What makes forex trading popular – and should you get involved in the world’s biggest market? Find out with our complete guide to the risks and benefits of forex trading.

The strong growth of the forex market has created a huge community of traders – scalpers, day traders, algorithm devotees and those who pin their trades around specific events. And yet there is still scope for new online retail forex traders – people just like you – to get involved.

Read on as we outline the chief reasons why you should consider the opportunities that forex trading provides – plus some of the risks that might put you off.

What are the benefits of forex trading?

1. Forex liquidity

According to the Swiss-based Bank for International Settlements (BIS), forex trading volume reached $7.5 trillion per day in April 2022, up from $6.6 trillion three years earlier. That makes FX the world’s biggest asset class by a comfortable distance.

Why is this a benefit of forex trading? Because it means currencies are highly liquid – there should always be lots of people wanting to buy and sell forex at any given time.

There are a number of inherent advantages in a consistently liquid market:

- You can enter and exit positions quickly and easily, without affecting the price of your chosen market

- Narrow spreads mean lower trading costs

- Volatility can be high and is caused by news events, not illiquid markets

However, it’s worth noting that not all FX pairs are equally liquid. The BIS also found that 88% of currency trades involve the US dollar, and that EUR/USD represents some 23% of all forex trades. So less-traded pairs, known as ‘minors’ and ‘exotics’, may not benefit from high liquidity.

2. Volatility

Volatility means that a market’s price moves a lot, and is prized by traders as it creates opportunities for profit. A stock that grows steadily each year for decades might be good for long-term investors – but it doesn’t produce many chances for short-term wins. Forex is the opposite of that.

Take EUR/USD, for example. Any news that impacts the US dollar or the euro – two of the world’s most closely watched economies – can see the pair rally or tumble. There’s a constant battle between the two currencies.

With such wide price swings taken place on any given day, successful trades can see significant profits in little time. And unlike other major markets, there’s almost always a trend to trade.

Volatility, however, isn’t always a good thing. While it can see profits stack up quickly, the same will happen to losses if you trade in the wrong direction. We’ll cover how to mitigate this below.

3. 24-hour forex trading

There’s a key difference between forex and other markets, such as shares. While shares are traded on exchanges – like the New York Stock Exchange – forex is bought and sold across a vast network of banks. It’s called an over-the-counter (OTC) market.

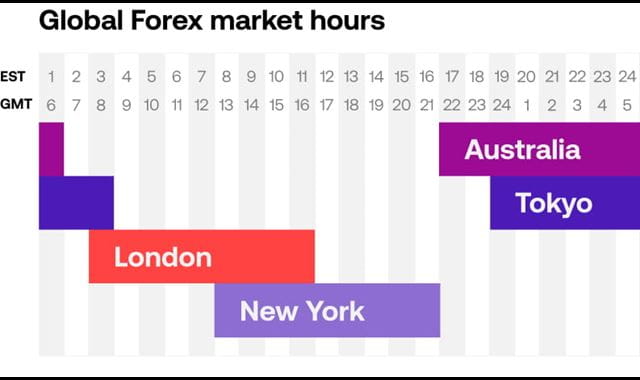

The network of banks stretches all around the globe, which means that there’s always a session open to trade forex. When banks close in London, for example, they’re open in New York. When New York closes, Sydney is open.

For FX traders, this brings one significant benefit: you can buy and sell currencies 24 hours a day. You don’t have to conform to the hours set by an exchange and can build a trading plan that suits your schedule. Forex is fully flexible.

However, 24-hour trading does have its drawbacks. Chiefly, that the markets are constantly moving, whether you’re at your desk or not. You could wake up to find that one of your positions has earned a massive profit, or it could have reversed overnight.

Day trading forex

For this reason, day trading is popular on FX markets.

In this trading style, you always ensure that all your positions are closed before the end of the day. Not only does this help ensure that you’re never caught out by overnight price action, it also means you avoid paying overnight financing – an FX trading charge that covers the cost to maintain your leverage.

The high volatility and liquidity in forex make it a hugely attractive market for day traders, who need to earn profits from positions that only last hours or even minutes.

Learn more about day trading forex.

4. Shorting currency pairs

Your forex trading provider will offer two prices for each currency pair they offer: the buy price and the sell price. You trade at the buy to open a long position, or at the sell if you want to go short.

This is a key benefit of FX trading – you don’t have to always go long in the hope that your chosen pair increases in value. If you think the euro is in for some tough times, for instance, you can short EUR/USD and profit from the falling prices. Remember, though, that you’ll lose out on a short position if the underlying market rises.

The difference between the buy and sell prices on a pair is called the spread, and tells you how much you’ll pay to open and close the trade.

5. Leverage in forex

Another major benefit of FX is leverage, which enables you to open significantly sized trades without paying for the full value of the position.

As we’ve seen, forex is very volatile – but the pairs don’t move in massive increments. In fact, a single point in most pairs is equal to 0.0001 of the quote currency (the second currency listed in a pair). In GBP/USD, for example, one pip is £0.0001.

Because of this, most forex trades involve buying and selling huge amounts of notional currency. Leverage means that you don’t tie up all your capital on any single trade, as you typically only need 3.33%-5% of its total value in your account to open and maintain the position.

While leverage can be a powerful benefit, it will also increase your risk. Learn more about risk management in the City Index Academy.

6. Range of FX markets

You can make a forex pair by combining any two currencies. So, you’ll be able to access a wide range of markets with a forex account, from key pairs such as EUR/USD to obscure ones such as GBP/NOK (the pound against the Norwegian krone).

With your City Index account, for instance, you can access 84 global pairs. Combine this with the other benefits listed here – including high volatility and 24-hour trading – and you get a market that’s rife with opportunity.

For many, the best way of getting started is with an FX demo account. These enable you to buy and sell our full range of forex pairs with virtual funds, so they’re completely free and you’re risking nothing.

Open your City Index demo here.

7. Forex trading tools

Forex traders can access a wealth of tools to help them spot opportunities, manage risk, track their performance and more. With a City Index account, for example, you can:

- Get automated forex trading signals with our AI-powered SMART Signals engine

- Put an absolute cap on your risk with guaranteed stops, or lock-in profits with trailing stops

- Trade anywhere with the City Index mobile trading app

- Track your successes and failures – so you can see where to improve – with Performance Analytics

8. Choose how you want to trade forex

There are two main ways to participate in the forex market: spot FX and spread betting. Both enable you to go long and short on FX pairs, and benefit from leverage, but they work in different ways.

You can try both methods with a City Index account. Follow the steps below to get started:

- Open your City Index account

- Add some funds so you can trade instantly

- Browse all our FX markets on the Web Trader platform or our mobile apps – you’ll see spot FX and spread betting markets listed

- Select a market to open your position

Or if you’d like to try out forex trading without committing any capital, you can try a City Index demo. It comes with virtual funds to enable risk-free trading on the live prices of all our FX pairs.

Why you shouldn’t trade forex

However, forex trading isn’t for everyone and there are significant risks involved. We’ve already touched on these, but before you decide whether to trade forex it’s worth looking at them in more detail.

While these risks can be mitigated, if any of the below fills you with fear then you might want to try trading stocks, commodities or indices instead – or steering clear of the markets altogether.

1. Volatility risk

The high volatility in forex can be both an advantage and an issue. Why? Because forex markets can make wide swings, which may quickly add up to significant losses.

Say, for example, that GBP/USD rises 200 points in a morning, then crashes back to close the session level. If you can capture either move correctly, then you’d make a significant profit. But equally, two wrong position

There are a number of tools on your City Index account to help you mitigate against the risk of large price swings. The most widely used is the stop loss, which automatically closes your trade when it hits a level of loss you set.

2. Overnight risk

If you leave a forex trade open overnight, then you won’t know what’s happening to it until you wake up in the morning. It could have gained you a giant profit, or it could have moved against you.

As we’ve seen, lots of traders avoid this risk entirely by never leaving a position overnight but that isn’t the only option available to you. Stop losses, again, can work in your favour here. And if you want maximum peace of mind overnight, you can upgrade to a guaranteed stop that can’t be affected by slippage.

3. Leverage risk

Leverage works by multiplying the amount you put down to open a trade. Forex is one of the markets with the highest available leverage, hitting 20:1 across several markets – which means that you can open a position worth $100,000 with just $20,000 in your account.

If your position earns you $10,000, then you’ve doubled your original stake compared to a return of just 10% on an unleveraged trade. But the same is true if you lose $10,000, a loss of 50% against 10%.

The best way to manage the risks of leverage is to make a comprehensive trading plan and stick to it. If you know how much you can risk on a single position – taking leverage into account – then you shouldn’t get any nasty shocks.

Learn more about mitigating the risks of forex trading.