A torrid start to trading for the new week as concerns around the impact of the coronavirus intensified in line with the rapid spread of the Covid-19 virus outside of China. As well as oil producers failing to agree on a new deal to limit supply after Russia blocked OPEC’s plan to push through an additional 1.5mb/d of supply cuts.

The existing supply agreement of oil producers expires on the 1st of April. From this date on, there will be no caps in place on the amount of oil that the 24 nations in the OPEC + arrangement can supply creating a dangerous imbalance at a time when demand for oil has softened considerably due to the impact of the coronavirus.

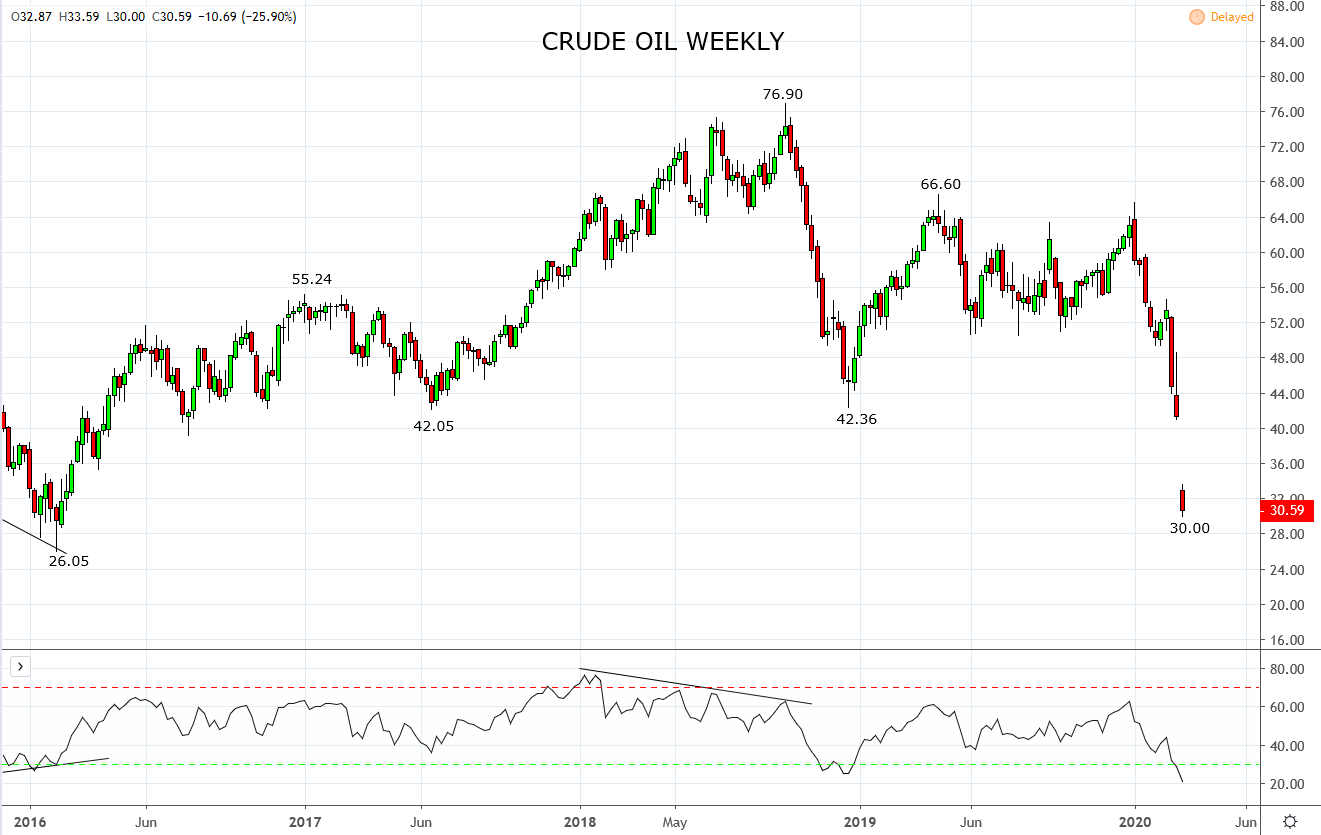

This is the key reason why crude oil futures have fallen by almost 25% from Fridays close to be trading just above $30.00/bbl at the time of writing (weekly chart below).

The OPEC disagreement demands trader's attention as it will force a dramatic re-alignment of the oil market as low-cost producers such as Saudi Arabia and Kuwait increase supply at the expense of high-cost producers. High-cost oil-producing countries with fragile financial systems such as Russia and Venezuela become vulnerable to a credit event.

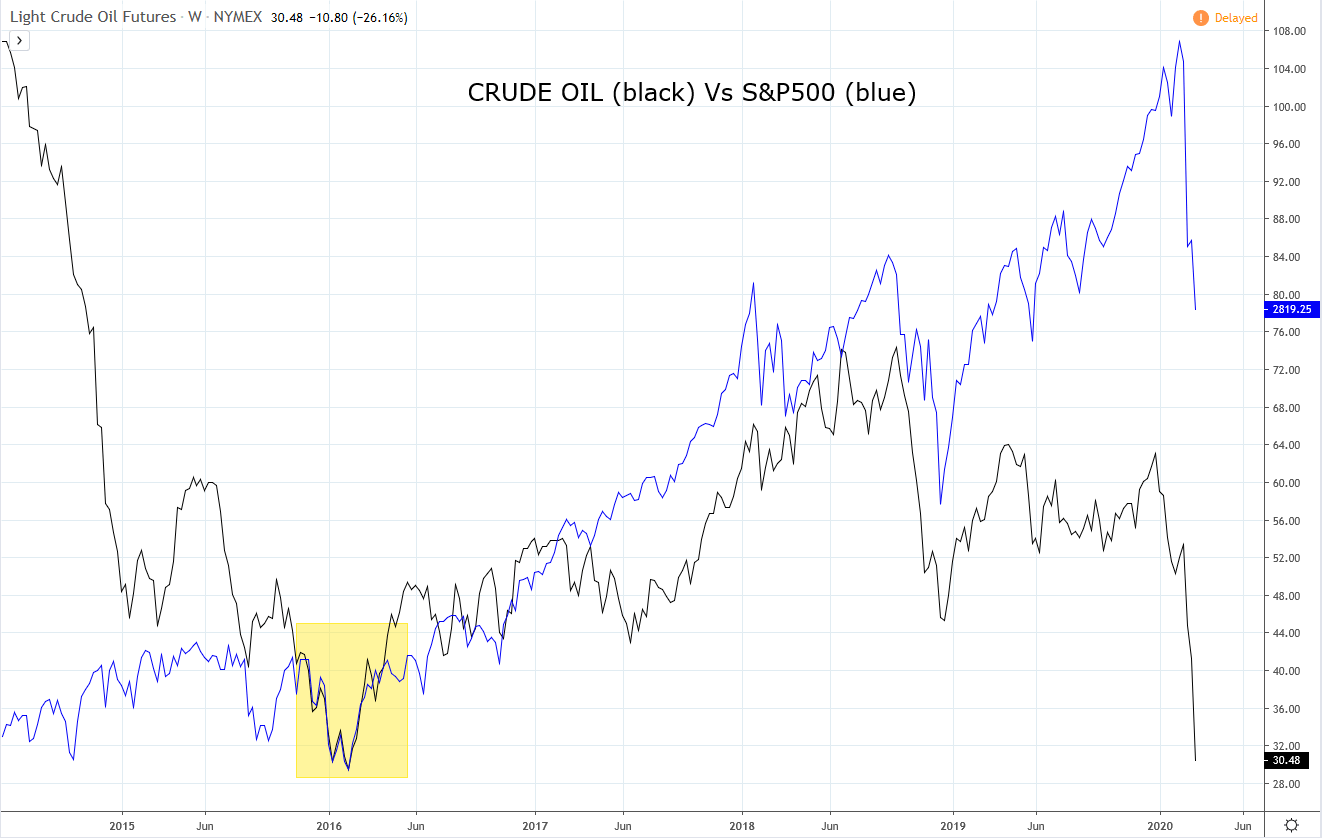

So too, higher-cost oil-producing companies based in the U.S and Canada. As evidence of this, we need only look back to the start of 2016 to see how falling oil prices impacted individual oil companies' stock prices.

At a more macro level, the fall in crude oil prices into the start of 2016 also sparked deflationary concerns that weighed on U.S. stock markets as a whole. It’s no coincidence that the S&P 500 bottomed at 1802.5 in the very same week of February 2016, that crude oil futures traded to their $26.05 low (highlighted chart below).

After the weekend's events in the oil market, the relationship between S&P 500 futures and crude oil futures is again on display. Effectively oil producers have thrown oil on the stock market fire lit by Covid-19, thereby adding another layer of complexity to markets.

Source Tradingview. The figures stated areas of the 9th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation