The Dax gapped down on the open and has extended losses across the European session amid growing concerns over the coronavirus outbreak, a travel ban from Trump and the ECB leaving rates unchanged.

ECB Keeps Rates Unchanged

The ECB unexpectedly left rates unchanged, sending the EUR/USD sharply higher. The Dax is inversely correlated to the value of the euro, thanks to Germany’s exporter nation status. Additionally, investors had been pricing in a cut, which is beneficial to businesses in times of stress, the fact that it didn’t appear has disappointed. The DAX dived a further 0.5% following the decision.

The ECB unexpectedly left rates unchanged, sending the EUR/USD sharply higher. The Dax is inversely correlated to the value of the euro, thanks to Germany’s exporter nation status. Additionally, investors had been pricing in a cut, which is beneficial to businesses in times of stress, the fact that it didn’t appear has disappointed. The DAX dived a further 0.5% following the decision.

The ECB disappointment came after the WHO declared coronavirus a pandemic and Trump closed the US borders with Europe for foreign nationals who have been to one of the 26 countries outlined.

Lufthansa Drops 9%

Travel between US and Europe is the aviation sector’s most important international market, so airlines are booking big losses in both Europe and the US.

Apart from the UK (33%), Germany sees the largest number of daily flights to the US (13%). Lufthansa has an 11% share of the total US – Europe market. Lufthansa is trading 5% lower. Any whiff that the ban could be broadened to US citizens as well, or that it will continue for longer than the 30 days mentioned could see a further drag on Lufthansa.

However, there is the additional downside that travel restrictions sends out negative connotations, resulting in a loss of consumer confidence on a broader scale.

Travel between US and Europe is the aviation sector’s most important international market, so airlines are booking big losses in both Europe and the US.

Apart from the UK (33%), Germany sees the largest number of daily flights to the US (13%). Lufthansa has an 11% share of the total US – Europe market. Lufthansa is trading 5% lower. Any whiff that the ban could be broadened to US citizens as well, or that it will continue for longer than the 30 days mentioned could see a further drag on Lufthansa.

However, there is the additional downside that travel restrictions sends out negative connotations, resulting in a loss of consumer confidence on a broader scale.

Recession coming?

The final kick in the teeth for German comes following a report from the Kiel Institute for the World Economy, which said that it now expects Germany to enter recession. The Institute forecasts Europe’s largest economy contracting by 0.1% in 2020 due to the coronavirus.

The final kick in the teeth for German comes following a report from the Kiel Institute for the World Economy, which said that it now expects Germany to enter recession. The Institute forecasts Europe’s largest economy contracting by 0.1% in 2020 due to the coronavirus.

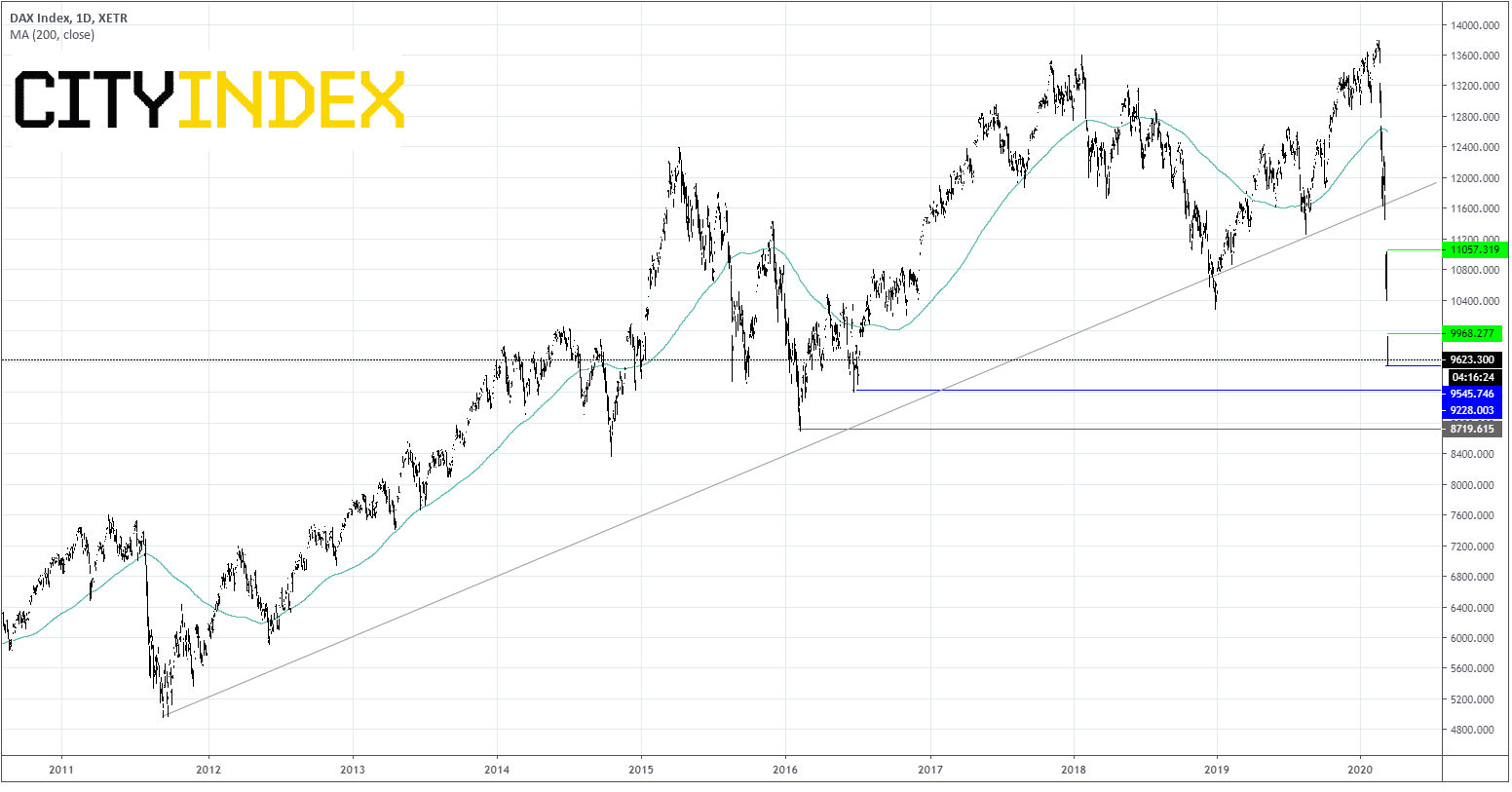

Levels To Watch

Don’t try to catch a falling knife! – The Dax is down 8% today and 30% this year. The chart is clearly bearish, with only a move closing the gap down will allow for breathing space.

The Dax is trading at the daily low. The next support level is at 9228 (low 1st July’16), prior to 8730 (9th Feb’16 low). On the upside resistance is at 9932 (today’s high).

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM