Alibaba (BABA) Q1 earnings preview: Regulatory risks in focus

Chinese e-commerce giant Alibaba (BABA) doesn’t get the same publicity as its US-based big tech rivals, but the company continues to show high growth and high profitability. See what we’ll be watching for the company’s key Q1 earnings report below:

When are Alibaba earnings?

Thursday, May 13 before the opening bell

Alibaba earnings expectations

$1.82 in EPS on $27.7B in revenues in Q1

What to watch from Alibaba earnings

Despite, or perhaps because of, China’s ongoing aggressive handling of the COVID-19 pandemic, Alibaba hasn’t seen strong stock outperformance like many of its e-commerce rivals. The company controls fully two-thirds of China’s e-commerce market through Taobao and Tmall, but investors are clearly skeptical of the company’s future prospects, given the fact that the shares are trading on the low end of BABA’s historical P/E ratio range.

One dark cloud hanging over the company is governmental oversight. Last month, Alibaba (BABA) paid a $2.8 billion antitrust fine by Chinese regulators for abusing its market dominance over merchants and rivals, and many observers have noted that Alibaba’s CEO, Jack Ma, may not be on the best terms with the CCP’s leadership. This personal tension creates additional regulatory risk that the major US technology giants don’t have, at least at the moment, so any comments on this front could have a big impact on the stock.

Outside of that key story, traders will also watch the figures for the company’s fast-growing cloud computing division as well as any new business initiatives and the outlook for the full year’s financial figures.

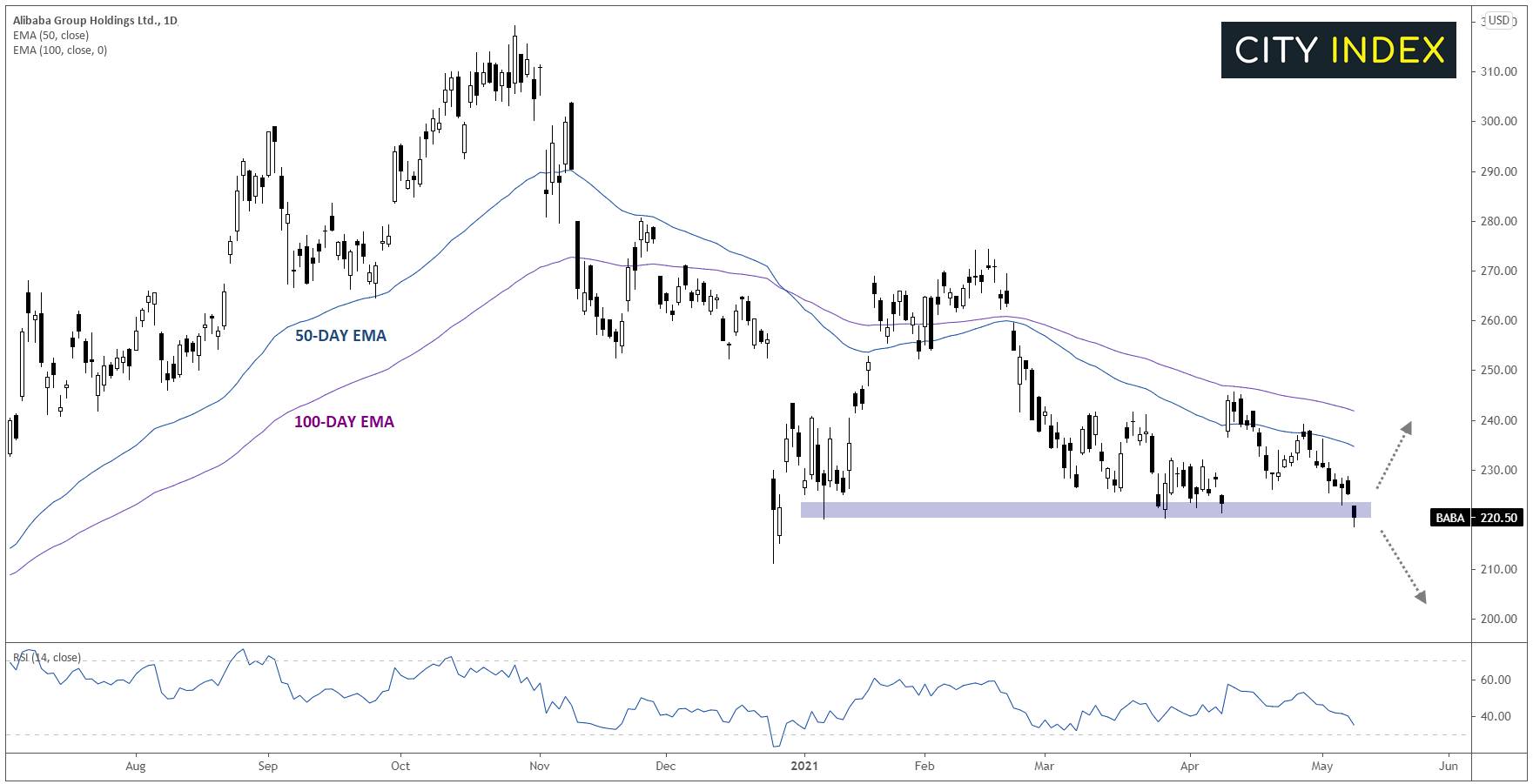

Alibaba (BABA) technical analysis

As we’ve hinted a couple times already, BABA’s stock is in the midst of a rough stretch. Since peaking near $320 back in October, the stock has fallen all the way to the low-$200s, where it’s spent most of the year to date consolidating. At press time, BABA is testing its lowest level of the year near $220, with both the 50- and 100-day EMA trending lower. Against this backdrop, a disappointing earnings report could be the catalyst for a breakdown toward $200 or lower, whereas a stronger-than-anticipated earnings report may only take rates up to the April highs in the $240-$245 range.

Source: TradingView, StoneX

Learn more about equity trading opportunities.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.