Market Summary:

I had thought that the ISM services index would take the lead for market action, yet Bitcoin had other ideas. The classic-flavoured crypto market momentarily reached a record high before doing a sharp reversal lower then proceeded to fall nearly 15% over the next three hours. Bitcoin is now flat for the week and on track for a a doji, although the risk of volatility around prior cycle highs was noted last week – so if history is anything to go by, we may have just entered a period of elevated volatility and shakeouts

- Wall Street indices gapped lower and sent the S&P 500 and Nasdaq to a 4-day low, the Dow Jones fell to a 2-week low

- The Japanese yen was the go-to safe-haven of choice for forex traders, rising across all of its FX major peers and sending USD/JPY below 149

- The Canadian dollar lost the most ground against the yen, with CAD/JPY looking like it may want to break beneath Thursday’s low and below 110

- Gold also faltered at its highs and pulled back from its intraday record high, yet remain on track to close to a record weekly high

- Tokyo’s inflation came in hotter than expected, which raises the prospect of if a BOJ hike sooner than later and supports a higher yen thesis

- Super Tuesday has kicked off in the US where former-President Trump aims to knock his main rival – Nikki Haley – out of the running for the Republican nominee. Whilst Trump cannot technically win outright with the 15 States voting today, he could win by a far enough margin to bolster his chances going forward

- ISM services PMI revealed further weakness in the US economy, with the headline index and prices paid expanding at a softer pace and employment contracting.

- The US dollar index closed lower for a third day, although it remains above its 200-day EMA heading towards a key testimony from Jerome Powell on Wednesday to the House Committee

Events in focus (AEDT):

- 09:00 – Australian construction, manufacturing indices (AIG)

- 11:30 - Australian GDP capex, final consumption

- 18:00 – German exports

- 01:15 – US ADP employment

- 01:45 – BOC interest rate decision, rate statement

- 02:00 – Fed Powell testifies to the House Committee

- 02:00 – US JOLTS job openings, small business optimism, wholesale inventories

- 02:00 – Canada PMI (Ivey)

- 02:30 – BOC press conference

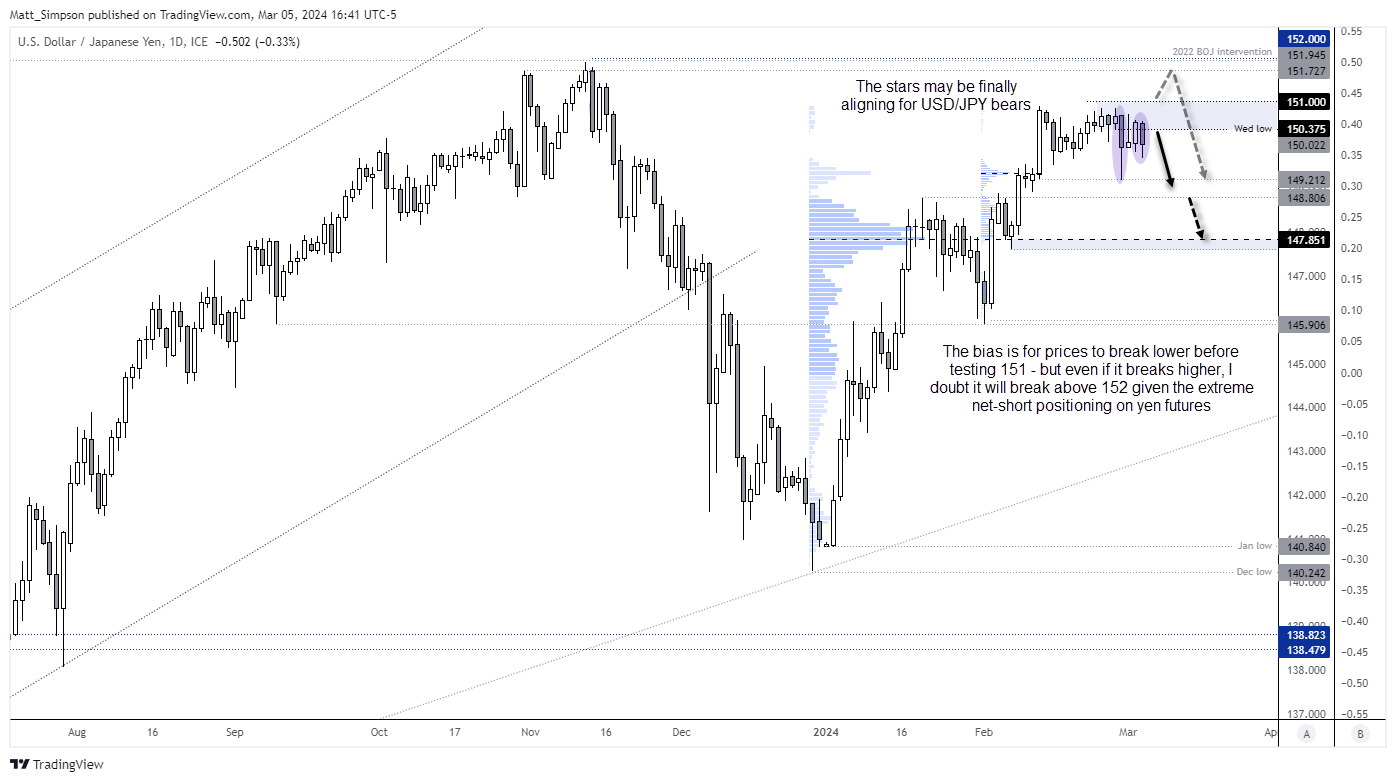

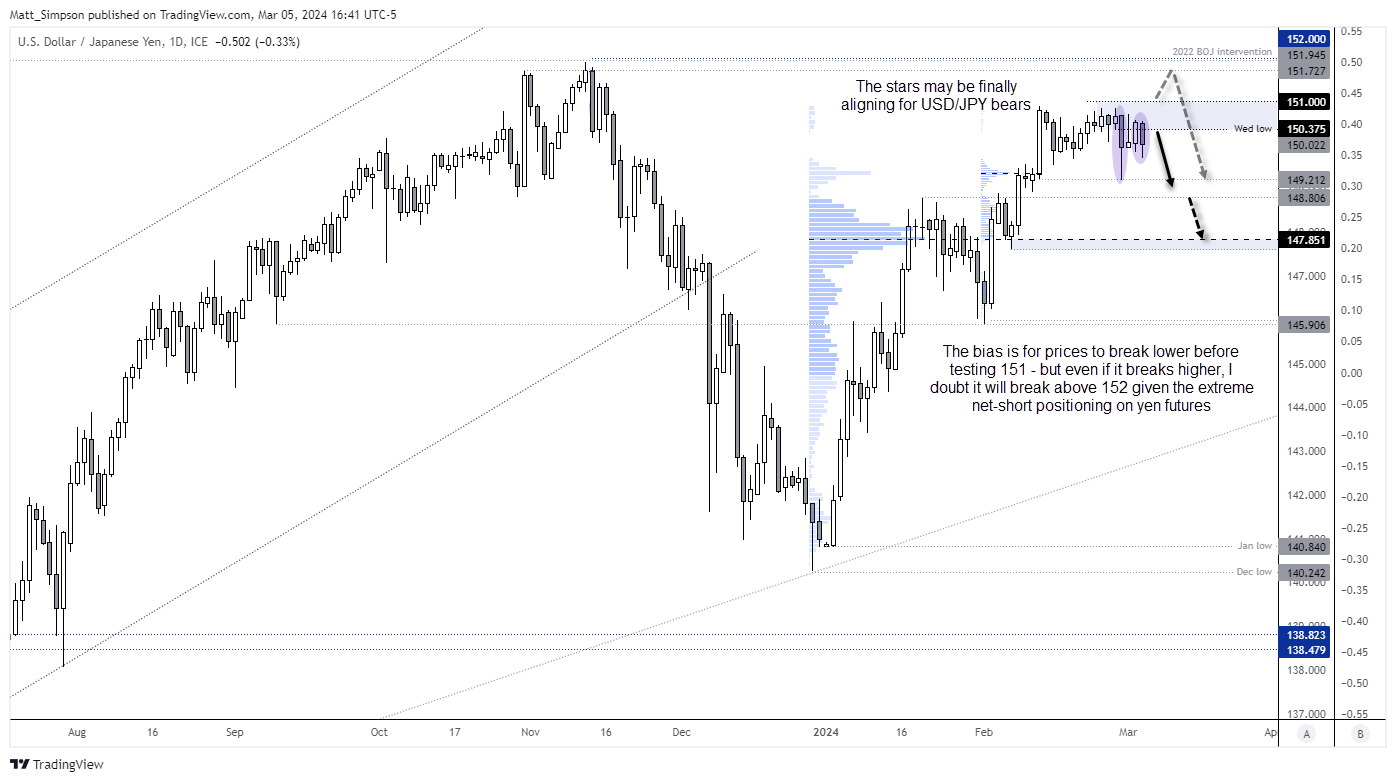

USD/JPY technical analysis

I have been quite vocal about a potential bearish reversal on USD/JPY in recent weeks, given the extreme bearish positioning on Japanese yen futures and more recently hawkish comments from a BOJ member, If US data continues to soften, the case for a lower USD/JPY builds. Especially if this weekly bearish reversal on USD/CNH continues to play out.

A 2-bar bearish reversal formed on USD/JPY following its bearish outside day on Tuesday, which might form part of a lower high within the ‘fade zone’ I mentioned last week. Bears could seek shorts within Tuesday’s range with a stop above this week’s high (or the 151 handle for a more conservative approach). This is anticipation of a move to and below the 149.20 low.

Of course, an upside risk for the pair is if Jerome Powell delivers a hawkish speech during his testimony to the House committee, and Bitcoin bulls come back in force despite the ugly shakeout at its record high.

CAD/JPY technical analysis:

If I had to short a yen pair today, my preference would be CAD/JPY. It was the weakest major-yen pair on Tuesday, but the cross has also broken trend support and printed a 3-bar bearish reversal pattern (evening star formation). And if the BOC add a dovish tone to today’s meeting, it could send CAD/JPY below 110.

A 100% projection of the initial leg lower lands around 109.30, and the 109 handle sits near a 38.2% Fibonacci retracement level – both of which seem viable downside targets for bears.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade