S&P 500: Key moment for US stocks as tech earnings, PCE inflation, technical setup collides

- Microsoft, Alphabet, Meta Platforms and Amazon release earnings between Tuesday and Thursday

- The Fed’s preferred underlying inflation measure is out Friday

- S&P 500 looks tired on the charts, making this a potentially pivotal week for the remainder of 2023

Having fallen through channel support and its 200-day MA, and with four members of the ‘Magnificent 7’ due to report third quarter earnings over the next few days, you get the sense this week could really set the tone for how the S&P 500 will close out 2023.

S&P 500 looking vulnerable ahead of key risk events

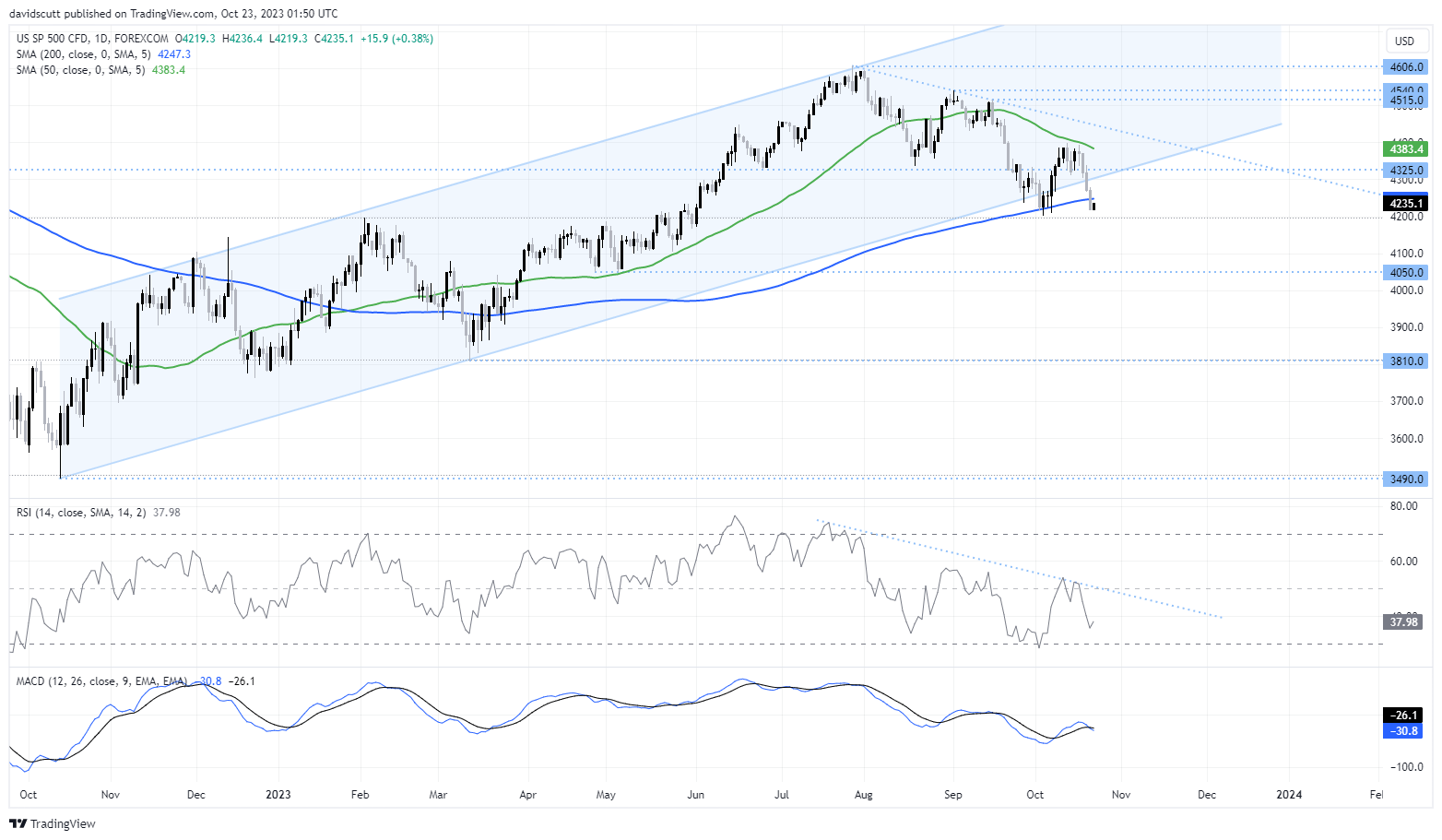

The US benchmark index appears tired on the daily chart, setting a string of lower highs since topping out in late July. The inability to bounce meaningfully from channel support for much of October adds to the tired picture, resulting in the index falling not only out of the ascending channel but also through its 200-day MA, something that did not occur when it last broke lower earlier this month. Sitting just above support at 4200, and with momentum indicators like RSI and MACD suggesting growing downside risks, the index looks as vulnerable as it’s been for a while.

But this is no average week.

Not only do we have the Federal Reserve’s preferred inflation measures for September arriving on Friday in the form of the core PCE deflator, but also earnings from Microsoft, Alphabet, Meta and Amazon, four constituents from the ‘Magnificent 7’ which have pushed the S&P 500 higher this year despite the remaining 493 members, collectively, dragging over the same period.

Bar for tech earnings looks to be high

With so much good news priced into these mega-cap tech names, primarily thanks to optimism surrounding revenue and profit growth driven by artificial intelligence adoption, it leaves very little room for disappointment. You only need to look at the reaction to results from Tesla and ASML released last week to see how high the bar has been set.

With Microsoft and Alphabet releasing earnings on Tuesday, Meta Networks on Wednesday and Amazon on Thursday, the technical setup on the charts suggests the next few days could prove to be pivotal for the S&P 500 heading towards year-end.

4200 looks key for S&P 500

On the downside, a break of 4200 may open a push towards 4050 and 38100 below that. On the upside, 4325, the 50-day MA and downtrend resistance currently located around 4445 are the levels to watch. In the absence of a positive outcome to the conflict between Israel and Hamas, or a sustainable decline in long bond yields that’s not driven by global growth fears, the bias appears to be sell rallies rather than buy dips right now.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade