GBP/USD rises ahead of the US NFP report

- 180K jobs are expected vs 336k in September

- Both the Fed and the BoE left rates unchanged

- GBP/USD attempts to break out from symmetrical triangle

GBP/USD is rising for a second straight session amid U.S. dollar weakness and as investors look ahead to the US non-farm payroll report.

Expectations are for 180,000 jobs to be created in October after 336,000 were added in September.

Meanwhile, the unemployment rate is expected to hold steady at 3.8%, and average hourly earnings are seen rising 0.3% MoM up from 0.2%, highlighting the ongoing tightness in labour market conditions

The data comes after the Federal Reserve left interest rates unchanged earlier this week and kept the door open for further hikes if needed. According to the CME Fed watch tool, the market is pricing in a 20% probability that the Fed will hike again in December.

Hot employment report could fuel bets of a more hawkish Fed, giving yields a boost and lifting the US dollar.

Meanwhile, should the non-farm payroll report come in below expectations and show signs that the US labor market is cooling, this scenario could boost GBP/USD.

The pound is holding on to gains from yesterday's Bank of England interest rate decision, where the central bank left rates unchanged but said they would remain high for longer.

Attention now turns to the service sector PMI data, which is expected to confirm the preliminary reading of 49.2 down from 49.3. Given the dominance of the service sector in the UK economy, a weak PMI could raise concerns about the sector acting as a drag on the economy at the start of the fourth quarter.

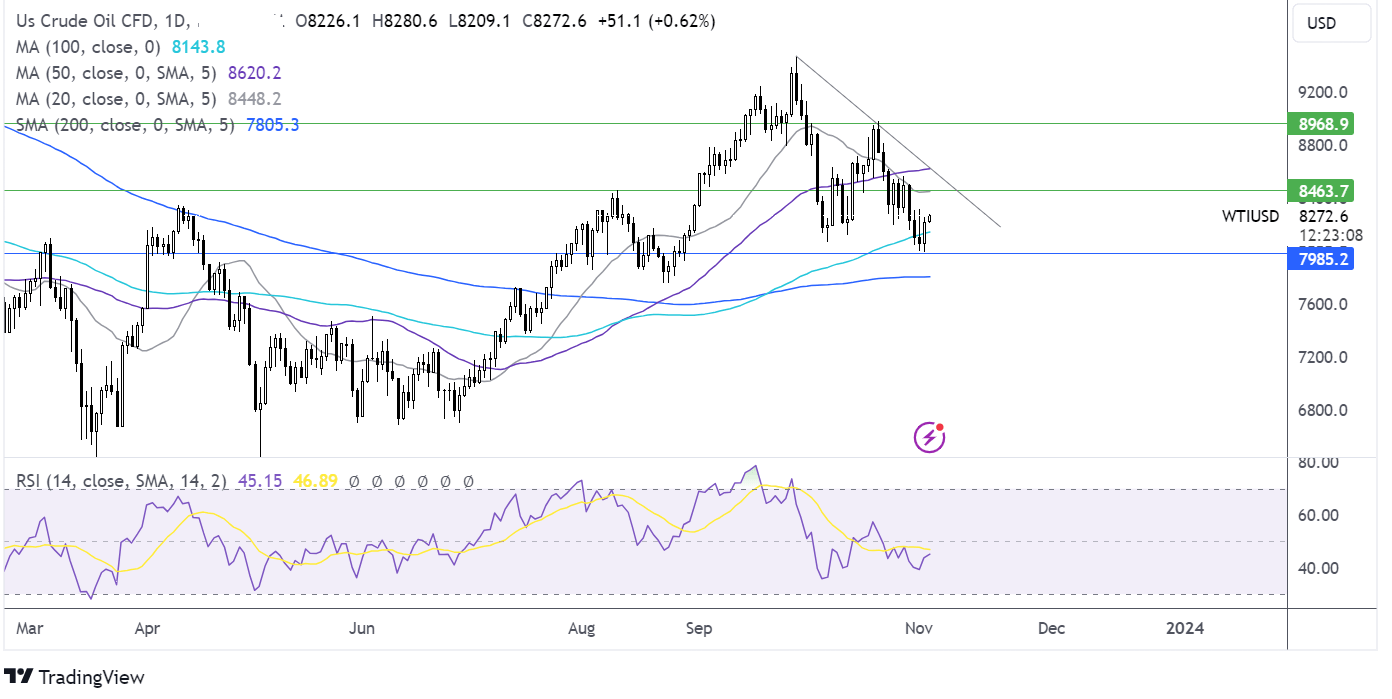

GBP/USD forecast – technical analysis

GBP/USD is attempting to break above the 20 sma and out of the upside of the symmetrical triangle within which it has been trading. A rise above 1.2230, the weekly high is needed to extend gains towards 1.2290, last week’s high and 1.2340, the October high.

