US futures

Dow futures 0.6% at 37973

S&P futures 0.14% at 5071

Nasdaq futures 0.18% at 17335

In Europe

FTSE -1.4% at 7850

Dax -0.88% at 17844

- US treasury yields rise to a 5-month high

- Federal Reserve Chair Jerome Powell will speak later

- BAC & MS rise after earnings

- Oil steadies after China data

10-year treasury yields rise to a 5-month high

US stocks inch higher on the open after losses from the previous session and ahead of a speech by Federal Reserve Chair Jerome Powell later. Treasury yields are rising, and investors are also cautious about the ongoing conflict in the Middle East.

Yields on US 10-year government bonds rose above 4.6% to a 5-month high a day after US retail sales rose by more than expected. A strong US consumer adds to evidence that the economy grew at a solid pace in the first quarter.

San Francisco Fed President Mary Daly also noted that the economy and the labour market are strong, and inflation is still above the Fed's 2% target, meaning there is no urgency to cut interest rates.

Her comments come ahead of Federal Reserve chair Jerome Powell, who is due to speak later in the day. Investors will be watching for any clues on the future path of interest rates. Traders currently see a 48% chance of the Fed starting to cut rates in July.

Meanwhile, Middle East geopolitical tensions remain in focus as the market waits for word on how Israel’s Prime Minister Benjamin Netanyahu will respond to Iran's weekend attack. The ball is in his court as to whether the recent escalation ends here or whether the tensions rise further with a counter attack.

Earnings season continues to ramp up with numbers from Bank of America, Morgan Stanley, and Johnson and Johnson.

Corporate news

Morgan Stanley is set to open over 2% higher after the bank posted a rise in Q1 profit thanks to a resurgence in investment banking.

Bank of America is also set to open higher after the lender posted a sharp rise in revenue. Its investment banking and wealth management businesses performed well, offsetting a decline in net interest income.

Tesla is set to open lower again after dropping 5% yesterday. The EV manufacturer is set to lay off over 10% of its global workforce amid falling sales and an intensifying price war.

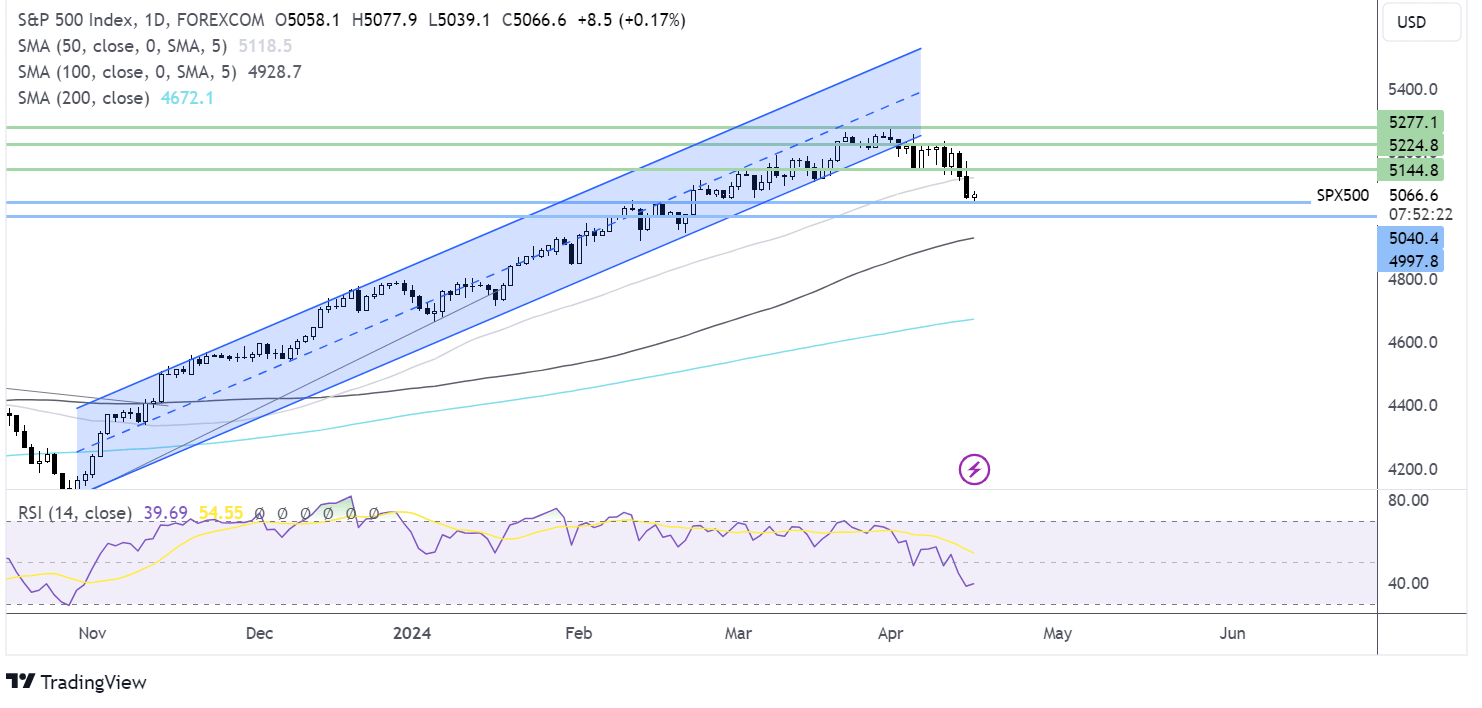

S&P 500 forecast – technical analysis.

S&P 500 broke out of its holding pattern, breaking below 5150 support and the 50 SMA, which, combined with the RSI below 50, keeps sellers hopeful of further losses. A break below 5040, the daily low, opens the door to 5000, the psychological level, before exposing the 100 SMA at 4930. Buyers will look for a rise above 5150 to extend gains towards 5230.

FX markets – USD slips, GBP/USD rises

The USD is falling away from a fresh five-month high reached earlier in the day. The USD has eased back as U.S. treasury yields come away from a 5-month high but remain above 4.6% on expectations that the Federal Reserve will keep interest rates high for longer.

EUR/USD is rising but still trades around 2024 low amid expectations that the ECB will start cutting interest rates as soon as June, while the Federal Reserve is not expected to begin cutting rates until later in the year. German ZEW economic sentiment improved to a 2-year high, rising to 42.9, up from 31.7 in March. The improvement in sentiment comes as inflationary in the country has fallen back to 2.2% and as the manufacturing downturn history is bottoming out.

GBP/USD is rising after UK jobs data. The unemployment rate rose to 4.2%, up from 4%, signaling weakness in the jobs market and the economy. However, UK wage growth only eased very slightly to 6% from 6.1%, suggesting ongoing inflationary pressure. The data that comes ahead of tomorrow’s inflation figures.

Oil holds steady after China data & Middle East tensions

Oil prices are holding steady, just below the five-month high reached late last week, as investors continue weighing up Middle East intentions and Chinese data.

Chinese GDP was stronger than expected at 5.3%; however, March retail sales and industrial production released alongside the figures were disappointing, painting a mixed picture for the world's largest oil importer.

Meanwhile, the market continues to watch developments in the Middle East and await a response from Israel’s Prime Minister, Benjamin Netanyahu, over Iran’s weekend attacks. An escalation of tensions depends on his response and could push oil prices higher.

Meanwhile, the U.S. dollar has risen to a five-month high, making oil more expensive for buyers of oil in other currencies.