- Dollar analysis: Attention turns to Powell speech and key data

- USD/CNH into focus ahead of key data from China next week

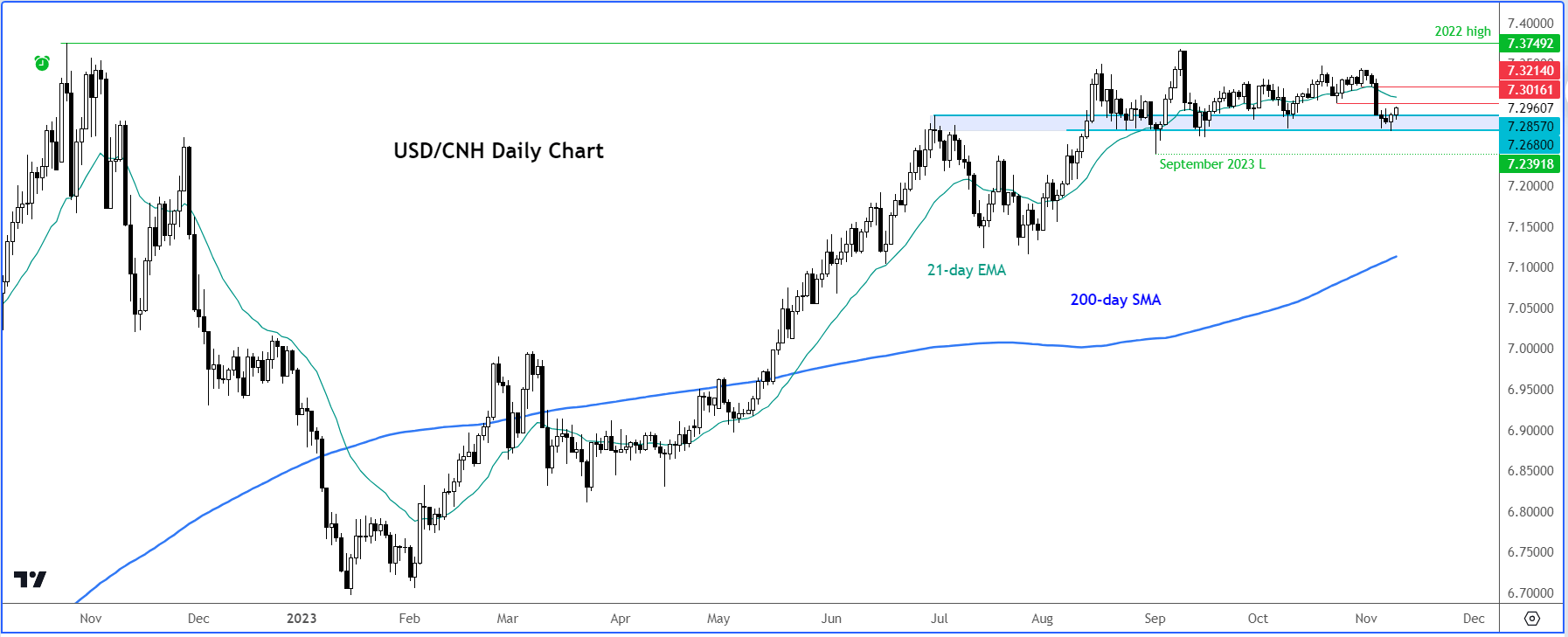

- Will we finally see a technical breakout in USD/CNH?

The USD/CNH pair has been stuck in a tight range, unable to move in either direction. In recent days, the US dollar has weakened a little across the board owing to recent signs of peak interest rates in the US. But expectations that interest rates will remain elevated for a long period of time means that the greenback continues to find support against weaker currencies like the yuan and yen, among others. The USD/CNH will be in focus as we have some key macro events to look forwards from both of the world’s two largest economies.

Dollar analysis: Attention turns to Powell speech and key data

Following Friday's non-farm payroll report, which was weaker than expected, we had some more evidence of a cooling US jobs market as Continuing Claims rose more than expected, further fuelling bets that the Fed may have reached the end of its rate hiking cycle. However, the slightly weaker data has been countered by Fed speakers this week pushing back on expectations that the Fed is now done with rate hikes or will soon start cutting rates. So, all eyes are now on Fed chair Jerome Powell, who is due to speak for a second time this week. Let’s see if he touches on monetary policy or the economic outlook, topics which he avoided in his speech the day before.

Meanwhile attention will remain on oncoming data. On Friday, we will have UoM’s consumer sentiment survey to look forward to. Next week, we have US retail sales and, more importantly, inflation data on Tuesday. For two consecutive months now, US inflation has surprised to the upside. In September, annual CPI remained unchanged at 3.7%, defying market expectations of a slight decrease following an even larger surprise the month before. But if we see a larger-than-expected drop in CPI this time, then it will further boost the “peak interest rates” narrative and potentially hurt the dollar. The opposite of that is something that the dollar bulls will be hoping to see.

USD/CNH into focus ahead of key data from China next week

It is also important to monitor economic indicators from China, the world’s largest gold consumer. As well as industrial production we will have retail sales data to look forward to in the early hours of Wednesday from the world’s second largest economy. Recent Chinese macro pointers have shown some improvement. This has stopped the yuan’s slide. We will need to see more evidence of a turnaround for yuan and local stocks to recover more meaningfully.

Let’s see if the upcoming events will inspire a break out in the USD/CNH this time. The bulls have again stepped in to defend key support in the 7.2680-7.2857 range this week. Short-term resistance is seen around 7.3015 and then at 7.3215 or thereabouts.

Source: TradingView.com

Video: Nasdaq, EUR/USD and gold analysis

-- Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade