The unexpected recovery comes following news that both the U.S and the U.K. would ban Russian oil imports and a pledge by E.U. leaders to cut Russian gas imports by two-thirds by year-end. Collectively the announcements have the potential to deliver the fatal economic blow needed to bring President Putin’s war machine to its knees.

In a move that bodes well for the tech-heavy Nasdaq on Wall Street this evening, the S&P/ASX200 Info Tech Sector added 3.19%. Block (SQ2) closed +5.89% higher at $141.20, Appen Ltd (APX) added 1.93% to close at $6.88, and Zip Co Ltd (Z1P) finished the day 1.24% higher at $1.63.

Recovering from an untidy session yesterday and buoyed by crude oil futures holding above $125, the S&P/ASX200 Energy Sector closed 0.14% higher. Woodside Petroleum (WPL) added 0.82% to close at $33.25. Beach Energy (BPT) closed flat at $1.70, while Santos (STO) fell 0.50% to close at $7.82.

A better day as well for the S&P/ ASX200 Financial Sector, which added 1.53% supported by another round of patient forward guidance from RBA Governor Philip Lowe. The Commonwealth Bank (CBA) was again the best performer closing 1.71% higher at $97.72, Westpac (WBC) added 1.66%, National Australia Bank (NAB) added 1.50%, ANZ added 1.19%, and Macquarie Group (MQG) closed 1.52% higher at $178.37.

Bullion traded as high as $2070 overnight, just $5 short of its August 2020. The market continues to embrace gold as a hedge against inflation, equity market volatility, and the war in Ukraine. Reflecting this, gold mining stocks enjoyed a good day, including Newcrest Mining (NCM) +1.9%, Northern Star Resources (NST) 0.7% and Evolution Mining (EVN) +1.81%.

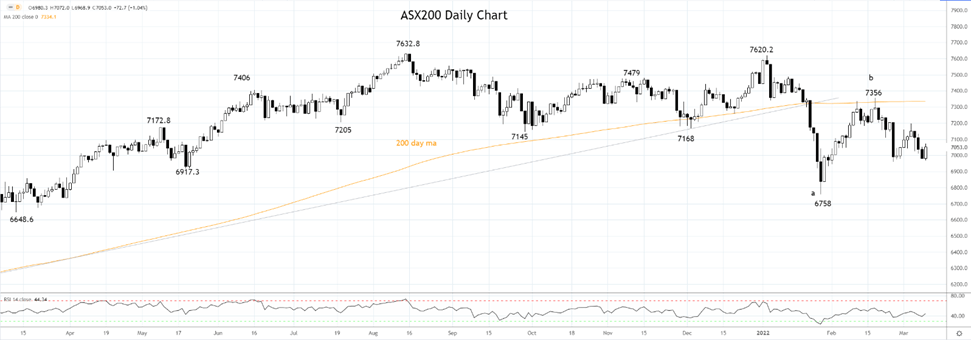

Technically, the ASX200 formed a bullish engulfing candle from a band of support 6970/60 area. Providing this support level continues to hold it bodes well for the ASX200 to retest the 7200 resistance level in coming sessions.

Source Tradingview. The figures stated are as of March 9th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade