US futures

Dow futures +0.2% at 34129

S&P futures +0.41% at 4347

Nasdaq futures +0.72% at 14798

In Europe

FTSE +0.70% at 7733

Dax -0.02% at 15567

- Stocks point to weekly & September so far losses

- US services PMI is expected to rise to 50.6

- USD is on track for a 10th straight week of gains

- Oil rises as Russia bans gasoline & diesel products

Steep losses this week

US stocks are pointing to a modestly higher start on Friday but are on track to book heavy losses across the week following the Federal Reserve's hawkish stance.

This week, the Federal Reserve indicated that it would raise interest rates again before the end of the year and would ease less next year, supporting the higher for longer mantra. US 10-year treasury yields climbed to their highest level since 2007 hurting demand for stocks, particularly the tech sector.

The NASDAQ 100 is on track to lose 3.5% this week, which would mark its weakest weekly performance since March. Meanwhile, the Dow Jones has fallen 1.6% this week and the S&P 500 has dropped 2.7%.

September is traditionally a negative month for US equities, and that appears to be true of this September so far. Despite stocks falling heavily in August, they have extended those losses across September. The Dow trades down just shy of 2% so far this month while the S&P500 trades 4% lower this month and the NASDAQ100 has dropped over 5.5%. With just one week left in September, the odds are a positive month for stocks is looking unlikely.

Looking ahead attention now turns to US PMI data which is expected to show that the manufacturing index remains in contraction in September at 48, modestly up from 47.9 in August. Meanwhile, the services PMI is expected to grow to 50.6 up from 50.5. Stronger-than-expected PMI data could show that US economy is proving to be more resilient than expected.

Corporate news

Activision Blizzard will be in focus and is expected to rise on the open after the UK competition regulator signaled that Microsoft's $69 billion restructured deal could now go through.

Citigroup is also set to rise after the bank announced that it would be cutting headcount in the UK offices, with redundancies expected to impact hundreds of jobs.

Alibaba ADR's are on the rise on reports that the Chinese conglomerate logistics arm is looking for a Hong Kong IPO potentially as soon as next week.

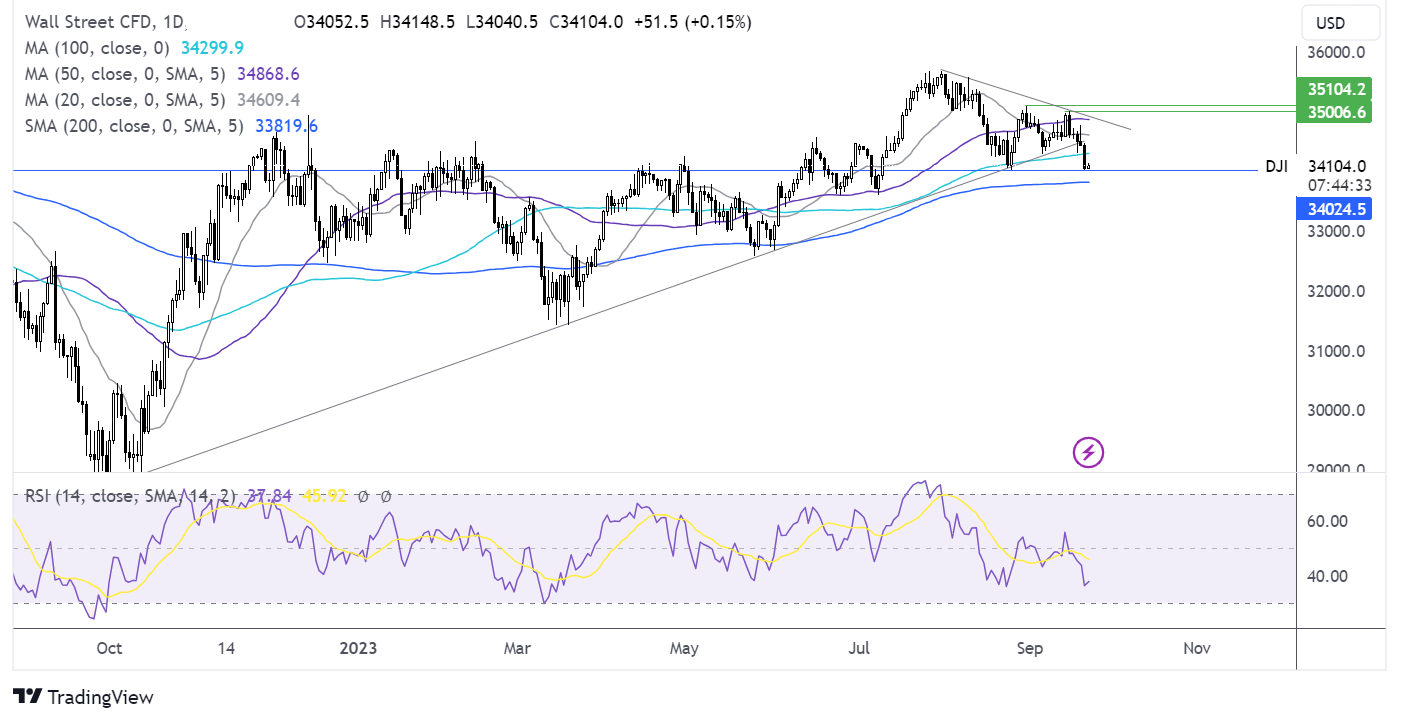

Dow Jones forecast – technical analysis.

The Dow Jones found support at 34025, the August low. Sellers will need to see a break below here in order to extend the selloff towards the 200 sma at 33800 and 33600, the July low. Meanwhile, should the support hold, buyers will look for a rise above 34275 to extend gains 34600 the 20 sma.

FX markets –USD rises, GBP falls

The USD is rising and is set to book gains across the week, marking the 10th straight weekly rise, the longest rally in the US dollar index in over a decade. The dollar is supported by treasury yields at 16 year high and expectations that the Federal Reserve will keep interest rates higher for longer.

EUR/USD is falling towards 1.0650 after eurozone PMI data points to the economy facing a contraction. The composite PMI was at 47.1 in September, below the 50 level, which separates expansion from contraction for a fourth straight month. Germany and France were key drivers of the region's downturn. A contraction in Q3 GDP is looking inevitable.

GBP/USD has fallen towards 1.2250, extending gains into a third straight day as investors digest a weaker-than-expected rebound in retail sales and a sharper contraction in the service sector activity. Retail sales rose 0.4% MoM in August up from -1.1% in July, but forecasts of 0.5%. Meanwhile, the services PMI fell to 47.2, well below the 49.2 forecast and down from 49.5 in August. The data adds to mounting evidence that the UK economy is heading for a contraction in the third quarter.

EUR/USD -0.10% at 1.0650

GBP/USD -0.43% at 1.2250

Oil rises as Russia supports supply concerns

Oil prices are heading higher after three days of declines amid revived supply concerns.

Russia's banning of the export of gasoline and diesel products has seen global supply concerns overshadow demand worries caused by a hawkish Federal Reserve and the prospect of higher interest rates for longer.

Russia announced the temporary ban to all countries outside of a circle of four ex-Soviet states with immediate effect in order to stabilise the domestic fuel market.

Both Brent and WTI are set to book modest losses across the week after gaining over 10% in the previous three weeks. Trading continues to be choppy as investors weigh up supply worries against slower demand concerns.

WTI crude trades +1.2% at $89.14

Brent trades +1.2% at $92.22

Looking ahead

14:45 US PMIs

18:00 Baker Hughes Rig Count