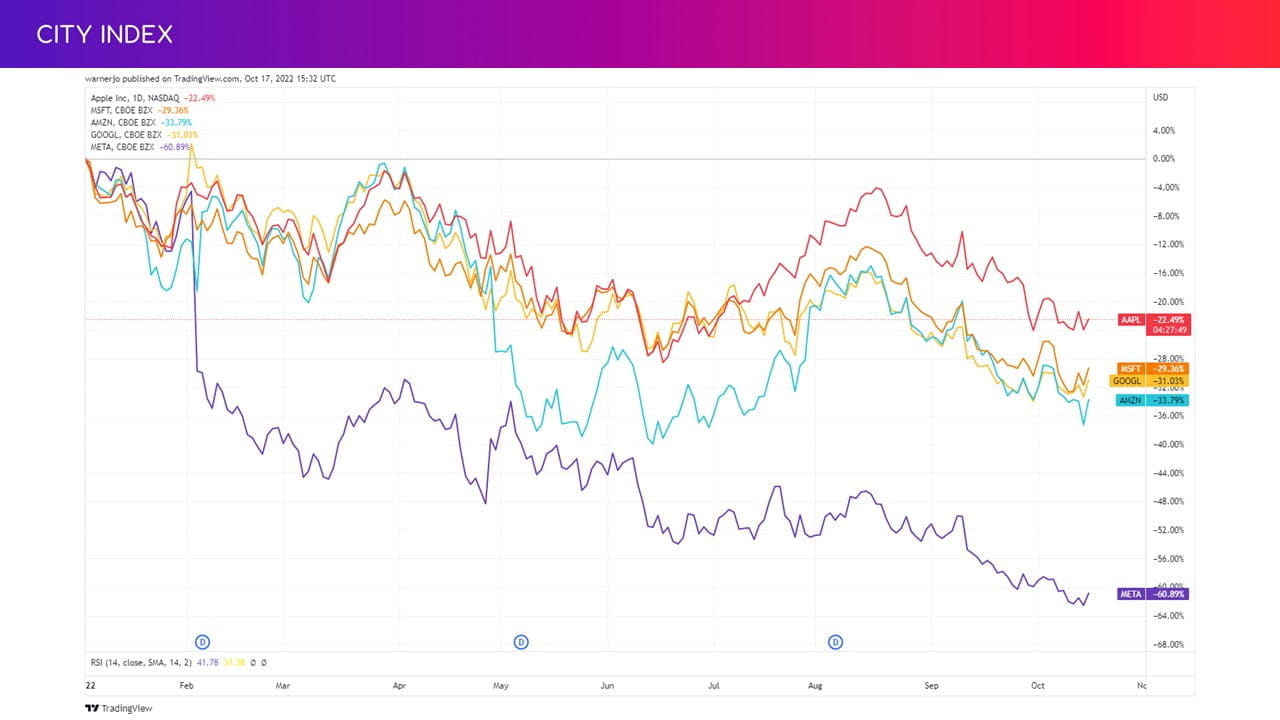

Big Tech stocks have lost significant ground in 2022 and succumbed to the broader market selloff. For perspective, the S&P 500 is down 23% since the start of the year while the Nasdaq 100 has fallen 33%, providing an idea of how they have each performed relative to the wider market. We have seen most of Big Tech move as one over the past three months, with Meta continuing to be the outlier after seeing its value collapse in early 2022.

Big Tech: Where is the value?

We have seen valuations come down from the inflated levels we saw when share prices exploded during the recovery from the pandemic, demonstrated by the elevated two-year price-to-earnings (PE) ratios.

Microsoft is now trading at more sensible levels that are in-line with the average seen over the past decade. Apple has seen its PE ratio fall this year, but it remains above historic levels to suggest it is still demanding a premium. Alphabet is offering a much lower ratio than it has done in the past, while Meta is a standout as it boasts a ratio that is less than half what it has managed to secure during the past five years after suffering the sharpest fall out of the group in 2022. Amazon is the exception due to the lack of profits compared to its rivals.

