- DAX outlook: What has driven the German index to record highs and can the rally persist?

- US investors are back, with Nvidia earnings coming into focus this week

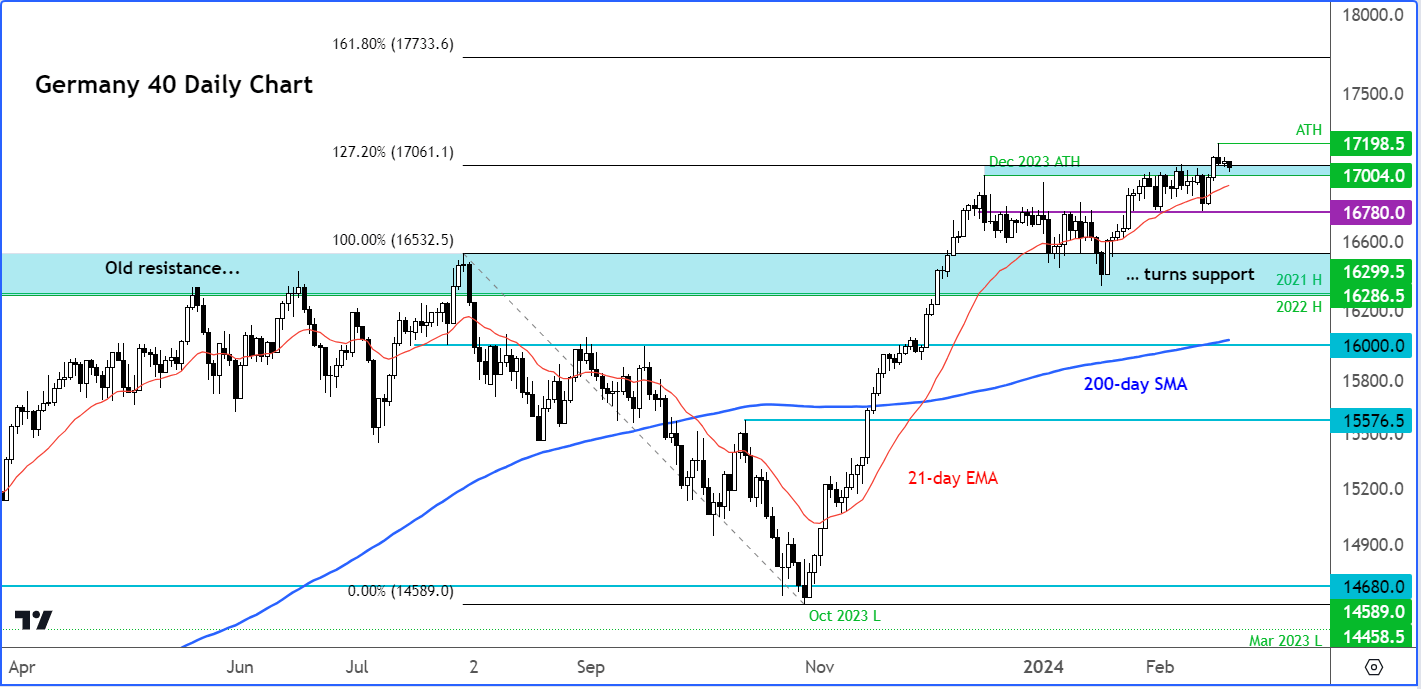

- DAX technical analysis shows index is testing key support

DAX analysis video and insights into S&P 500 and major FX

DAX outlook remains positive for now

The DAX was trading lower in the first half of Tuesday’s session, but there was no major indication that the rally is over yet, with many investors sitting on their hands so far this week. Although this week may see a relatively subdued flow of macroeconomic data, North American markets resume trading today following a long weekend break, and with China also returning to activity, markets should turn livelier are after a subdued start on Monday. At the time of writing, some of the other European indices were also trading modestly lower while some like Ibex were a bit higher, while US futures were down across the board. After hitting repeated highs in recent weeks, the markets have paused for a breather, allowing overbought conditions to be worked off, as investors await fresh macro stimulus.

What investors are focusing on this week?

As mentioned, there’s not a lot on the agenda in terms of macro data, but China and US are back, and we will have earnings from Nvidia in mid-week to look forward to. Among this week’s data highlights, the global PMI figures on Thursday could move the markets. It is worth paying close attention to the PMI data from Germany and the Eurozone, which have shown growth rates below those observed in the US. Despite the subdued Eurozone data, the DAX continued to achieve record highs so far this year, while most mainland European indices have also performed strongly. However, there will come a time when the market needs to evaluate the influence of sluggish data on earnings and determine if asset prices have been driven excessively high as a result.

DAX outlook: What has driven the German index to record highs and can the rally persist?

For now, investors are happy to buy any dips they could get their hands on, it seems. Sentiment among stock market investors has remained positive. Driving the DAX to record highs has been partly driven by speculation that the ECB is going to cut rates in the coming months. The drop in negotiated wage growth to 4.5% year-on-year from 4.7% confirms that wages are no longer accelerating, and if this trend is sustained, then the ECB could cut rates in the coming months, with most likely in June.

The German index has also been finding support from its technology constituents, with the sector surging on AI optimism in the US, which has lifted the tech stocks across the globe. Let’s see if US investors will carry on where they left off last week, and once again buy the latest dip on their return today.

Inflation in the Eurozone has already fallen significantly from double digits of just a year and a half ago, to just 2.8% annual pace last month. Analysts anticipate further moderation towards the 2% target throughout this year. However, persistent risks remain: Elevated wage growth is still a key issue, even if it is no longer accelerating, while disruptions in Red Sea shipping pose renewed threats to supply chains. Despite these factors, they have been largely overlooked as the debate intensifies over when the ECB should commence rate reductions.

Will US markets again ignore rising inflationary pressures?

On Friday, US markets fell into the close and index futures have eased further lower ahead of the cash open later. Following a hot CPI report, PPI was equally strong, printing 0.3% month over month against expectations of 0.1%, while core PPI rose 0.5% on the month, easily beating expectations of 0.1%. The PPI gains were fuelled by a sharp rise in costs of services, highlighting concerns about the sticky nature of inflation. We also saw an uptick in the UoM consumer sentiment and inflation expectations survey, with the latter rising to 3% from 2.9%. The market was therefore once again reminded that the Federal Reserve will be in no rush to cut interest rates.

Despite hotter inflation data, US stock indices have persistently surged to new all-time highs. Investors have consistently disregarded the Fed’s repeated opposition to the notion of an early interest rate reduction. Instead, they have fixated on generally strong earnings and the enthusiasm surrounding artificial intelligence. Nonetheless, with some of the "Magnificent 7" stocks attaining exceedingly lofty valuations, there is a risk of a market correction in the not-too-distant future. Nvidia is slated to report its earnings last among this group in mid-week. Considering that much of the optimism has already been factored into stock prices, a correction within the tech sector should not be deemed a major surprise. Equally, don’t be surprised if the pullback turns out to be very modest, once again.

DAX outlook: technical levels and factors to watch

Source: TradingView.com

The DAX broke to a new record high on Friday, reaching a high of nearly 17200, before pulling back along with US markets, and then drifting further lower at the start of this week. The German index has now reached a key short-term support area between 17000 to 17060, which was previously resistance on multiple occasions, including in December. To sustain the bullish trend, it's imperative that the bulls maintain their position here.

We will only entertain bearish scenarios if we witness a break in the pattern of higher highs and higher lows. Bearing this in mind, a potential breach below the 16780 support level could serve as a cautionary signal, indicating the potential end of the bullish trend. So far, however, there has been a notable absence of bearish activity. The bears will need to remain patient for now.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade