Reviewed by Patrick Foot, Senior Financial Writer.

- How do currency markets work?

- What is forex trading?

- How does forex trading work?

- Forex trading basics

- Forex trading examples

- Different ways to trade forex

- Benefits of forex trading

- What moves forex markets?

- Forex trading risks

- Learn how to trade currency rates

- FAQ

How do currency markets work?

Currency markets work via a global network of banks, business and individuals that are constantly buying and selling currencies with one another. Unlike most financial assets – such as shares or commodities – the foreign exchange market has no physical location and trades 24 hours a day.

This is called an over-the-counter market, and it means that currency prices are constantly fluctuating in value against each other, potentially offering a greater number of trading opportunities.

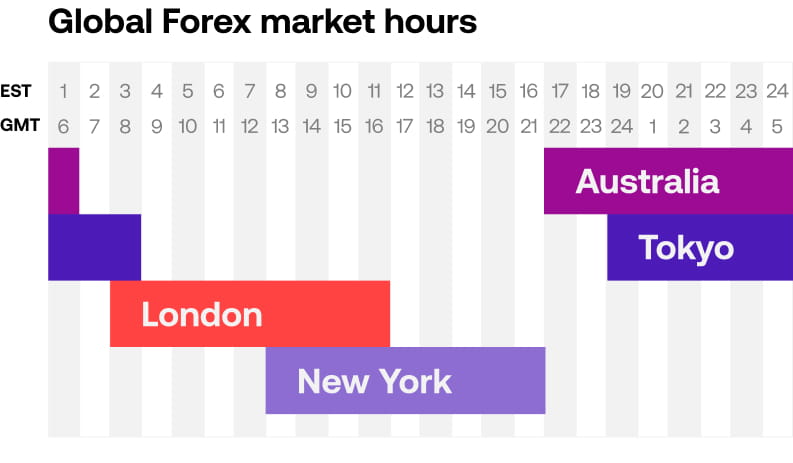

There are four main forex trading hubs: London, Tokyo, New York and Sydney. When trading stops in one, it starts in another.

However, forex is also traded across Zurich, Frankfurt, Hong Kong, Singapore and Paris.

At City Index, you can speculate on the future direction of currencies, taking either a long (buy) or short (sell) position depending on whether you think a forex pair’s value will go up or down.

What is forex trading?

Forex is a financial market, short for foreign exchange. Forex trading (or FX) simply means buying one currency while selling another. It's how you change money to go abroad or import something from a different country.

Individuals, businesses and governments around the world all buy and sell billions of pounds of forex each and every day.

But this activity makes up a tiny fraction of the market. It's dwarfed by forex traders speculating on currency markets for profit.

How does forex trading work?

Forex trading works by buying and selling currencies to make a profit. Forex traders try to take advantage of fluctuations in exchange rates, speculating on where a currency might be headed next.

The forex market is the biggest financial market in the world. According to the Bank for International Settlements, it has a turnover of more than $7.5 trillion each day.

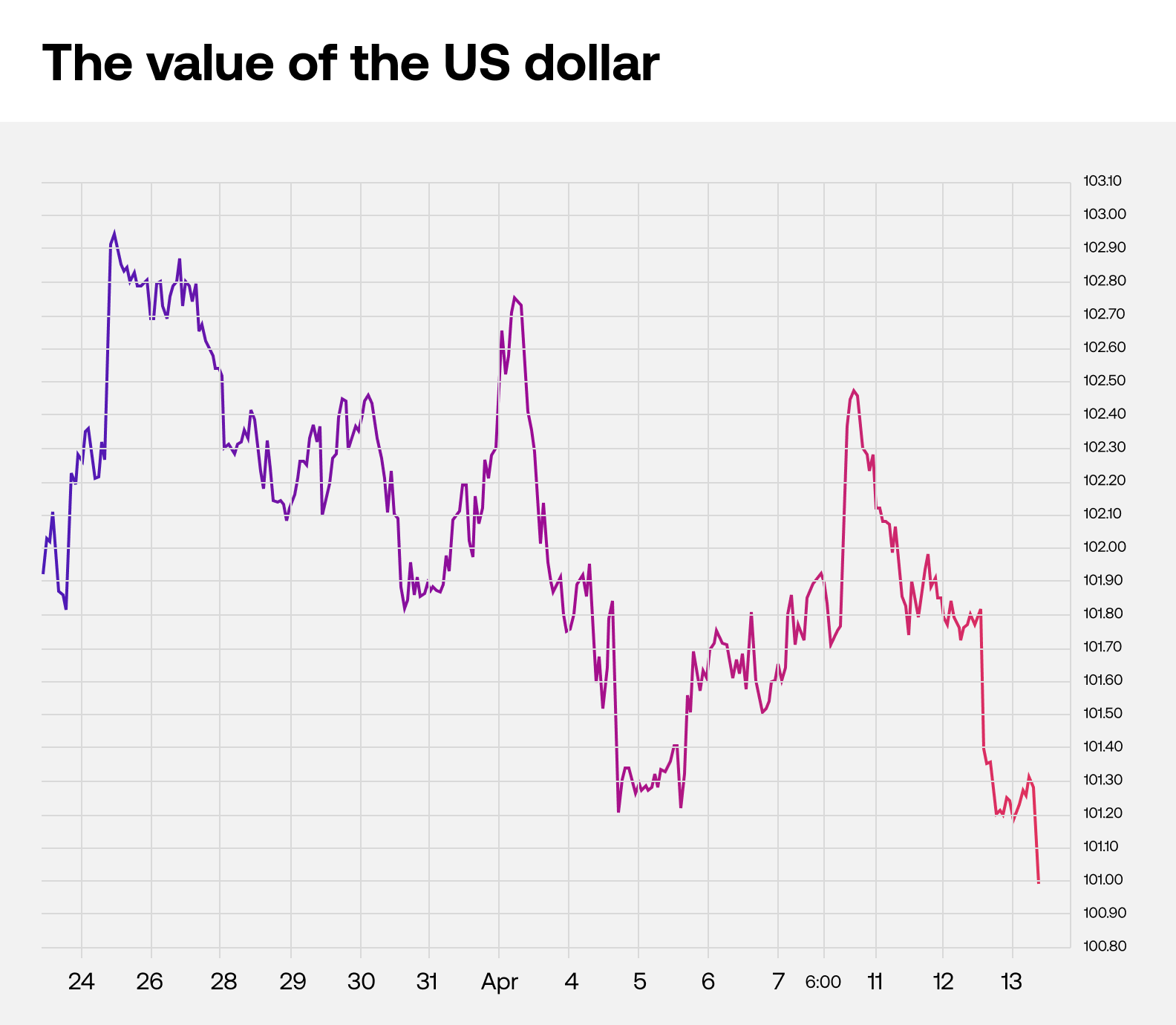

The huge volume of forex traded each day means that currency prices are constantly moving against one another. The US dollar, for example, is always going up or down in value. In forex trading, you aim to use this to make money.

That's forex trading in a nutshell. But before you start buying and selling currencies, there are a few concepts you should get to grips with.

Forex trading basics

Let's take a look at some of the key concepts that underpin FX trading:

What are currency pairs?

Currency pairs are what you trade when you trade forex – you're buying one currency while simultaneously selling another. Key examples of currency pairs include EUR/USD (the euro against the dollar), JPY/USD (the Japanese yen against the dollar) and GBP/USD (the pound against the dollar).

It's similar to exchanging money to buy shares – but instead of getting shares, you're getting an equivalent amount of another currency.

Say, for instance, that you have £1,000. You believe that the pound is going to fall in value against the euro, so you decide to use your pounds to buy euros. If GBP does fall against EUR, then your euros will be worth more than £1,000. You can swap your euros back to pounds, and keep the difference as profit.

In this example, we've traded the EUR/GBP forex pair.

Each currency pair has a price, which tells you how much of the second currency you'll have to sell to buy one unit of the first.

Base and quote currencies

The first currency in a pair is called the base. The second is the quote. As you may have noticed above, each currency is denoted by a three-letter code: like EUR for the euro, or USD for the US dollar.

Let's take a closer look at our example above. Here, EUR/GBP is trading at 0.8600. It costs 0.8600 GBP (the quote currency) to buy one unit of EUR (the base).

FX pair

EUR |

USD |

|---|---|

| The base currency, in this case the euro (EUR) | The quote currency, in this case the US dollar (USD) |

What is a pip in forex?

In forex, a pip is an individual unit of currency movement.

Each pip is worth 0.01% of one unit of the base currency, or the fourth digit after the decimal point on a forex quote. If EUR/USD moves from 1.1000 to 1.1001, it has moved one pip. If it moves 100 pips – say, from 1.1000 to 1.1100 – it has increased by one euro cent.

The key exception to this rule is when the currency pair has JPY as the quote. As the Japanese yen is worth much less compared to other major currencies, a pip is only equal to 0.1% of a yen. This is the second figure after the decimal point.

What is a lot?

A lot is a standard size of forex trade.

As you may have spotted, a pip isn't worth very much. To earn sizable profits, you have to trade a large amount of forex. A standard contract, called a lot, is worth 100,000 units of the base currency. Trading a lot will earn or lose you 10 units of currency for each pip that the underlying market moves.

What are spreads in forex trading?

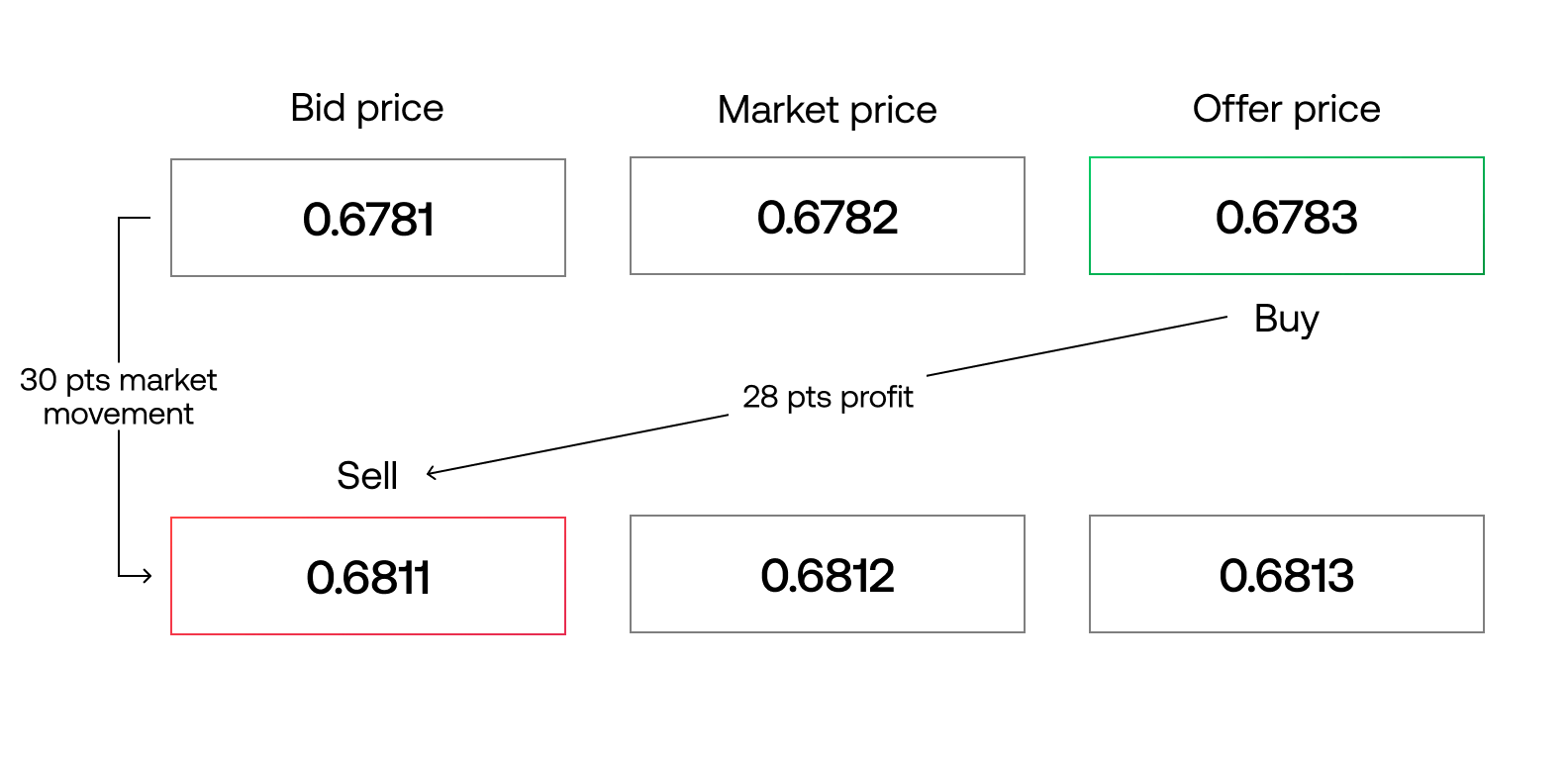

Spreads are how you pay for a forex trade. You'll always see two prices listed on a forex market:

- The first is called the bid price. You trade at this price when you sell an FX pair

- The second is called the offer (or the ask). You trade at this price when you buy an FX pair

In between these is the market price, which is what you'll typically see on a chart.

You rarely pay commission to trade currencies. Instead, the cost to open and close your position is covered by the gap between the bid and offer prices: called the spread.

AUD/USD, for example, might have a market price of 0.6782 – with a bid price of 0.6781 and an offer of 0.6783. This means it has a spread of two.

Say that you buy AUD/USD at 0.6783, then it rises to 0.6812, with a bid of 0.6811 and an offer of 0.6813. So, you close your position at 0.6811. The market has risen by 30 (from 0.6782 to 0.6812) but your profit is only 28 (0.6783 to 0.6811). You've paid two pips as the spread.

Can I sell a pair without buying it first?

One key benefit of forex trading is that you don't have to buy at the offer and sell at the bid.

When you short forex, you're using the base currency to purchase the quote. Instead of going long on EUR/GBP by using GBP to buy EUR, you could short EUR/GBP by using EUR to buy GBP. If the pair falls, your pounds are worth more in euros, earning you a profit.

If you think that any pair is in for a rough ride, you can short it and attempt to profit from the move. Remember, though, that you'll make a loss if the currency pair moves up instead of down.

Forex margin and leverage

Leverage enables you to open FX positions without paying for their full value. Instead, you only need a fraction of your position's cost – known as your margin – in your account to cover any running losses.

City Index's margin rates on FX markets go as low as 3.33%, which means you might only need 3.33% of your position's value to open a trade. Buying a single lot of GBP/USD would require you to have £3,333 in your account – not the full £100,000.

Your profit or loss will still be based on the full size of the trade, however. This makes forex leverage risky, as it can magnify your losses.

Forex trading examples

Here are a couple of in-depth forex examples to see how this works in practice. You can follow along with these examples using a free City Index demo account.

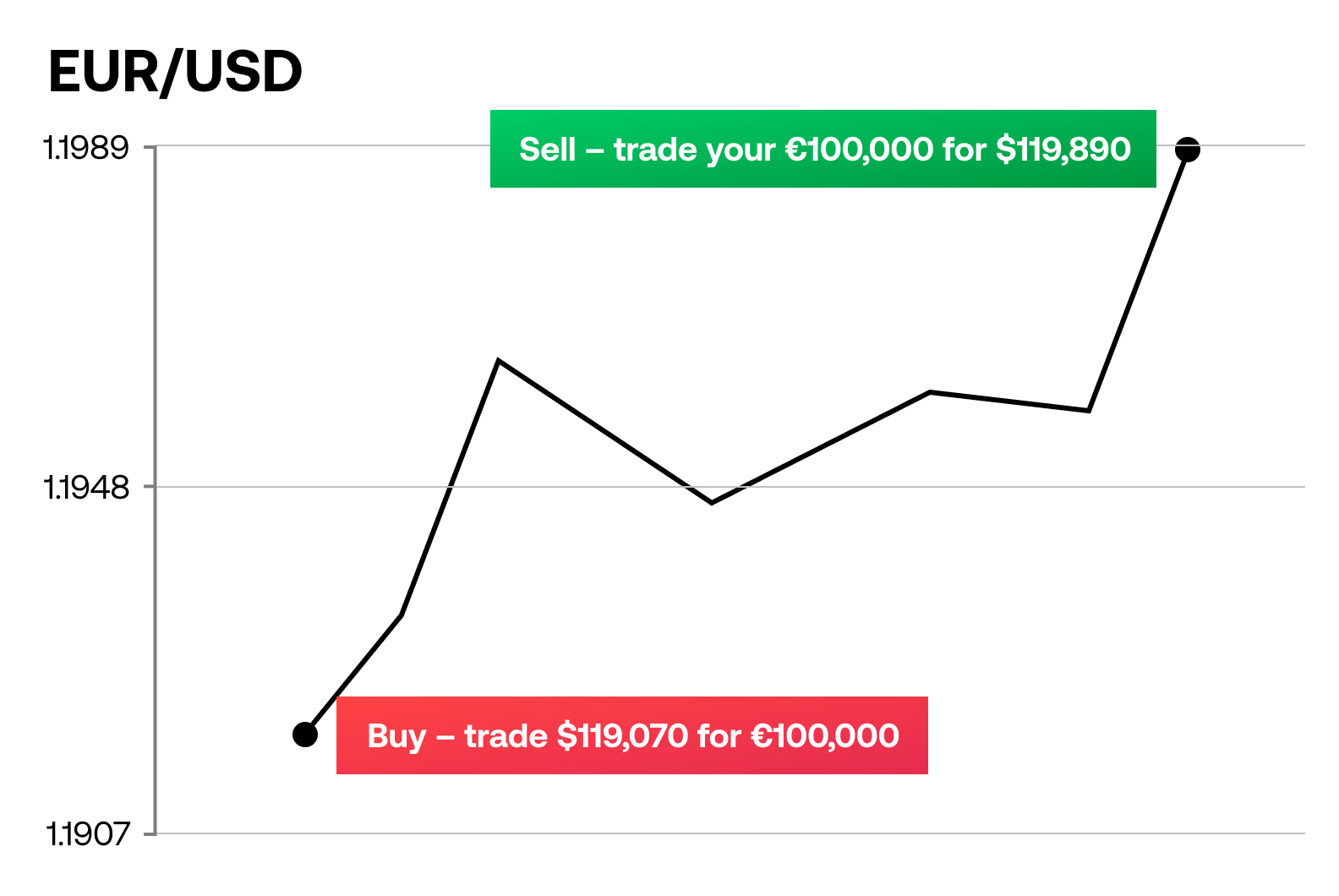

1. Buying EUR/USD

You buy one lot of EUR/USD at 1.1907. This is the equivalent of selling $119,070 to buy €100,000.

EUR/USD has a margin requirement of 3.33%, so you'll need $3,965 (3.33% * $119,070) in your account to open the trade.

The pair rises 82 points to 1.1989, and you close your position. Your €100,000 is now worth $119,890, a profit of ($119,890 - $119,070) $820.

If EUR/USD fell 82 points, though, you'd lose $820.

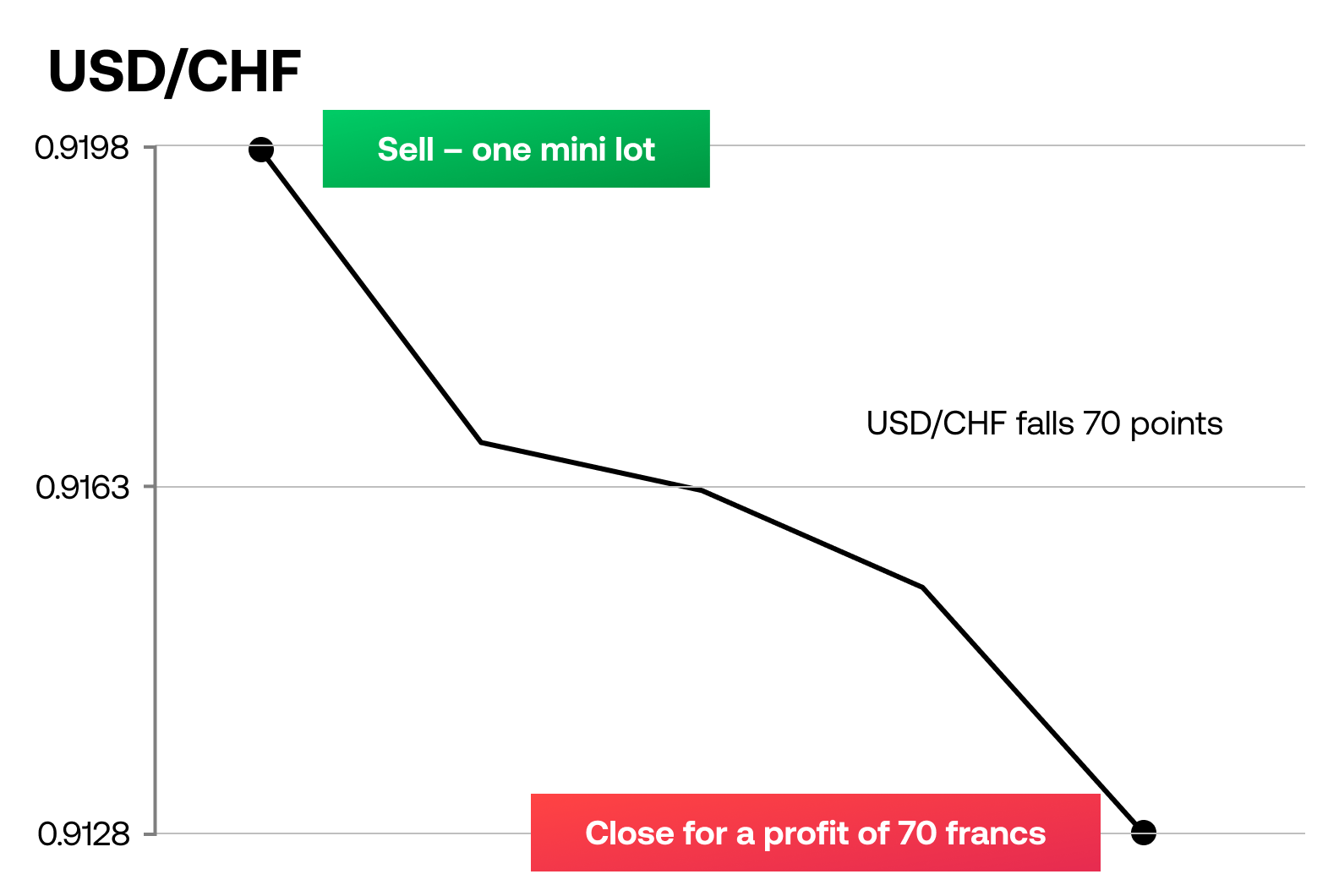

2. Selling USD/CHF

You sell one mini lot of USD/CHF at 0.9198. A mini lot is equivalent to trading 10,000 units of the base currency instead of 100,000. Here, you're selling $10,000 by buying CHF 9198.

USD/CHF also has a margin requirement of 3.33%. This time, you'll only need CHF 306 (3.33% * CHF 9198) in your account to open the position.

The pair falls 70 points to 0.9128. Your mini lot earns you 1 franc for every point that it falls, giving you a total profit of (70 * 1) 70 francs.

If the pair had risen instead, you'd make a loss.

Different ways to trade forex

There are a few different ways you can trade forex, and it's worth learning about them all before you open an account.

- Spot forex. Spot forex is what we've covered here so far, when you trade on the live prices of currencies. It is the FX market on which all others are based, and the most popular among retail traders.

- Forwards and futures. Forwards and futures allow you to trade currencies at a set price on a future date. They're popular among institutional traders and companies.

- Derivatives. You don't have to exchange currencies to trade forex. With derivatives such as options and spread betting, you're speculating on the movements of pairs without buying or selling the currencies themselves.

Learn more about how to trade forex.

Benefits of forex trading

1. Liquidity

As we've covered, the forex market dwarfs every other asset class. Because of this, it is highly liquid. That means there are lots of other traders trying to buy and sell currencies at any one time – so there's usually someone available to take the other side of any deal.

This ensures that prices are constantly moving and helps keep forex trading cost effective.

2. 24-hour trading

Forex isn't bought and sold on exchanges, like stocks or futures. Instead, a network of banks and businesses around the world facilitate trading. These banks and businesses don't have to stick with an exchange's opening hours, enabling you to buy and sell currency pairs 24 hours a day from Monday to Friday.

For traders who value flexibility, this is a key benefit. You're not confined to the specific hours of a stock exchange – you make your strategy work around your schedule instead.

3. Wide range of pairs

Currency prices tend to reflect the economic performance of the countries (or groups of countries) they represent. So, by trading forex, you can take your position on a huge range of global economies.

With a City Index forex trading account, you can trade 81 FX pairs, ranging from the popular (such as EUR/USD) to the obscure (such as USD/CZK). Combined with high liquidity and 24-hour trading, this means that opportunities abound in the currency market.

