When are the AMC Q3 earnings?

AMC Entertainment is scheduled to release third quarter earnings after the markets close on Tuesday November 8. The earnings webcast will be held on the same day at 1600 CST, or 1700 EST.

AMC Q3 earnings consensus

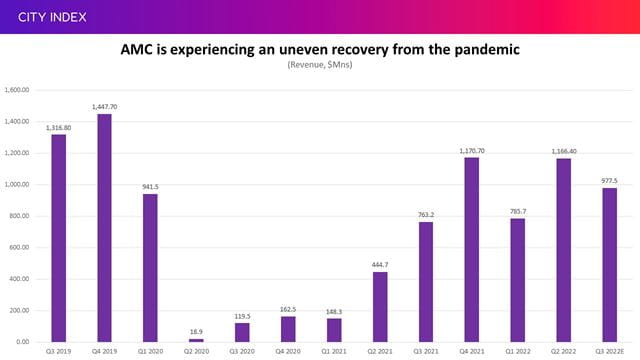

Wall Street forecasts AMC will report a 28% year-on-year rise in revenue to $977.5 million in the third quarter, according to consensus numbers from Bloomberg, while adjusted Ebitda is expected to come in at a small $480,000 loss compared to the $5.4 million loss saw the year before.

The net loss is expected to total $241 million and the diluted loss per share is forecast to come in at $0.27.

AMC Q3 earnings preview

AMC has bounced back since it made virtually zilch in sales when theatres were closed during the second quarter of 2020, but we can see that revenue, driven by sales of tickets and snacks, has experienced an uneven recovery from the pandemic. We have seen sales dip since peaking late last year, reflecting the volatility we have seen in the film slate in 2022. Productions have also been trying to get back on track after being disrupted by Covid-19 and we have seen several big titles delayed this year as studios try to time the optimal release dates in response to subdued demand.

(Source: Q3 2022 estimates are from Bloomberg)

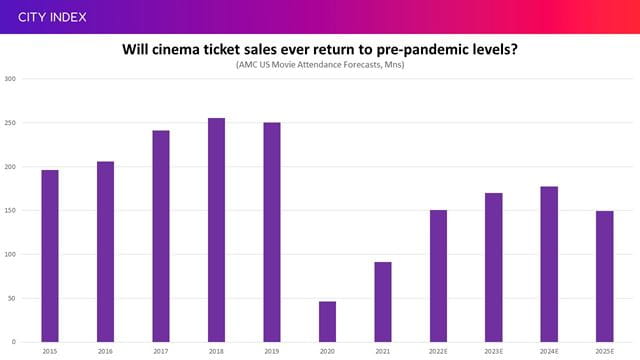

Ultimately, fewer people are going to the cinema than before the pandemic and revenue remains well below what we saw in 2019. There is still a long way to go before ticket sales return to pre-pandemic levels, and there is an argument that they may never fully recover given the surge in popularity of streaming services and the dramatic shift in viewing habits during lockdown. Markets see attendance levels and revenue continuing to climb through to 2024 but think both will still trail what we saw before Covid-19.

(Source: Estimates for 2022-2025 are from Bloomberg)

‘Our current internal forecast is that the 2023 domestic box office, the basic metric suggesting the health of theatrical exhibition both in the US and globally, will be billions of dollars larger than that of 2022. We look forward to Q4 of 2022 and calendar year 2023 with glee,’ said CEO Adam Aron three months ago.

Over the shorter-term, the fourth quarter is expected to be much better than the third thanks to several blockbuster releases pencilled-in for the holiday season. This includes the latest title out from Marvel as Black Panther: Wakanda Forever hits the big screen in November followed by the long-awaited sequel of Avatar: The Way of Water in December. AMC has already said that it expects this to help drive a stronger performance and markets believe revenue will return to around $1.2 billion in the fourth quarter, providing potential for AMC to deliver a new post-pandemic record.

Although ticket sales usually grab the headlines, shareholders would be wise to keep an eye on how those moviegoers that have returned to the theatre are treating themselves with concessions. This is where AMC makes its money as food and beverages offer much higher margins, but this could prove more sensitive to any pullback in consumer spending as fears of a recession build. Wall Street is looking for a 27% year-on-year rise in food and beverage sales in the third quarter to $337.5 million, trailing the anticipated 36% rise in ticket sales to $580.1 million.

AMC remains in the red and continues to burn through cash, which will be the biggest concern for shareholders. Quite simply, AMC is still spending more than it makes. Total operating expenses are rising at a faster pace than the recovery in sales and are forecast to come in over 23% higher than last year at $1.12 billion this quarter, more than the $977.5 million of sales. That trend is expected to continue in the fourth quarter.

This is amplifying AMC’s debt burden, with over $5 billion of long-term debt on its books which in turn is also weighing on the bottom-line as AMC is spending over $90 million each quarter in interest. This, in turn, is placing its dwindling cash balance under the spotlight. Wall Street thinks its cash hoard will have been squeezed to $882.6 million by the end of September from over $1.6 billion a year ago.

We saw its biggest rival Cineworld, which is listed in London, file for bankruptcy protection in the US back in September after running out of cash and it is now trying to revive its fortunes after striking a deal with its landlords and lenders that will allow it to repay a chunk of its debt and raise fresh cash.

Where next for AMC stock?

AMC shares are down over 78% since the start of 2022 as appetite for riskier assets has waned amid the broader selloff seen this year. We saw the stock hit it a 17-month low in the middle of October and this remains in play despite shares having found higher ground since then.

The low of $5.50, which is in-line with the level of support we saw during the second quarter of 2021, should be regarded as the immediate level of support, although we could see it slip toward the April 2021 low of $5.30. These must hold to avoid opening the door to a potentially sharper fall toward the reliable level of support we saw back in early 2021 at $3.30. That is reinforced by the current average target price of $3.00 set by the eight brokers that cover the stock.

Notably, the RSI is approaching bearish territory and trading volumes have held largely steady in recent months but remain well below the 100-day average to suggest the current trend could continue without a new catalyst to provide some new momentum and direction.

The stock needs to recapture the 50-day moving average at $7.70 to install hopes of a revival. The 100-day moving average at $8.90 is in-line with the March 2021 ceiling while the 200-day moving average at $9.50, aligned with the June-peak, should be treated as the top upside target. A move above $12 would be possible from here.

How to trade AMC stock

You can trade AMC shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘AMC’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.