Market Summary:

- Alphabet shares rallied as much as 3.3% on Monday on the news that the company is in talks with Apple to supply Gemini AI to smartphones – which is the latest indication that Apple’s AI is behind the curve

- The Nasdaq 100 led gains on Wall Street with the S&P 500 up ~0.8%, although none of the cash indices are yet to retest their record highs ahead of the FOMC meeting

- Gold prices gently fell to a 7-day low on Monday although support was found at the previous ATH, allowing prices to form a potential pennant (usually a continuation pattern). Although with a BOJ and FOMC meeting looming, volatility can be expected and prices really could break in either direction this week

- WTI crude oil prices rose to a 1-month high to keep the $84 upside target alive and well, thanks to lower oil output from Saudi Arabia and Iraq

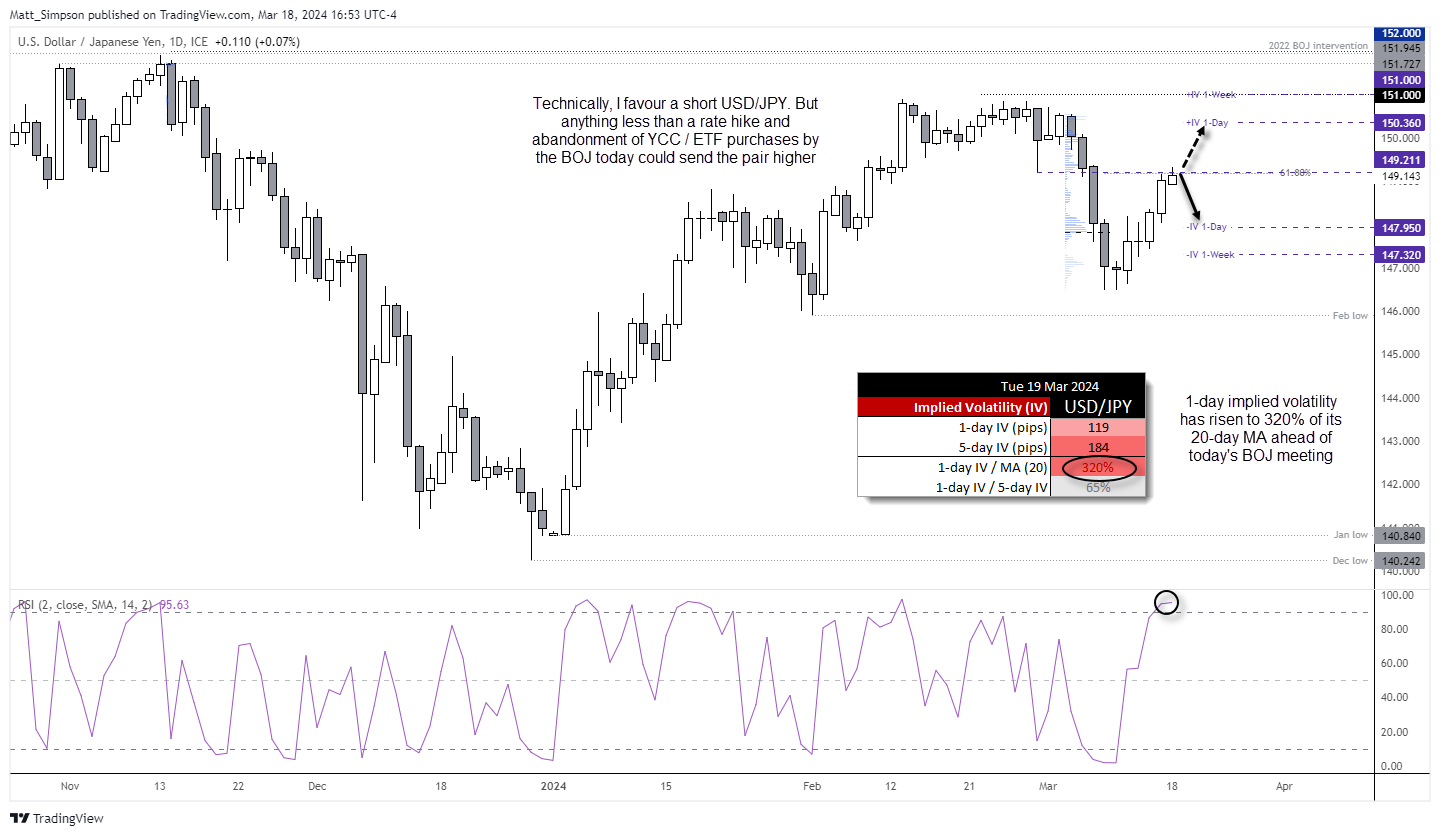

- USD/JPY rose for a fifth day ahead of today’s all-important BOJ meeting, where expectations are now for the BOJ to hike rate to 0% and abandon YCC (yield curve control)

- USD/JPY reached my upside 149 target on Friday after a textbook pullback to 148 ahead of the US open

- The US dollar index rose for a third day as markets seem to be slowly coming around to the potential that the Fed won’t signal 3 rate cuts in their forecasts (like they did in December)

- However, trend resistance from the February high could cap gains on the US dollar index as we approach the Fed meeting (although today’s BOJ meeting could prompt some volatility and see it break higher of the BOJ do not change policy)

View related analysis:

AUD/USD weekly outlook: RBA, AU employment at the helm

Central Bank galore with BOJ, Fed, BOE, SNB and RBA on tap: The Week Ahead

GBP/USD hints at sentiment extreme ahead of BOE, FOMC: COT report

Events in focus (AEDT):

The RBA and BOJ are set to announce their monetary policy decisions today. The RBA is likely to be the easier of the two, as they tend to announce at a prescheduled time. No change is expected, and if there is to be any surprise it would need to be the removal of their slight tightening bias in the last paragraph. And that leaves the BOJ interest decision as the clear headline event.

- 13:00 – Australian inflation expectations (Melbourne Institute)

- 13:30 – BOJ interest rate decision (times may vary, quite considerably)

- 14:30 – RBA interest rate decision, rate statement

- 15:30 – Japan capacity utilisations, industrial production

- 17:30 – BOJ press conference

- 21:00 – German / Eurozone ZEW economic sentiment

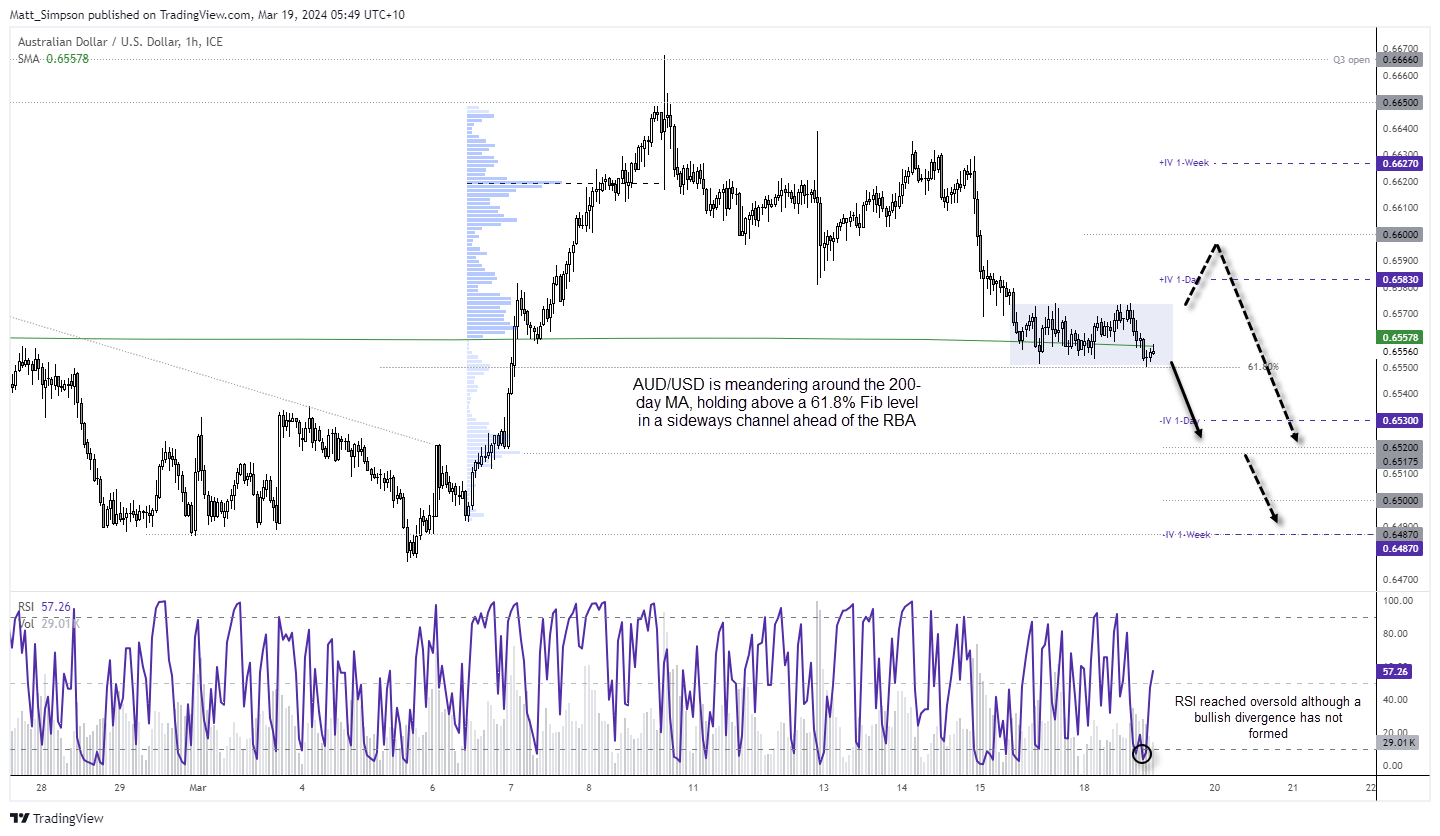

AUD/USD technical analysis:

The Australia dollar retraced lower for a third day, although its daily % high-low range was the second lowest of the year (behind January 1st). The 1-hour chart shows that support has been found at a 61.8% Fibonacci retracement and prices are meandering around the 200-day average, and oscillating within a sideways channel (usually a continuation channel which implies a downside break).

RSI (2) reached overbought, although a bullish divergence has not formed. The 1-day implied volatility band hints at a relatively low volatility day for an RBA meeting, which itself shows options traders are not expecting fireworks.

Ultimately, for AUD/USD to move decisively lower likely requires the RBA to remove their slight hawkish bias and could send prices below the 61.8% Fibonacci level, and bring 0.6520 and 0.6500 into focus for bears. Also keep in mind the BOJ meeting which could further weigh on AUD if volatility erupts across assets and prompts a risk-off environment.

If the RBA meeting is a non-event, perhaps prices can bounce from current levels. Although as the week progresses, I’ll look for evidence of a swing high as my bias is for the Fed meeting to not be as dovish as markets originally anticipated.

USD/JPY technical analysis:

The retracement higher on USD/JPY has recouped around two-thirds of its losses the five days prior, having met my upside 149 target stalling around the 61.8% Fibonacci level and Feb 29th low. The 1-day implied volatility level for USD/JPY is 320% of its 20-day average to show options traders expect a volatile ride today.

On a purely technical level my bias is for a move lower from current. But for that to materialise we likely need to see the BOJ hike by at least 0.1bp and abandon YCC and cease ETF purchases as rumoured on Monday. Anything less could send USD/JPY higher.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade