- Australia’s monthly inflation indicator is released on Wednesday

- It’s an incomplete report, missing key information on many services categories

- The year-on-year rate is seen rising to 3.6% from 3.4% in December

Australian consumer price inflation is expected to accelerate in January, fitting with numerous other inflation readings around the developed world recently that suggest the last mile in returning price pressures to acceptable levels will be anything but easy. While that sounds like a scenario that could benefit the AUD/USD on reduced RBA rate cut bets, don’t be surprised if an initial bounce is faded quickly on this occasion.

Inflation report an incomplete picture

The January inflation report is “incomplete” being the start of new quarter, leaving out price movements across many categories, including for services which remain the main concern for RBA policymakers. In contrast to inflation reports later in the quarter, the information today will be heavily weighted towards goods prices which account for a smaller share of the ABS inflation basket.

It will provide an early indication on what trends are happening with inflation but not a definitive reading.

The year-on-year increase is expected to accelerate to 3.6% from 3.4% in December, reflecting a lower base effect created by a 0.33% decline reported in January 2023. Other reasons to show caution include the fact that RBA policymakers don’t put as much weight on changes in headline inflation, choosing instead to look at trimmed mean readings which strip away volatile price movements. While this report has some underlying inflation measures, they are not comparable to the far more comprehensive quarterly inflation report.

Given the proximity to the US core PCE inflation report on Thursday – which is Fed’s preferred measure of underlying price pressures -- there may also be a reluctance among traders to take any big positions ahead of its release.

On a side note, Australia’s Q4 construction work done report will arrive at the same time as the domestic inflation report. While parts will flow directly into Australia’s Q4 GDP number, the weighting is insignificant relative to other larger parts of the economy. This suggests it’s unlikely to have any meaningful impact on AUD/USD.

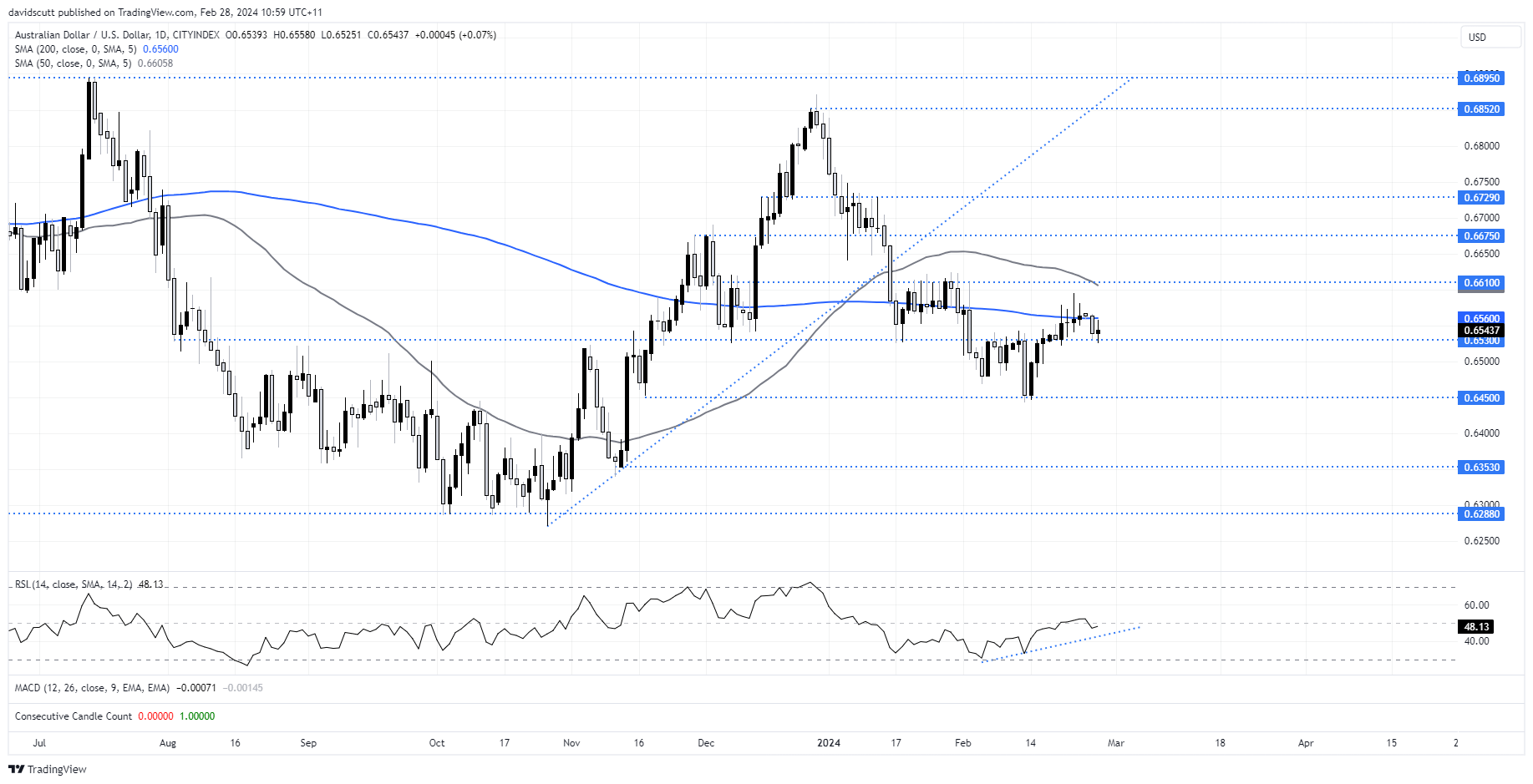

AUD/USD has looked unconvincing

AUD/USD has been convincing over the past week on the daily, struggling to overcome sellers above the 200-day moving average at .6560. Should we see a pop above the 200DMA on the inflation report, that provides an opportunity for traders looking to fade the move with resistance layered all the way up to just under .6600. Stops above that level would provide protection. On the downside, support is located at .6530. Below that, AUD/USD did a bit of work at .6500 earlier this month with more pronounced support zone found at .6450.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade