Volatility continues to remain extremely high across the financial markets. Investors are trying to make sense of all the central bank rate hikes and quantitative tightening while worrying signs of recession emerges every day, to add to inflation woes. As a result, they have been dumping all sorts of risk assets, seeking refuge in the dollar. Signs of some opportunistic dip buying emerged as European indices bounced off their lows, lifting US futures and cryptos off their worst levels.

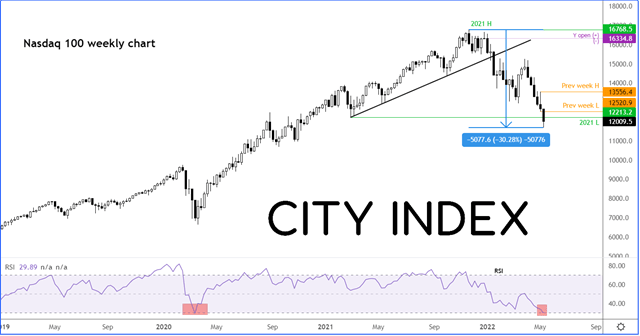

Volatility was everywhere. We saw the Swiss franc hit parity with the US dollar for first time since 2019 as the greenback pushed to a new multi-decade high against a basket of foreign currencies. On top of this, the Nasdaq bounced off its worst levels after earlier extending its drawdown from its record high to more than 30%, which was actually higher than even the March-2020-covid peak percentage drawdown. Cryptos plummeted again and WTI hit $107. On a micro level, GameStop was halted for trading after jumping 16% on the session.

On a macro level, we saw weakness in UK data earlier as GDP, manufacturing and industrial production all disappointed, increasing fears that the UK economy is heading for a recession.At times like now, it is very difficult to navigate the markets and traders are happy to take quick profits, which is why stocks have struggled to sustain any recovery attempts. But the Nasdaq is now 30% off the record highs, which means there is now a chance for a bear market rebound, especially as yields have come down a tad in recent trade. But any sort of a bounce we get, remember that we are now in a bear market and rallies get sold into more often than dips being bought

Source: StoneX and TradingView.com

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade