Despite data from China today that showed the Omicron outbreak appears under control and that Chinese economic data may have bottomed, it's been a disappointing day for U.S equity futures, giving back all of yesterday's gains and more.

Behind today's sell-off, events over the past 24 hours have combined to dent hopes that peak inflation and peak Federal Reserve hawkishness might be in the rear vision mirror.

The events have included a red-hot German inflation print and hawkish comments from Federal Reserve Governor Waller, who stated, "In particular, I am not taking 50 basis-point hikes off the table until I see inflation coming down closer to our 2% target."

Throwing fuel on a smouldering bond market bonfire, the price of crude oil has rallied above $119 per barrel, its highest level in almost three months following the EU agreeing to ban Russian seaborne oil imports just as the driving season in the U.S kicks off and a broader re-opening commences in China.

While these events have provided a setback or a speedbump to our view that a short-covering rally towards 4300 is underway, we don't see them as being the catalyst for a sustained reversal lower. Short-covering rallies don't usually end until the crowd gives up on the bearish view and turns bullish.

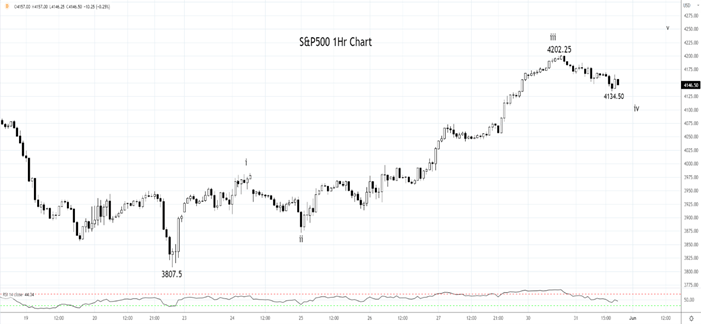

Turning to the charts. As viewed on the 60-minute chart below, the rally from the 3807.5 low appears to be missing another leg higher above the overnight 4202.25 high towards 4250/4300.

Providing the current pullback holds support near 4100 we continue to call for higher prices before the current short-covering rally has run its course.

Source Tradingview. The figures stated are as of May 31st of May 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade