Iron ore futures, along with other bulk commodities, have been charging higher recently, a performance in stark contrast to other asset classes in China that have been under considerable selling pressure. Given iron ore is a key steel input, and the largest of steel demand in China is the property sector, buoyancy in futures suggests additional support for China’s industrial sector may arrive in the not-too-distant future.

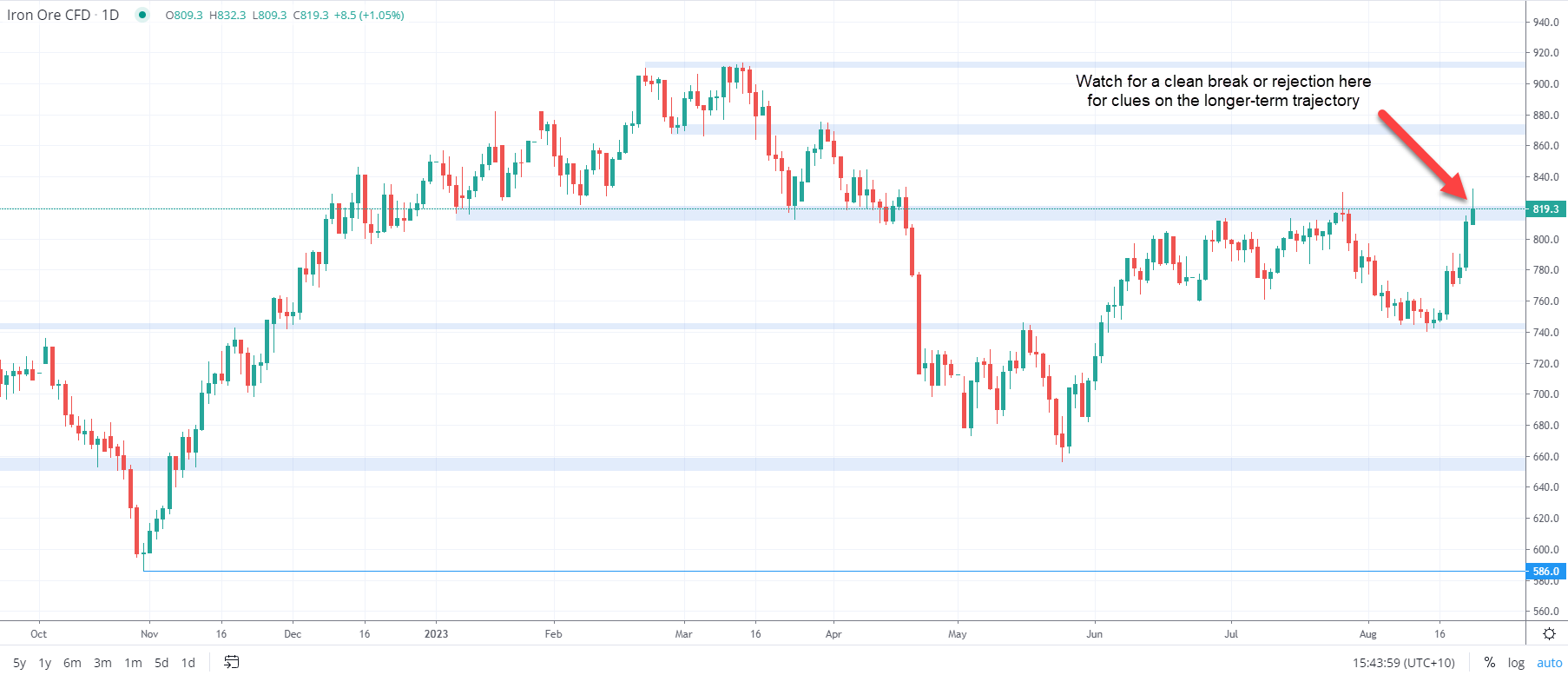

Even though nothing has been confirmed, there’s been no shortage of traders willing to front-run a potential large-scale stimulus package. The daily chart below shows the swift turnaround in sentiment perfectly.

The rally has left iron ore at an interesting juncture, running into a resistance zone that previously acted as support. It’s not had success around this level, trying and failing constantly to break higher over the past two months. And when it has momentarily enjoyed success, sellers have been quick to hammer it back down again. The battle between the bulls and bears around this zone suggests near-term price action may be influential in determining the longer-term trajectory.

Should iron ore successfully break above the zone and close there, it opens the door to a potential run higher to the next resistance zone beginning around ¥870. Beyond that level, a test of the highs struck earlier this year may beckon.

If the rally fails, minor support at ¥760 seems the first port of call before a more significant support zone beginning at ¥745. Should that fail to hold, a decline towards ¥660 beckons.

For the ample uncertainties that exist – potential stimulus, concern regarding property developers and the impact that may have on demand during what is a traditionally strong period – the price action is not complex when it comes to iron ore.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade