The Fed held rates as widely expected, although I’ll admit to being surprised that the Fed did not reduce their median forecast from three cuts, down to two or even one this year. With a median expectation of three cuts this year, it means that either the Fed need to begin easing quickly as not to stand accused of being ‘politically motivated’ ahead of the US election, or they have simply given up on the 2% inflation target. And I am beginning to think it may be the latter, given the Fed upgraded their core PCE inflation forecast for 2025 to 2.6% from 2.4% and maintained it at 2.2% in 2025.

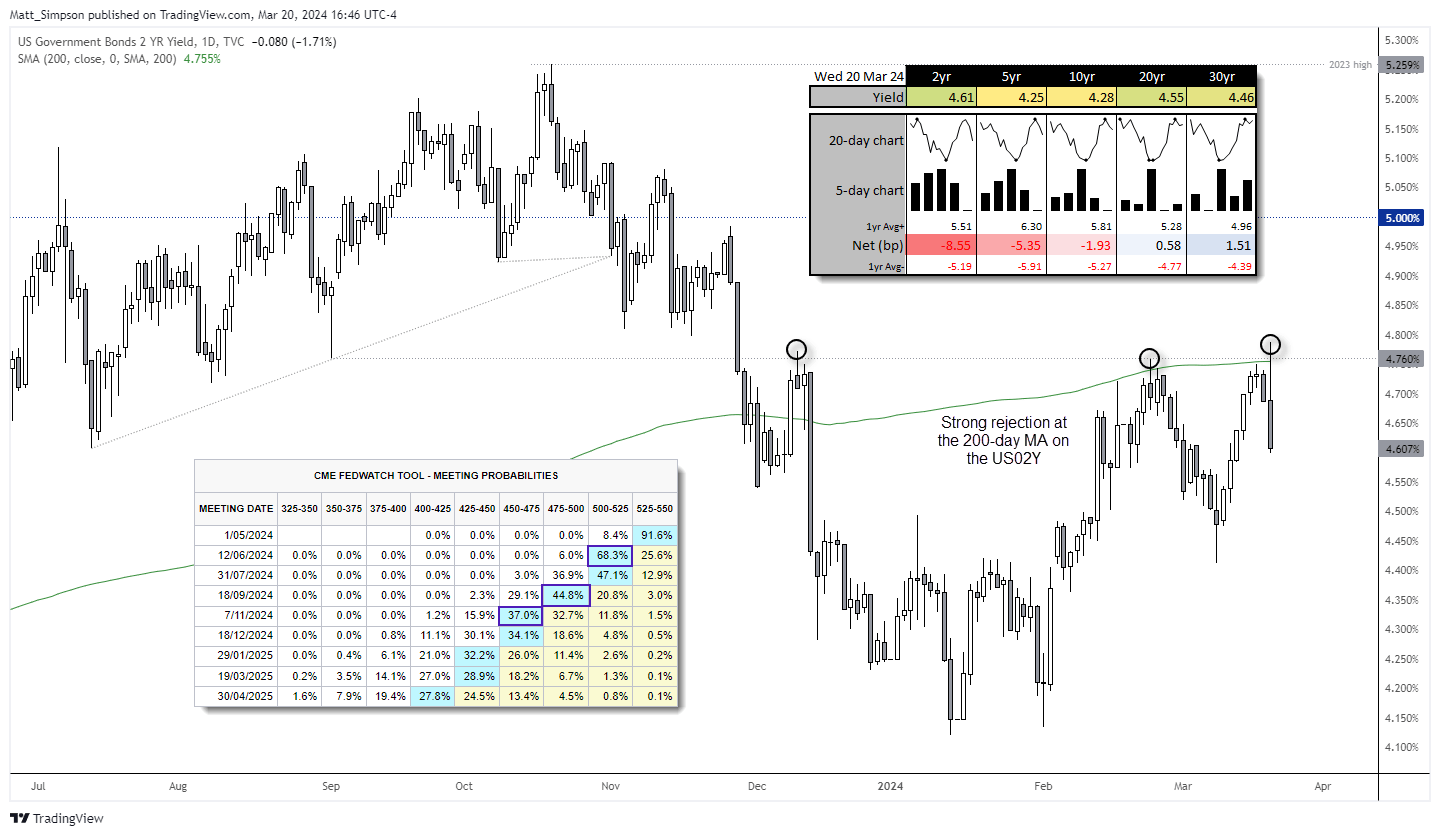

Fed fund futures imply a 68.3% probability of a July cut, a 44.8% chance of a second cut in September and 37% chance of a third 25bo cut in November.

The US dollar was dragged lower by the yield curve, and the US02Y (which is most sensitive to anticipated monetary policy) formed a prominent bearish engulfing day with a clear rejection at the 200-day average. And with the potential for traders to continue pricing Fed cuts, the path of least resistance for the US dollar could be lower over the near term.

Read Matt Weller’s rundown: Fed Meeting Analysis: FOMC and Powell Still Looking For Excuses to Cut

- EUR/USD rallied from its 200-day MA and GBP/USD sprung from its 50-day MA despite softer inflation data bringing forward bets of a BOE cut

- USD/JPY reached a 3-month high and stopped just 18-pips beneath the 152 handle before handing pack ~50% of Wednesday’s gains

- The Nikkei newspaper reports that the Next BOJ hike could be in July or October, although the FOMC meeting clearly stole the show in terms of market flows

- The S&P 500 closed at a new record high and above 5200 in response to the seemingly dovish Fed meeting

- Bitcoin futures snapped a 4-day losing streak and regained its footing just above $60k, and recouped most of Tuesday’s gains

- Gold rallied over 1.3% during its best day in twelve, with a clear sign of bullish range expansion from the 2023 bringing a break to a new ATH into focus, potentially today

Events in focus (AEDT):

The Fed meeting may be behind us, but we still have an action-packed calendar to look forward to today. The Australian employment report is the main feature for today’s APAC session, as any further signs of weakness could further bolster bets of an RBA cut fresh on the back of the RBA removing their tightening bias. I doubt it would reverse yesterday’s AUD/USD gains, but it might be enough to see it retrace to its 200-dy MA.

The SNB are expected to hold until June or July, but never underestimate the potential for the SNB to come out swinging and pull the lever anyway (given their softer levels of inflation). We also have flash PMIs across the major regions, with a BOE meeting in between.

- 10:00 – Japan’s trade balance

- 11:30 – Australian employment change

- 11:30 – Japan manufacturing PMI

- 19:30 – SNB interest rate decision, press conference

- 19:30 – German flash PMIs

- 20:00 – Eurozone flash PMIs

- 20:30 – UK flash PMIs

- 23:00 – BOE interest rate decision, MPC votes, statement, minutes

- 23:30 – US jobless claims

- 00:35 – BOC deputy governor speaks

- 00:45 – US flash PMIs

AUD/USD technical analysis:

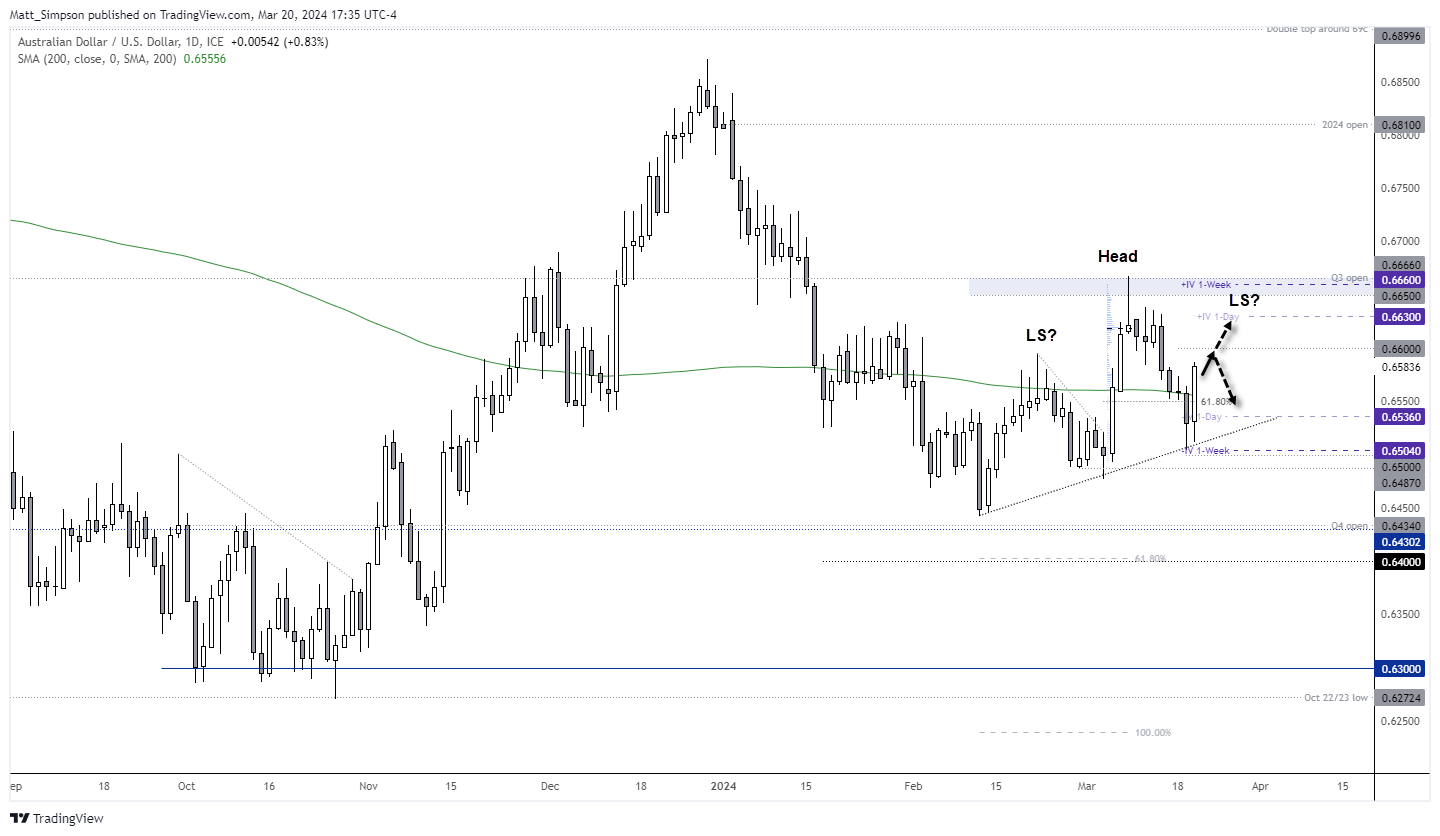

The Australian dollar enjoyed its best day in two weeks on the back of prospective Fed cuts. AUD/USD rallied from trend support and close firmly above its 200-day average. There’s a reasonable chance it could head for 66c ahead of today’s employment figures at 11:30 AEDT (00:30 GMT), at which point it is down to whether the jobs data delivers another leg higher for AUD/USD, or weak data excited RBA doves to short it.

Should we see a lower high form over the coming days, then my eyes will be on for a break back below the 200 average and a potential break of the neckline to confirm a head and shoulders pattern.

But for now that is on the backburner, as we may see a second wave of USD weakness as traders respond to the Fed’s relatively dovish meeting.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade