Crude oil looks set to resume its battle with sellers parked around the $84 per barrel level, bouncing strongly on Thursday following several positive fundamental catalysts. With US non-farm payrolls report for August released later in the session – providing another glimpse at the engine room for the US consumer – Friday could easily bring significant two-way price volatility for crude markets.

Crude supply capped by Russia, Saudi curbs

With Saudi Arabia likely to extend its voluntary production cut of one million barrels per day for a third month in October, crude bulls were provided another positive supply-side announcement on Thursday as Russian Deputy Prime Minister Alexander Novak announced agreement had been reached with OPEC+ members to cut Russian oil exports further. Details of the agreement look set to be released next week, including whether it encompasses production or exports, or both.

Prior to the announcement, Russia – the second-largest crude exporter globally – cut crude shipments by 500,000 barrels per day in August and 300,000 barrels per day for September.

Crude oil price buoyant despite economic gloom

Despite plenty of pessimism regarding the health of the global economy and hence the outlook for crude demand, especially regarding China, near-dated crude oil contracts continue sit well above those further out the curve, suggesting crude markets remain tight despite those fears.

In the US, the price premium demanded for front-month WTI compared to that expiring in six months’ time has blown out to widest level since November 2022, a period that coincided with significant excitement about the looming reopening of the Chinese economy.

Demand for crude and its byproducts in the world’s largest consumer, the United States, remained strong at the start of the summer driving season with the US EIA reporting supplies of crude and petroleum products rose to 20.716 million barrels per day in June, the highest daily average since November 2019.

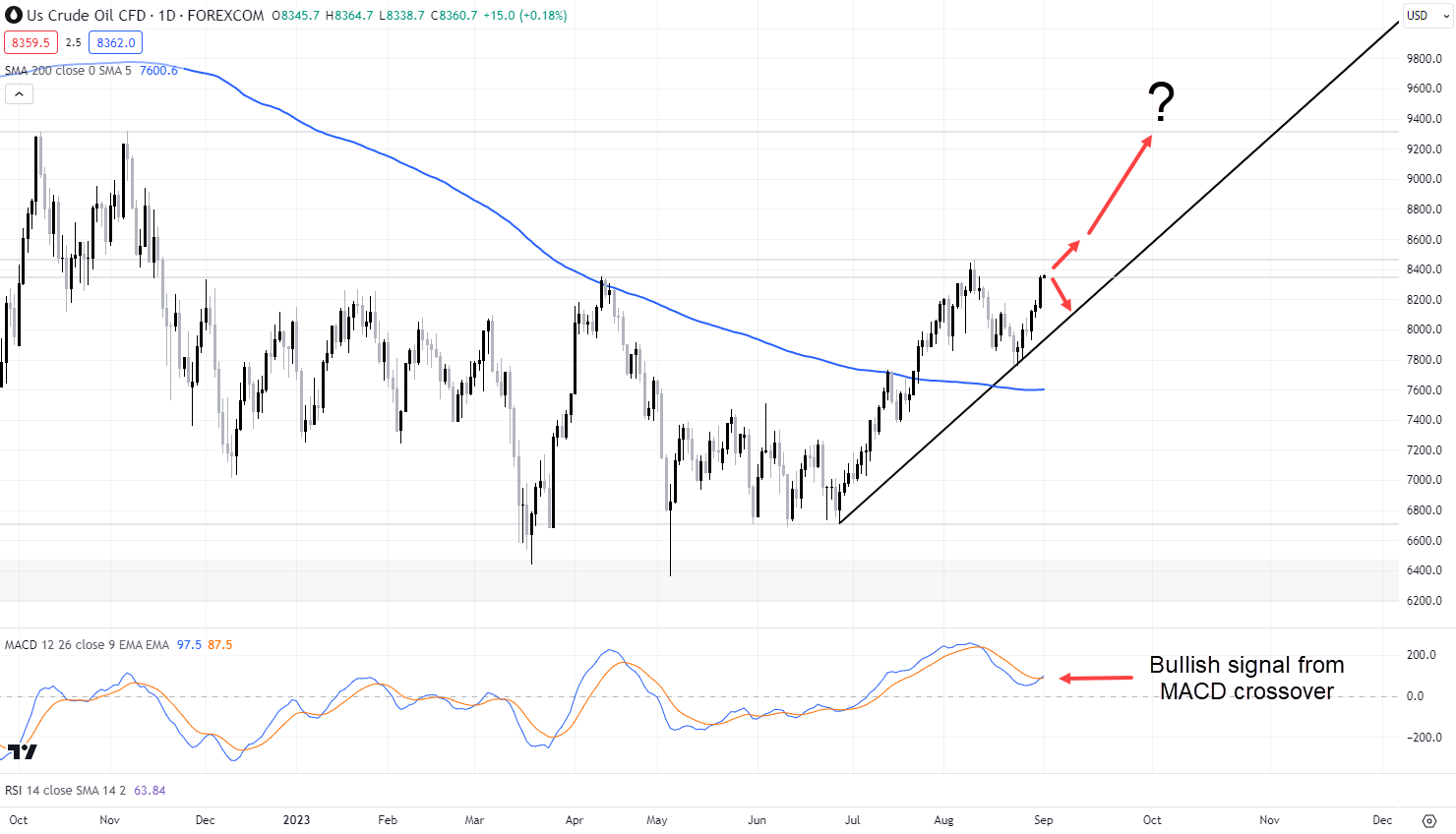

Crude still looking good despite running a long way fast

Given the positive news flow received on Thursday, coming on top of numerous stimulus measures announced in China over the past few weeks, it’s little wonder we saw crude oil pop over 2% for the session, taking it back towards the highs struck in mid-August. While it has run a long way quickly, adding nearly 25% since late June, it remains a buy-on-dips prospect until we see a clear break of the uptrend established over two months ago. Also working in its favour, we’ve seen a MACD crossover above 0 on the daily, signaling the potential for further price gains ahead. Nor it crude overbought on RSI despite the continued rally.

Sellers at $83.50 and again at $84.50 successfully repelled attempts in August to push higher, meaning a break above those levels will be required to see meaningful upside from here. Should they go, it opens the door for a move back towards the November 2022 highs above $93.00. For those looking for further upside, crude has done plenty of work around the $82 this year, meaning a tight stop below that level will help to limit losses in the advent of a sudden reversal. Below that, uptrend support currently kicks in just below $80.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade