US futures

Dow futures -0.18% at 38505

S&P futures -0.24% at 4965

Nasdaq futures -0.50% at 17450

In Europe

FTSE -0.93% at 7645

Dax 0.17% at 16930

- Fed minutes could give more clarity on the rate outlook

- Nvidia falls ahead of earnings

- Oil falls on concerns of high rates for longer

Nvidia & Fed minutes could impact sentiment

U.S. stocks are pointing to a slightly weaker open on Wednesday ahead of the minutes from the Federal Reserve January meeting and earnings from Nvidia, which could justify or not the hype around the 2024 AI rally. Both events have the potential to impact sentiment and move the dial.

First up, investors will be observing to see whether the central bankers pour more cold water on rapid interest rate cut expectations in the minutes of last month's FOMC.

In the January meeting, the Federal Reserve kept interest rates on hold at 5.25 to 5.5% and reiterated that policymakers expect to cut rates only three times this year. The market is considerably ahead of the curve regarding rate cuts, expecting 94 basis points worth of cuts before the end of the year.

Federal Reserve chair Jerome Powell and other Federal Reserve policymakers have pushed back on rate cut expectations, and investors will now look at the minutes for further clarity over one of the Fed's outlooks.

Corporate news

Nvidia is falling premarket ahead of the AI chipmaker's quarterly earnings, which are due after the market close. This could signal jitters as traders worry about the firm's expensive valuation. Expectations are EPS of $4.58 on revenue of $20.37 billion, up substantially from a year earlier.

Walgreens Boots drops 3% after the pharmacy fell out of the Dow Jones industrial Average Index, being replaced by Amazon after nearly three years on the blue chip index.

Palo Alto Networks have tumbled 23% after the cyber security firm reported current quarter guidance that missed forecasts as clients watch their expenditures.

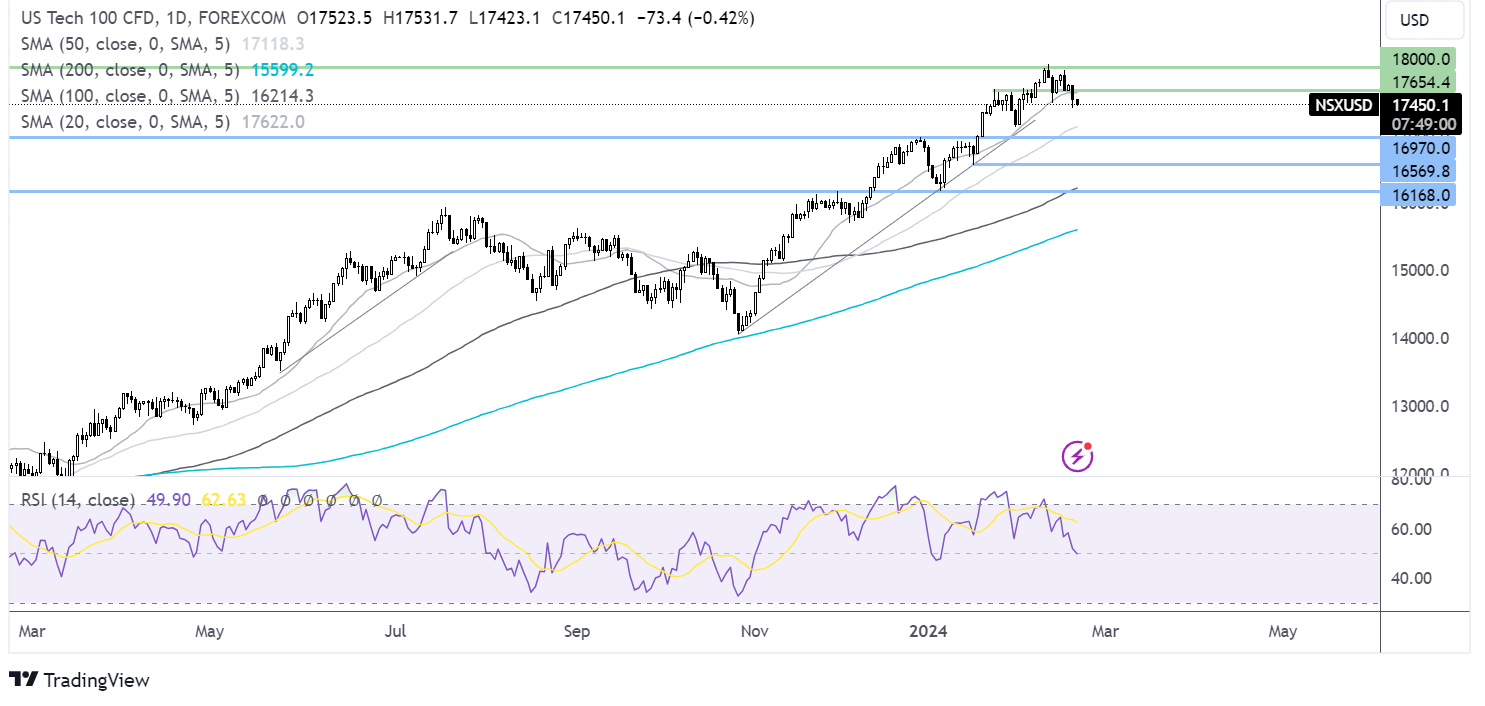

Nasdaq 100 forecast – technical analysis

Nasdaq 100 is falling for a third straight day, falling below the multi-month rising trendline and 17550, the January high. Sellers will look to take out 17395, yesterday’s low, to extend losses towards 17000, the December high. Meanwhile, buyers will need to rise above 17730, the rising trendline resistance, and yesterday’s high to push back up to 17887 and fresh all time highs.

FX markets – USD is steady, GBP/USD rises

The USD is holding steady after five days of losses and as attention turns to the FOMC minutes.

EUR/USD is holding steady after five days of gains as investors look ahead to eurozone consumer confidence data, which is due shortly and expected to show that sentiment improved slightly to -15.6 from -16.1 in February. Stronger than expected consumer morale could improve the consumption outlook for the region.

GBP/USD is edging higher after the UK government budget surplus reached a record high of £16.7 billion in January. Stronger receipts from VAT, personal and corporation tax, and lower interest cost payments mean that Chancellor Jeremy Hunt has potentially more wiggle room for tax cuts in the March budget.

Oil falls on worries over high rates for longer.

Oil prices are falling over 1.5% lower on Wednesday amid growing expectations that any interest rate cuts in the US will take longer than initially expected. High-interest rates for longer weigh on the demand outlook for oil. The minutes of the Fed meeting are due later and should offer further clues about the timing of interest rate cuts.

As diplomacy in the Middle East is struggling to make advances, Houthi attacks on ships in the Red Sea have continued to affect the shipping route.

Oil markets trade in backwardation whereby there is a premium or front month April Brent futures over the September contract, a sign of a tightly supplied market.

.