|

Valuation Multiples |

LTM P/E Ratio |

2-Yr Av |

5-Yr Av |

10-Yr Av |

|

Microsoft |

25.7x |

34.0x |

31.4x |

24.6x |

|

Apple |

23.3x |

29.2x |

23.8x |

18.8x |

|

Alphabet |

19.1x |

30.7x |

29.5x |

29.1x |

|

Amazon |

102.1x |

92.5x |

117.0x |

337.5x |

|

Meta |

10.9x |

22.4x |

24.4x |

116.0x |

(Source: Bloomberg)

Brokers remain extremely bullish on Big Tech stocks despite most of them having seen their average target price fall in recent months to take slower growth prospects and the pressure being applied to earnings into account. All of them have an average Buy rating from brokers, according to data from Refinitiv. Notably, they have become more receptive to Meta considering it boasted an average rating of Hold ahead of the last quarterly earnings season. Below is the average target price on each stock and the potential upside as of October 17.

|

Company |

Average Target Price |

Potential Upside |

|

Microsoft |

$328.15 |

39% |

|

Apple |

$183.69 |

30% |

|

Alphabet |

$141.33 |

41% |

|

Amazon |

$168.83 |

50% |

|

Meta |

$218.27 |

65% |

(Source: Refinitiv)

Big Tech Q3 earnings: What to expect this season

Markets will be on the lookout for how rampant inflation, rising interest rates and the strength of the US dollar are impacting corporate profits, and on how the outlook appears given the shaky economic picture and rising risks of a recession next year. The chief executives of both Citigroup and JPMorgan recently warned that signs are emerging that the US will enter a recession next year and the debate is now shifting to how deep and painful it will be.

Read more: Stocks to trade when inflation is rising

For Big Tech, the question is how resilient they can be as we head into what is shaping up to be an even more challenging year in 2023. Jamie Dimon, the boss at JPMorgan, has recently warned the S&P 500 could tumble up to another 20% before finding the bottom and said this will be considerably more painful than the drop we have already seen this year. For now, markets are waiting with bated breath for the day inflation will ease enough to let the Federal Reserve pivot toward a more dovish stance and start bringing interest rates back down, but that looks unlikely anytime soon. A recent survey of fund managers by Bank of America suggested this could happen in the first half of 2023, although that is among the more optimistic forecasts.

Read more: Stocks to trade when interest rates are rising

We have seen a much bigger divergence in terms of performance among Big Tech stocks this year and this is set to continue this quarter, with Microsoft and Apple the only ones set to deliver earnings growth in terms of headline EPS, with Amazon and Meta both forecast to see their bottom lines suffer sharp falls:

|

Company |

Quarterly EPS Change Estimate |

|

Microsoft |

+2.2% |

|

Apple |

+1.7% |

|

Alphabet |

-3.2% |

|

Amazon |

-17% |

|

Meta |

-40% |

(Source: Bloomberg)

Alphabet

Alphabet is not immune to the slowdown in demand for online advertising as businesses scale back their budgets, although it is expected to prove far more resilient than the likes of social media companies thanks to its monopoly over internet search and the popularity of YouTube. It is also less impacted than companies like Meta by the IDFA changes introduced by Applelast year, which has made it far more difficult for platforms to target consumers and track their online behaviour.

Wall Street forecasts Alphabet will report a 9.1% year-on-year rise in revenue in the third quarter to $71.06 billion and that diluted EPS will fall 3.2% to $1.26. That would be the slowest revenue growth in years. It is worth noting the strong dollar will be a headwind for its topline, with revenue set to rise over 14% at constant currency.

That will be the result of a 7% rise in advertising income - thanks to growth from Search (8.5%), Network (5.0%) and YouTube (4.3%) – but mostly driven a 33% jump in revenue from its fast-growing Google Cloud arm.

Meanwhile, earnings are set to decline for a second consecutive quarter as rising costs squeeze margins. Its margin is expected to have held broadly flat from the previous quarter at around 28%, but this time last year it stood at over 32%. Costs continue to rise at a faster pace than sales, with operating expenses estimated to rise 18% from last year to $51.9 billion this quarter. Slower growth and tighter margins are expected to see its vast advertising unit report a 3.2% drop in operating income.

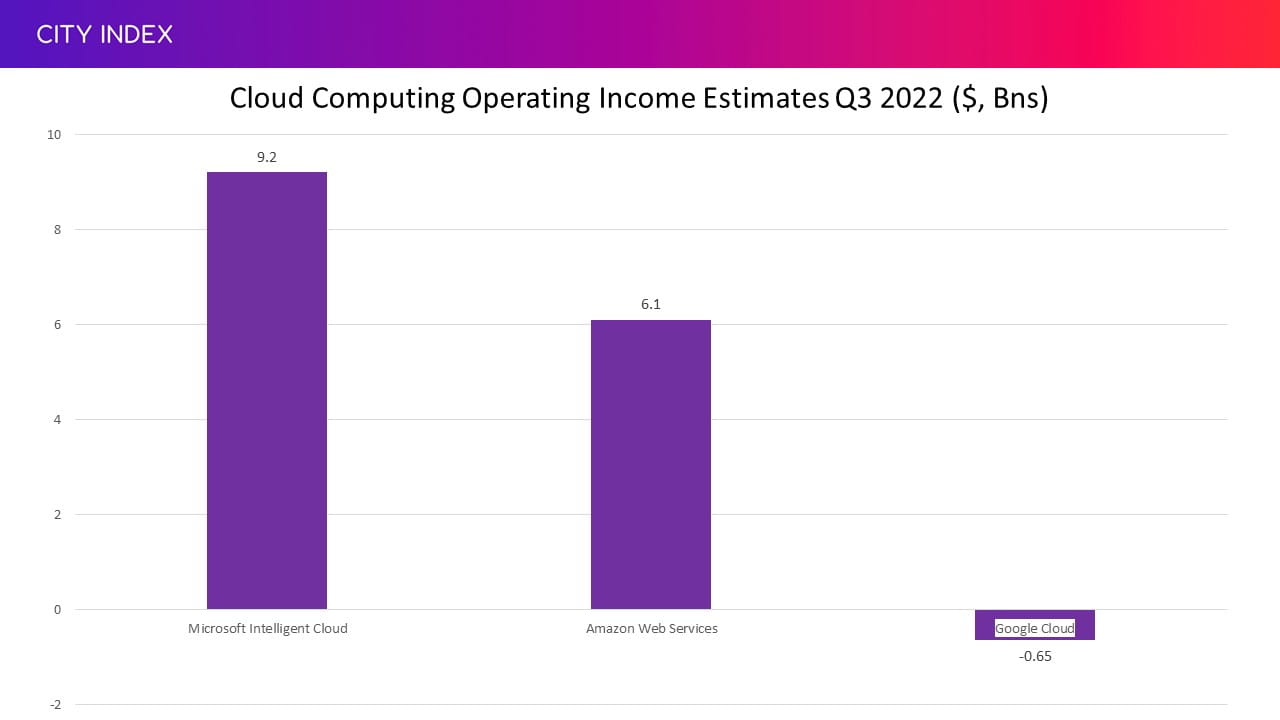

Also, Google Cloud remains a drag on the bottom-line even if it continues to drive the top. Google Cloud is expected to drag down operating income by over $650 million this quarter, whereas its larger rivals are both set to see profits boosted by their larger cloud computing operations:

That places Alphabet in a bit of a situation. Advertising is what makes all the profit but is suffering from the most severe slowdown in years, while Google Cloud is propelling the topline even as the economic climate becomes more challenging but is still in the red. That could put profitability under further strain if it persists.

Microsoft

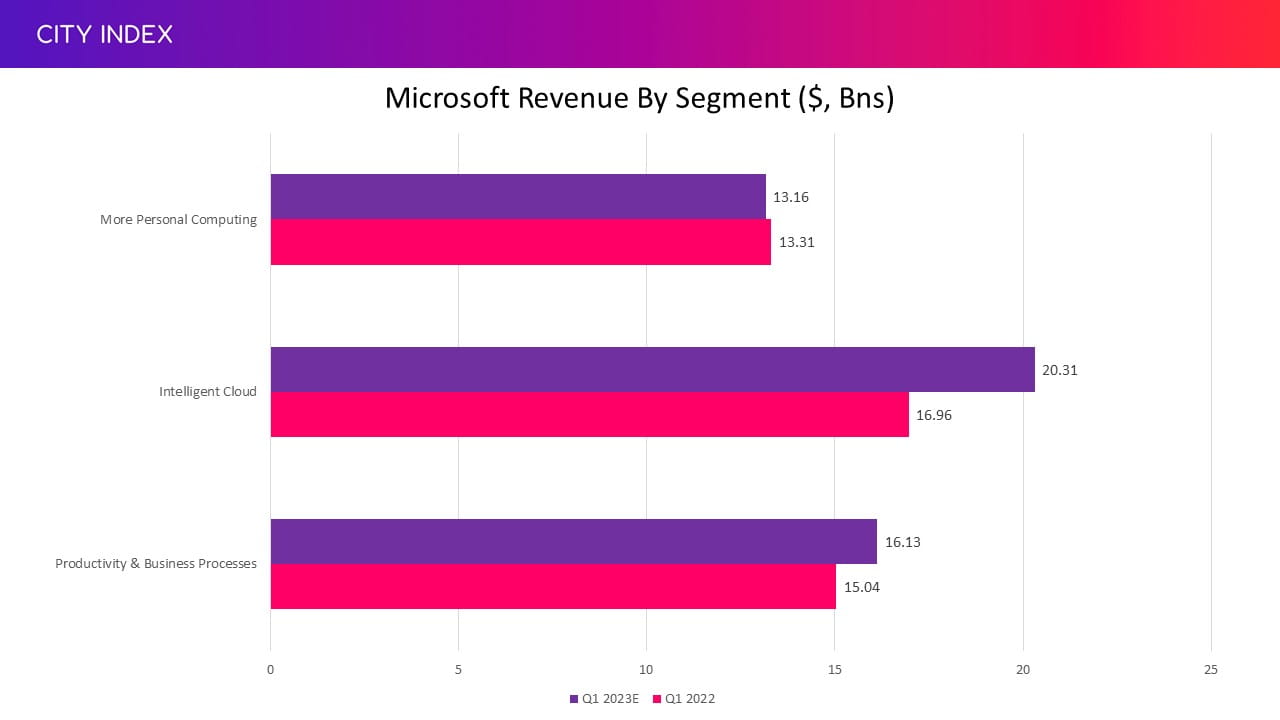

Microsoft is expected to report the strongest earnings growth out of all Big Tech this earnings season. Wall Street forecasts Microsoft will report a 9.8% rise in revenue in the first quarter of its new financial year to $49.75 billion and a 2.2% increase in diluted EPS to $2.32. The company, which makes over half its sales outside the US, will also feel the impact from the strong dollar considering the topline is forecast to grow almost 15% at constant currency.

Microsoft provides an array of vital services and products to businesses, such as cloud computing and software, and this is expected to benefit the company this season as demand here is likely to hold-up far better than on the consumer side. This is demonstrated by the fact revenue from Microsoft’s More Personal Computing arm that is more geared toward consumers is forecast to decline from last year and be countered by strong growth from its other units catering more toward businesses.

More Personal Computing makes its money from Xbox gaming consoles, Surface laptops, its Windows operating system and its search and advertising operation. Other tech stocks, including those from the semiconductor space, have already waved the warning flag that demand for consumer electronics is slowing down, while the boom in demand from businesses during the height of remote work during the pandemic is also unwinding. The division is expected to report a sharp 17% drop in operating income this quarter to $3.5 billion.

Productivity & Business Processes homes its suite of Office and Dynamic software as well as its recruitment-focused social media site LinkedIn. The software, which is mostly offered through lucrative licensing, remains key for both individuals and businesses and demand should hold up better than other forms of software going forward. The division is forecast to report a 5.2% lift in operating income to $8.0 billion this quarter.

Intelligent Cloud remains the biggest contributor to both topline growth and operating income. The unit is forecast to deliver a 21% pop in operating profit this quarter to $9.1 billion. Azure, which underpins its cloud operations and is often closely watched by the markets, is expected to report an impressive 43% rise in revenue at constant currency.

Meta

Meta was one of the first casualties in the tech space this year, with shares having gradually lost ground since falling of a cliff back in February when it revealed it shed daily users for the first time in its history, sparking fears that Facebook and its other apps are already near their peak.

User numbers are climbing again. The company is expected to report Daily Active Users (DAUs) of 1.973 billion in the third quarter, up from 1.970 billion three months earlier. However, this has done little to allay the array of concerns weighing on the minds of shareholders.

CEO Mark Zuckerberg said back in July that the disappointing outlook for this quarter was driven by the ‘continuation of the weak advertising demand environment’, which is being driven by ‘broader macroeconomic uncertainty’. This is supported by the fact other social media firms such as Snap and Twitter have also struggled to impress the markets. With a recession looming around the corner, the environment is set to remain challenging for the foreseeable future.

Prices have also suffered since it became more difficult for social media apps to target adverts at iOS users after Apple introduced changes to its policy last year, which has ultimately reduced the effectiveness of their ads. Bloomberg Intelligence claims this will knock around $10 billion off Meta’s annual revenue this year alone. Meanwhile, there has also been an impact from Meta’s pivot to less lucrative short-form videos and ‘Reels’ from longer-form videos in the hopes it can compete better with the likes of TikTok and YouTube.

The result, as far as Wall Street is concerned, will be a 5.3% drop in third-quarter revenue from last year to $27.48 billion and a 40% drop in diluted EPS to $1.92. Meta’s guidance for the quarter is for revenue of $26 billion to $28.5 billion. Eyes will also be on the revenue guidance for the final quarter of 2022, with analysts looking for Meta to target a figure of around $32.5 billion.

We have already seen Meta press pause on new hiring and announce it is reducing its headcount for the first-time ever in response to much tougher conditions, with Zuckerberg warning in the last quarter that the company needs to ‘get more done with fewer resources’. That is in the hope of getting a grip on costs. Meta has said total costs will be in the range of $85 billion to $88 billion this year – up to 24% higher than in 2021.

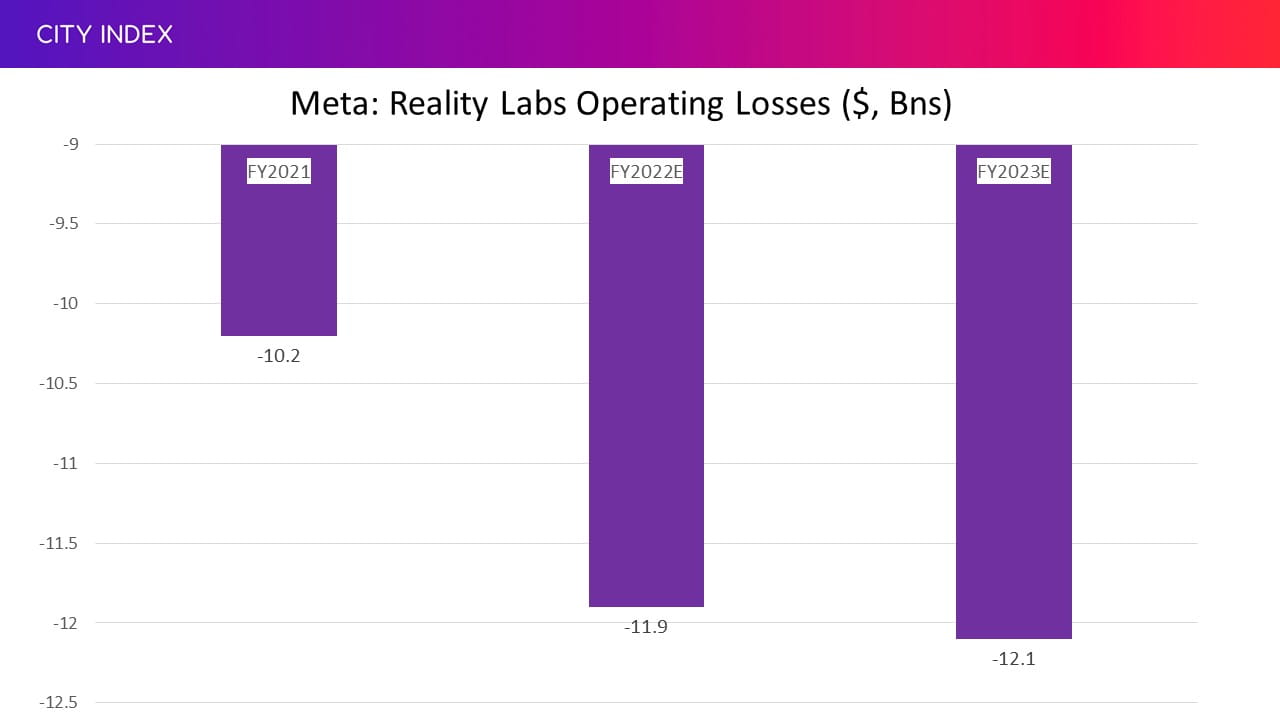

Meta has bet its future on the metaverse and recently held its annual event to showcase the latest developments, headlined by its new premium Quest Pro mixed-reality headset that Zuckerberg said will allow ‘entirely new categories of things getting built’. The new headset is targeted at professionals such as designers and creative professionals and will be launched on October 25 at a price of $1,500. This will allow Meta to target the high-end of the market and compliment its existing Quest 2 headset that dominates the consumer market with a focus on gaming.

However, Meta is years away from seeing any form of return from its costly metaverse ambitions, having sunk over $16 billion into its efforts since the start of 2021 alone, and the business will continue to be driven by advertising on social media for years to come. With this in mind, a pullback in spending here could provide a way of delivering savings without impacting the core business, although this would put its hopes of spearheading the metaverse at risk.

Apple

It is a big quarter for Apple considering there are concerns over both supply and demand. Supply constraints have proven a headwind but look to be improving, and we have seen Apple shift more production to India in the hope of minimising the disruption stemming from China. Meanwhile, there are growing fears that demand for consumer electronics, including smartphones, is stuttering.

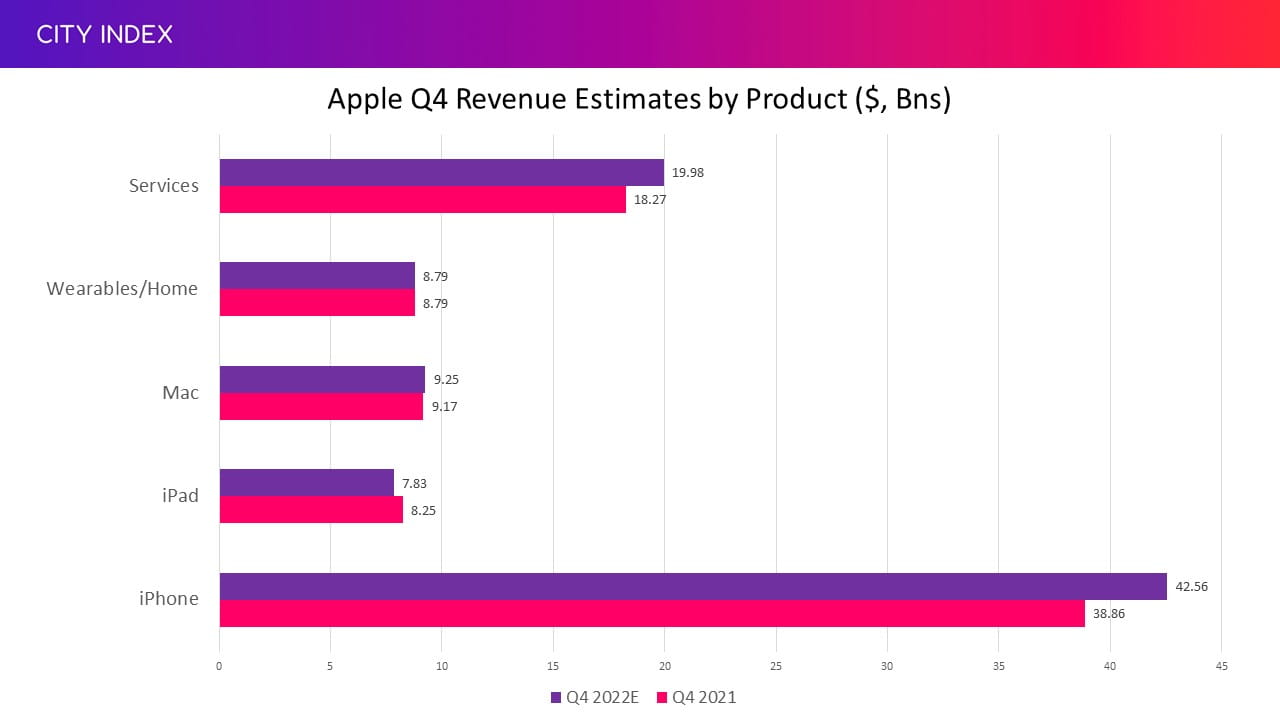

Wall Street forecasts Apple will report a 6.3% jump in revenue in the fourth quarter to $88.6 billion and a 1.7% rise in diluted EPS to $1.26. That would be welcome as it would mark a reacceleration in sales following the tepid growth seen in the last quarter and a return to earnings growth after they posted a rare decline three months ago.

It is important to flag that Apple is still facing tough comparatives. This time last year, Apple posted a 29% jump in sales and saw EPS pop 70%. Plus, the strong US dollar will severely crimp its topline this time around, while rising costs are also continuing to weigh on the bottom.

Apple launched the new iPhone 14 in September and it hit the shelves earlier this month. Eyes will be on how initial demand has fared as this will set the tone for the first quarter that covers the busy holiday shopping period, which tends to be the busiest quarter for sales. We can see below that the iPhone and its Services division that homes its apps and subscription services will drive topline growth in the fourth quarter:

Notably, Apple will enjoy an extra week of iPhone sales in the quarter thanks to the earlier launch of the latest model. Analysts remain confident that the Pro models, which received the bulk of the upgrades, have proven popular and will help raise average selling prices and counter potentially flat volumes.

Bloomberg reported last month that Apple has backed-off from plans to increase production of the iPhone 14 by up to 6 million units in the second half of 2022 after an anticipated surge in demand failed to materialise, putting iPhone 14 shipments to come in flat with what we saw with the iPhone 13.

‘While still early days in the iPhone 14 product cycle, we do expect the weaker consumer spending environment to impact the earnings trajectory, and it could drive softer than consensus earnings in some of the later quarters in FY2023,’ JPMorgan warned this month.

Demand for other hardware looks set to remain soft while revenue growth from services is expected to slow for a fifth consecutive quarter as app sales continue to falter.

Apple has not been providing an outlook but commentary on the new financial year will be closely watched. It appears Wall Street believes 2023 will be even tougher than this year considering they estimate sales and earnings growth will both continue to slow.

Amazon

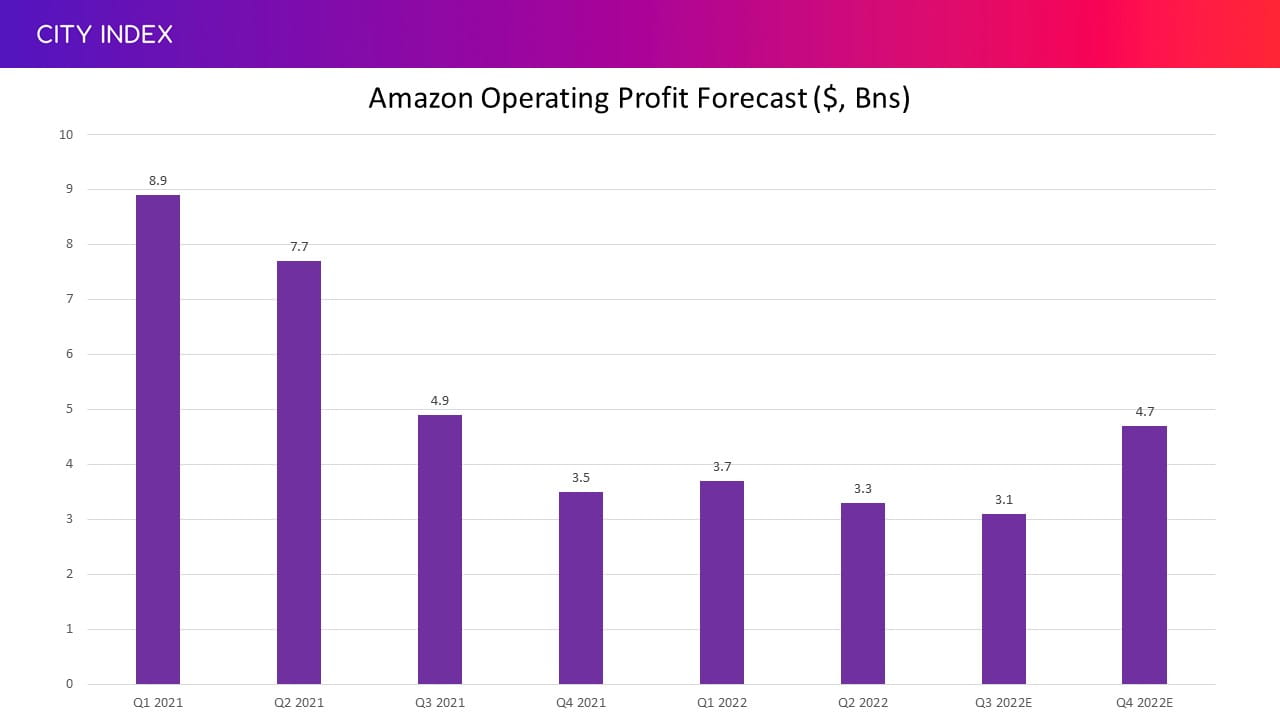

Amazon continues to power ahead and deliver buoyant levels of sales growth despite the shaky outlook for the economy and evidence of a pullback in spending from consumers. In fact, the double-digit revenue growth pencilled-in for this quarter will be more than double the rate we have seen in the previous two. That will be partly down to the fact that this quarter will be easier as tough comparatives spawning from the boom in demand during the pandemic start to fall away, leading to faster sales growth and a milder decline in earnings.

Amazon has said net sales will be between $125.0 billion to $130.0 billion in the third quarter and given itself leeway when it comes to profits after stating operating income will be between breakeven and $3.5 billion. Wall Street has pencilled-in quarterly sales of $128 billion, up some 15.5% from last year, and operating profit of $3.05 billion, down 37% from the year before. Diluted EPS is forecast to fall 16.7% to $0.26.

We should see revenue grow across the board. Its core online ecommerce operation is forecast to deliver an 8.5% rise in sales, income from the array of services it provides to third-party sellers is expected to increase 17.5%, and its subscription business underpinned by Prime is expected to rise 13%. Prime appears to be a major advantage by keeping customers within its flywheel strategy and encouraging members to keep shopping on the platform even if they spend less elsewhere. Sales growth will also be aided by the fact its Prime Day sale was held in the third quarter. Last year, it was held in the second.

Notably, Amazon has just held its Prime Early Access sale ahead of the Black Friday and Cyber Monday events in November, all of which should come into play in the fourth quarter. However, initial analysis suggests the event failed to provide the blockbuster figures that Amazon had hoped for. ‘This Prime [Early Access] Day seemed to be mostly just another day on Amazon,’ said CEO of data analysis firm Klover, Brian Mandelbaum. He added that households spent around 40% less at this event than the Prime Day back in July. Separate data from research firm Numerator said the average basket dropped to $46.68 from over $60 at the summer event. With that in mind, the outlook for the busy holiday shopping season in the fourth quarter will prove influential. Wall Street is looking for Amazon to target net sales of $156.3 billion and operating profit of $4.7 billion in the final three months of 2022.

The real profit driver of the business, AWS, which is the largest cloud computing company in the world, is expected to remain the jewel in the crown with a 30% jump in revenue. Notably, its smaller but faster-growing advertising business is expected to grow 24% this quarter, which would be welcomed considering the softness seen by the biggest players.

The topline may continue to grow but profits are under pressure as Amazon grapples with rising costs, which are forecast to be 18% higher in the third quarter than a year ago, and the unfavourable strength of the dollar. However, it is making an effort to limit this pressure after stating that costs would be some $1.5 billion lower this quarter than the previous one. Still, Amazon has long been willing to sacrifice profitability in favour of growth and gaining market share with a view of reaping rewards later down the line. We have seen operating profits fall dramatically since peaking in early 2021, although Wall Street remains hopeful this can start to rebound again as we enter the busy holiday shopping season in the fourth quarter and that the third will be the trough.

Take advantage of extended hours trading

Big Tech stocks tend to release earnings after US markets close and this means most must wait until they reopen the following day before being able to trade. But by then, the news has already been digested and the instant reaction in share price has happened in after-hours trading. To react immediately, traders should take their positions in pre and post-market sessions.

With this in mind, you can take advantage of our service that allows you to trade Big Tech stocks using our extended hours offering.

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels. Find out more about Extended Hours Trading.

How to trade Big Tech stocks

You can trade Big Tech stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.