On the downside, failure to hold above the 20 sma could see the price test 1.21 the rising trendline support ahead of 1.2070, last week’s low.

Oil holds onto yesterday’s gains but is set to fall across the week

- Oil is on track to fall 3% this week

- Middle East tension ease & China in focus

- Oil recovers from 80 and rises above 100 sma

Oil prices are edging higher, extending gains from yesterday when oil prices received a boost from the improved risk appetite after the Fed and BoE left rates on hold and hinted that they are done hiking.

Still oil is set to fall over 3% across the week, marking the second streak week of declines as fears of oil supply being impacted by the Middle East conflict ease and amid concerns over the demand outlook in China, the world’s largest oil importer.

Data this week from China has been broadly weaker than expected, raising doubts over the revival of the Chinese economy. Earlier in the week, the PMI data showed a contraction in the manufacturing sector, and today, the Caixin PMI showed Chinese services activity expanded at a faster pace, but sales grew at the slowest rate in 10 months, and business confidence waned,

Meanwhile, geopolitical concerns remain in focus as Israel continues their assault on Gaza. The oil market will be watching for an escalation of tensions, particularly on the Lebanese border, as Hezbollah attacks increase.

Looking ahead, US jobs data is in focus, and the Baker Hughes rig count which is considered an indicator of future production.

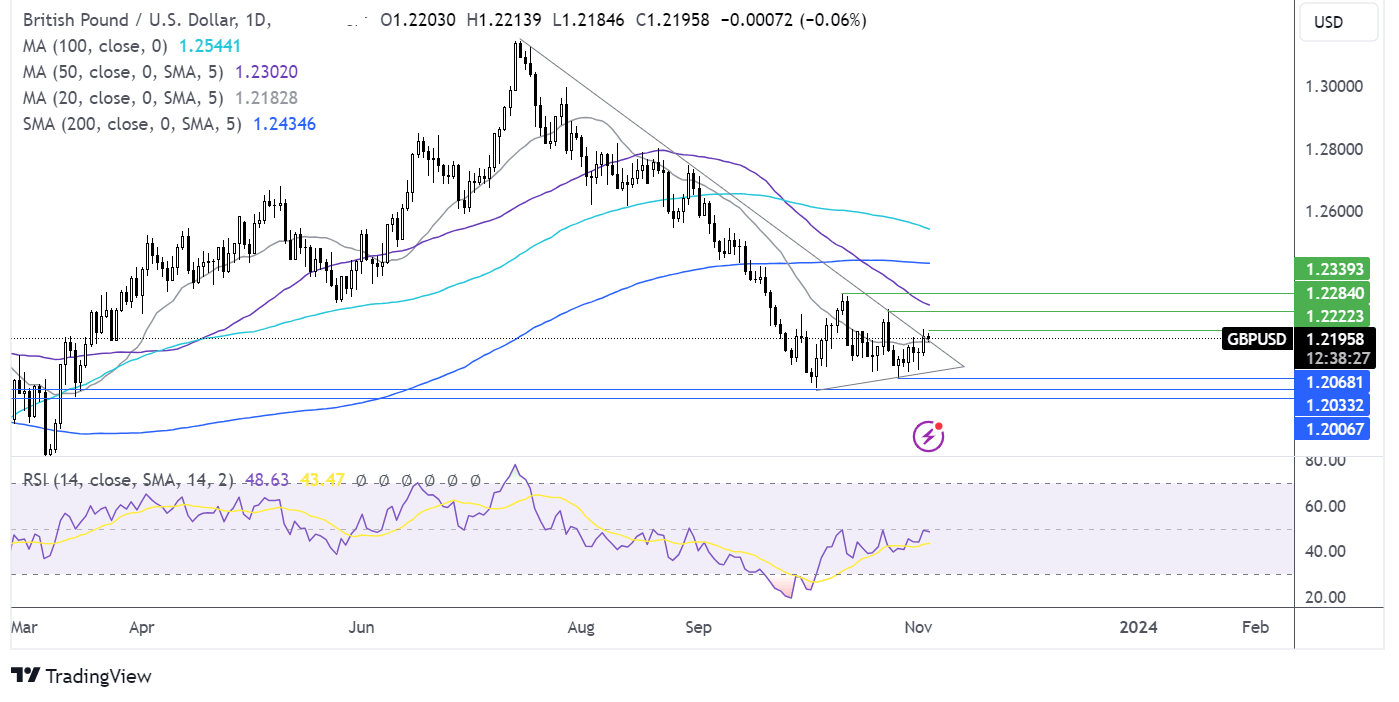

Oil forecast – technical analysis

After finding support at 80.00, oil prices rebounded higher, rising above the 100 sma, bringing 84.50 the 20 sma and the August high into focus. A rise above here could see buyers target 86.00 the 50 sma and the falling trendline.

Meanwhile, failure to hold above the 100 sma could see sellers target 80.00.