US futures

Dow futures -0.4% at 38360

S&P futures 0.53% at 4906

Nasdaq futures 0.30% at 17400

In Europe

FTSE 0.28% at 7637

Dax 0.03% at 16930

- NFP smashes forecasts with 353k jobs added vs 180k exp.

- Meta, Amazon impress, Apple disappoints

- Oil on track for a 5% weekly decline

US NFP smashes forecasts

U.S. stocks point to a mixed open after upbeat earnings from tech majors Meta, Apple, and Amazon and after an impressively strong non-farm payroll report which supports a more hawkish Fed.

The closely watched U.S. jobs report showed that 353k jobs were added in January, up from an upwardly revised 333k added In December. Meanwhile, the unemployment rate defied expectations and held steady at 3.7%, while economists predicted a rise to 3.8%, and average earnings were stronger at 4.5%

The latest data suggests that the labor market is still very resilient despite interest rates remaining elevated at a 22-year high.

The data comes after the Federal Reserve interest rate decision earlier in the week when the Fed left rates unchanged for a fourth straight month, and Federal Reserve chair Jerome Powell pushed back on expectations of a March right as he described the labor market as strong.

The data shows that hiring momentum remained strong at the start of 2024 supporting the Fed’s view that the central bank can wait longer before cutting interest rates.

Looking ahead, attention will be on US Michigan consumer confidence data, which is expected to show that consumer morale improved in January rose to 78.9, up from 69.7 in December.

Corporate news

Meta is set to open around 17% higher after beating top and bottom line estimates in Q4 and after the company announces its first-ever dividend. Sales in the final quarter of last year jumped 25% year on year whilst expenses fell 8% to $23.73 billion. EPS was $5.33 versus $4.96 on revenue of $40.1 billion versus $39.18 billion. Meanwhile, daily active users increased to 2.11 billion, up from 2 point 08 billion.

Amazon is Amazon is set to open 14% higher after better-than-expected results. The e-commerce giant posted EPS of $1.00 vs $0.80 on revenue of $170 billion versus the $166.2 billion forecast. Amazon Web Services revenue came in as expected at $24.2 billion, and advertising was ahead of forecasts. The results show that CEO Andy Jassy's efforts to rein in costs are paying off after the company laid off 27,000 employees between the end of 2022 and mid-2023.

Apple is set to fall 2% on the open after fiscal first-quarter earnings beat estimates for revenue and profits; however, it also saw a 13% decline in sales in China, one of its most important markets. EPS came in at $2.18 versus $2.10 expected on revenue of $119.58 billion versus the $117.91 billion forecast. However, the stock's outlook suggests weak iPhone sales, which is pulling the share price lower.

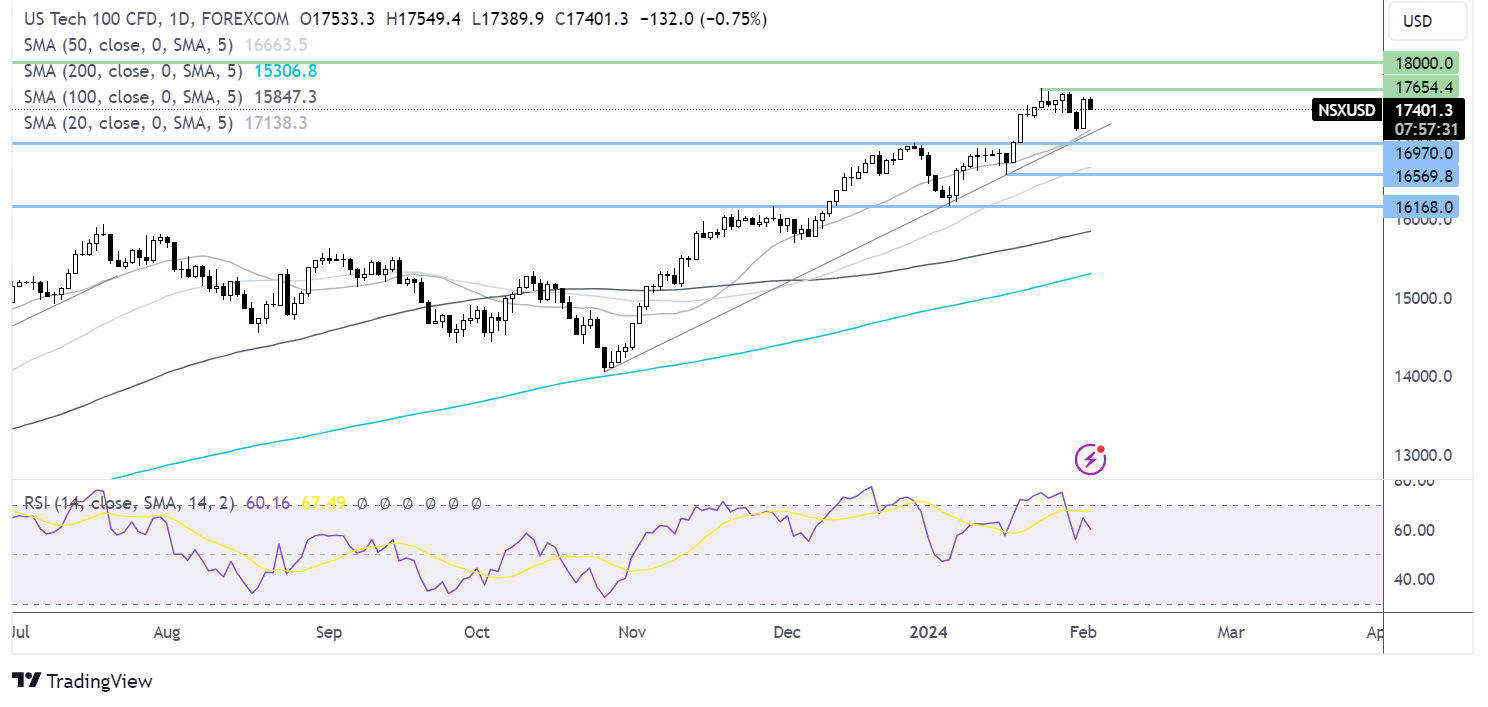

Nasdaq 100 forecast – technical analysis

After finding support at 17120, the weekly low, just above the rising trendline support and 20 SMA, the Nasdaq 100 rebounded higher and is eyeing up the 17670 all-time high. A rise above here is needed to bring 18000 into focus. Meanwhile, sellers will look for a break below 17120 to create a lower low bringing 16890 into focus the December high.

FX markets – USD rises EUR/USD falls

The USD is rallying after US non-farm payroll data has seen investors push back expectations of a Federal Reserve interest rate cut boosting USD.

EUR/USD is falling on the back of U.S. dollar strength. Seasonality is not EURUSD’s friend in February. Traders should keep in mind that February tends to be a bearish month for the euro and U.S. dollar, with the pair falling in February for 14 of the past 24 years, including each February since 2017.

GBP/USD is falling on USD strength but remains supported by the Bank of England interest rate decision yesterday, where the central bank left interest rates on hold at 5.25% in a more hawkish vote than expected.

Oil set to fall 5% this week

Oil prices are falling and set to drop over 5% this week on reports of a possible ceasefire between Israel and Hamas and after a power outage shot a large US refinery.

Whilst reports of a ceasefire in the Middle East are unsubstantiated, the market is already reducing the geopolitical risk premium attached to oil. A ceasefire may also reduce militant attacks on ships in the Red Sea which have also disrupted global supply chains and oil trading.

Also, on the supply side, OPEC sources have said that the group intends to leave voluntary oil production cuts in place for the first quarter, with another decision due in March.

Meanwhile, BP said it was shutting down a 435,000-barrel-per-day refinery in Indiana following a power outage.

.