See more benefits of FX trading.

Types of forex pair

A forex pair is a combination of any two currencies. From EUR/USD (the euro and the dollar) to HUF/PLN (the Hungarian forint and the Polish złoty), there are dozens of potential pairs to trade.

But to keep things simple, pairs are typically split into three categories: majors, minors and exotics.

Majors

The major pairs are EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF and USD/CAD.

Notice something about all the pairs above? They all contain the US dollar. According to the Bank for International Settlements, USD is present in 88% of all FX trades – mostly focusing on the majors.

EUR/USD, the combination of two of the biggest economies in the world – the eurozone and the United States – is the biggest major, representing around 28% of all trading.

| Pair | Currencies | Nickname |

|---|---|---|

| EUR/USD | Euro vs US dollar | Eurodollar |

| USD/JPY | US dollar vs Japanese yen | Dollar-yen |

| GBP/USD | Pound sterling vs US dollar | Cable |

| AUD/USD | Australian dollar vs US dollar | Aussie |

| USD/CHF | US dollar vs Swiss franc | Swissy |

| USD/CAD | US dollar vs Canadian dollar | Loonie |

Minors

The minor pairs consist of all the currencies listed above, but crossed with each other instead of USD. EUR/GBP, AUD/NZD and EUR/CHF are all minor pairs.

As these pairs don't contain the dollar, they tend to be a little bit less liquid than the majors. So you might find that spreads are slightly wider.

| Pair | Currencies |

|---|---|

| EUR/GBP | Euro vs Pound sterling |

| AUD/JPY | Australian dollar vs Japanese yen |

| GBP/CHF | Pound sterling vs Swiss franc |

| AUD/NZD | Australian dollar vs NZ dollar |

| EUR/CHF | Euro vs Swiss franc |

| AUD/CAD | Australian dollar vs Canadian dollar |

Exotics

Finally, you have the exotic pairs. Essentially, any pair containing a currency that isn't one of the majors, such as USD/PLN (US dollar vs Polish złoty), EUR/TRY (euro vs Turkish lira) and USD/ZAR (US dollar vs South African rand).

What moves forex markets?

Forex markets move according to supply and demand, just like any other financial asset. Currency supply is usually controlled by central banks, while the picture for demand is more complex – driven by economic activity, interest rates and major financial players.

Most FX traders will pay close attention to upcoming economic events such as GDP releases, employment figures and inflation reports. These give crucial insight into how an economy is performing – and can help you predict what a central bank might do next.

Here are a few factors that often move currency markets:

Forex trading risks

There are a few risks you'll encounter when you trade forex. Let's take a look at three of the main ones.

1. Leverage risk

When you're trading forex, leverage will amplify both your profits and your losses.

Say you want to trade AUD/USD and your position has a total value of $75,200. To make the trade, you might only need 5% of its total value in your account, or $3,760. If your trade earns a $1,000 profit you've made $1,000 from $3,760 – a much greater return than if you'd paid the full $75,200.

But if you lose $1,000 from your $3,760, your loss is more than a quarter of your starting capital. Leverage has amplified your loss.

You can learn more about managing forex risks here.

2. Interest rate risk

Interest rates can have a huge effect on FX pairs, especially when one central bank moves out of step with another.

When a central bank raises rates, it can cause an influx in investment – which creates demand for a currency and causes its value to rise. If rates fall, the opposite happens, which can see currencies devaluate.

This volatility brings opportunity for FX traders, but it can also bring risk if a central bank moves rates in a direction you weren't expecting.

3. Counterparty risk

Simply put, counterparty risk is the chance that the person or individual that takes the other side of a position doesn't fulfil their duty.

FX is traded over the counter, which means there's no central exchange matching buyers to sellers. This brings significant benefits to traders – it is why FX is traded 24 hours a day – but it does also mean more counterparty risk.

Learn how to trade currency rates

If you're looking for more information on how the financial markets work – including in-depth lessons on forex trading – head over to the City Index Academy. You'll find step-by-step courses on how to trade, techniques of successful traders, how master forex and more.

Here are a few lessons you might be interested in:

- Introduction to financial markets. An overview of all the asset classes you can trade, plus a few key concepts you should know

- Forex trading strategies. How should you target profit from FX markets?