With little in the way of news flow and the US on a public holiday over Thanksgiving, odds favoured a quiet session. Yet with reports that researchers in South Africa detected a new variant, which may be less effective against vaccinations has soured sentiment. The UK was quick to respond by introducing travel restrictions with South Africa and neighbouring countries, with UK Health Secretary Sajid Javid telling broadcasters that “there’s a significant number of mutations, perhaps double the number of mutations that we have seen in the Delta variant”. But what really shook confidence today was the discovery of two new-variant cases in Hong Kong.

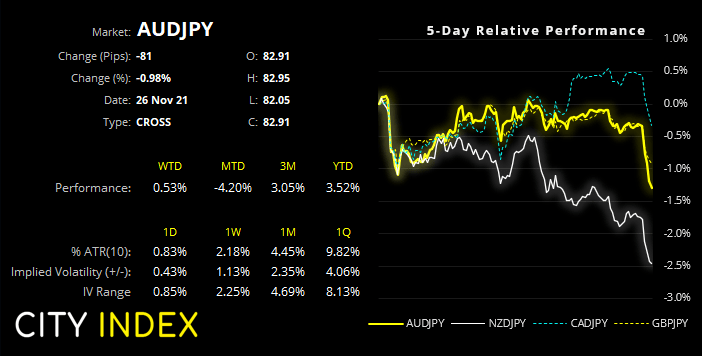

The Japanese yen is the strongest currency of the session as traders flocked to the currency as a safety play. AUD/JPY and NZD/JPY (barometers of risk for currency traders) are the weakest pairs of the session and their daily ranges have already met their ATR’s (average true ranges).

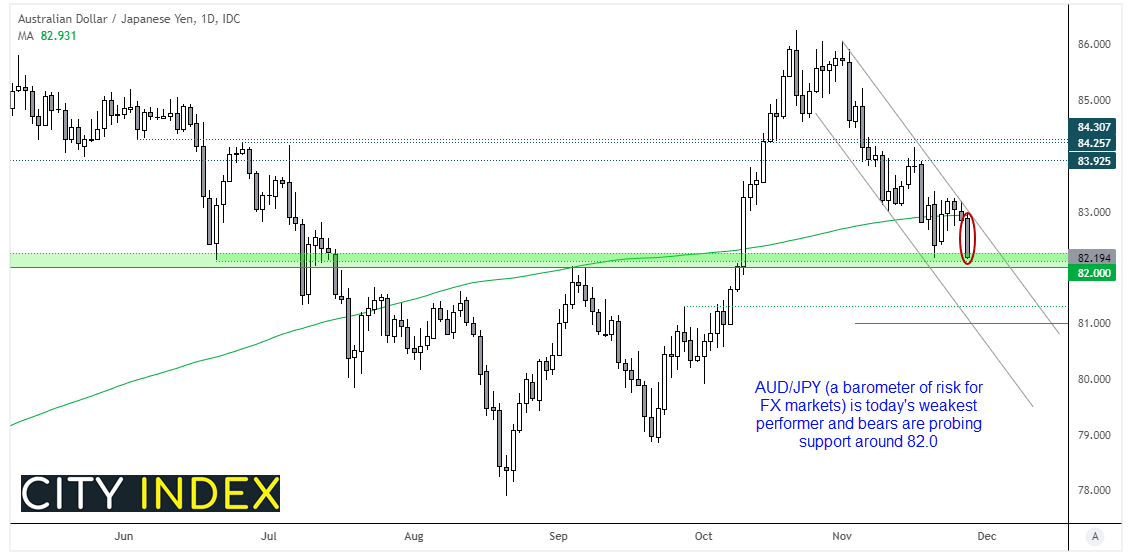

AUD/JPY leads the yen pairs lower

AUD/JPY is certainly a market to watch to see if there is any follow-through. Earlier today, the assumption was that 82.0 would hold as support and see the cross break higher, in line with risk-appetite in the US. Yet prices are now probing the key support zone, with a break below 82.0 likely to trigger some large stops and exacerbate a downside move. Also note that prices have now accelerate away from the 200-day SMA and trades within a bearish channel. For now, the bias remains bearish below today’s high and for a break below 82.0. And how traders across Europe react at the open should provide an early insight into how the final day of the week will play out.

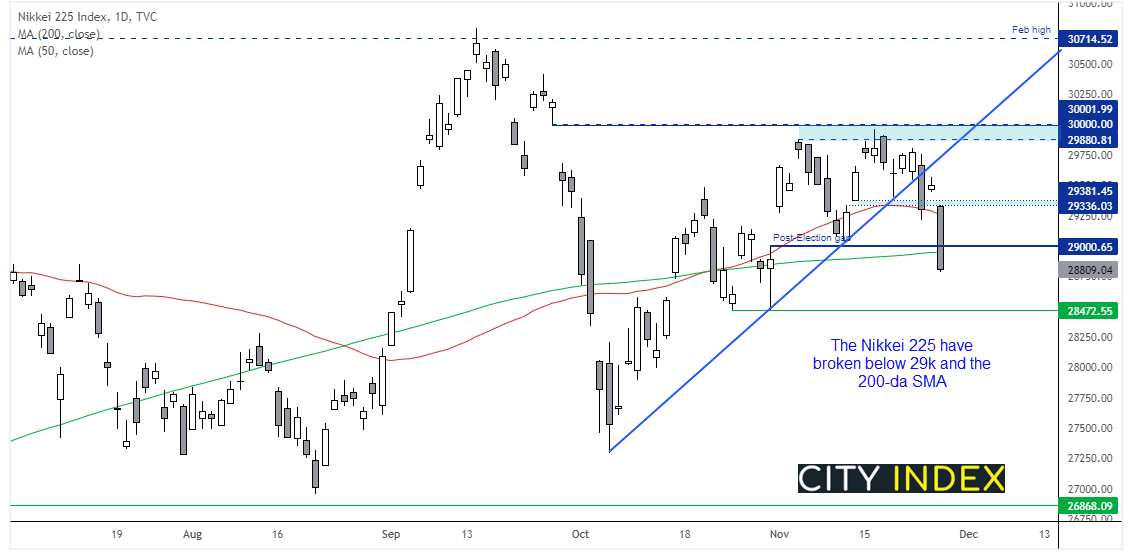

Nikkei 225 falls below 29k

The Nikkei 225 has also accelerated lower. The daily was the open price, which was at the 18,336/81 resistance zone and prices promptly fell below the 50, 200-day SMA’s and now 29k. As the market has clearly topped out and broken a trendline on the daily chart we suspect the market could now be headed for the lows around 28,4733.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade