US futures

Dow futures +0.07% at 33790

S&P futures +0.03% at 3963

Nasdaq futures +0.13% at 11608

In Europe

FTSE +0.5% at 7529

Dax -0.2% at 14390

Learn more about trading indices

Beijing pledges more vaccines

US stocks are set for a stronger start amid rising speculation that the unrest in China from Covid restrictions would force authorities to move faster to loosen curbs. Beijing didn’t announce any major changes to the current measures by did say that it would speed up the pace of vaccinations among senior citizens. This could be considered a crucial step toward ending strict lockdown rules.

The change in mood comes after widespread unrest in China yesterday in response to strict unsustainable Covid restrictions. China is at a critical juncture for its policy.

In addition to China, stocks are benefitting from optimism that the Federal Reserve could slow the pace of rate hikes as from the December meeting. Federal Reserve speakers yesterday sent mixed messages. NY Fed President John Williams suggested that there is still work to be done to tame inflation, but there could be a cut next year. James Bullard and Vice Lael Brainard also flagged the amount of work still to be done. The hawkish chatter could be a prelude to Federal Reserve Chair Jerome Powell’s speech tomorrow.

Adding to the upbeat mood, initial data from Adobe Analytics showed a record-breaking Cyber Monday as US spending tops $11.6 billion. This was an 8.5% rise over 2021 when interest rates were still low. This may well be the last hooray for retailers, as strong spending suggests that investors were keen to snap up a deal amid high inflation and rising interest rates.

Looking ahead, attention will turn to US consumer confidence data which is expected to show that morale slowed slightly to 100, from 102.5.

Corporate news:

Apple is rebounding on China optimism after losses yesterday amid the unrest at the Foxconn plant.

UPS jumps 1.4% pre-market after Deutsche Bank upgrades its stance to buy from hold, saying that macro concerns are now priced into the stock.

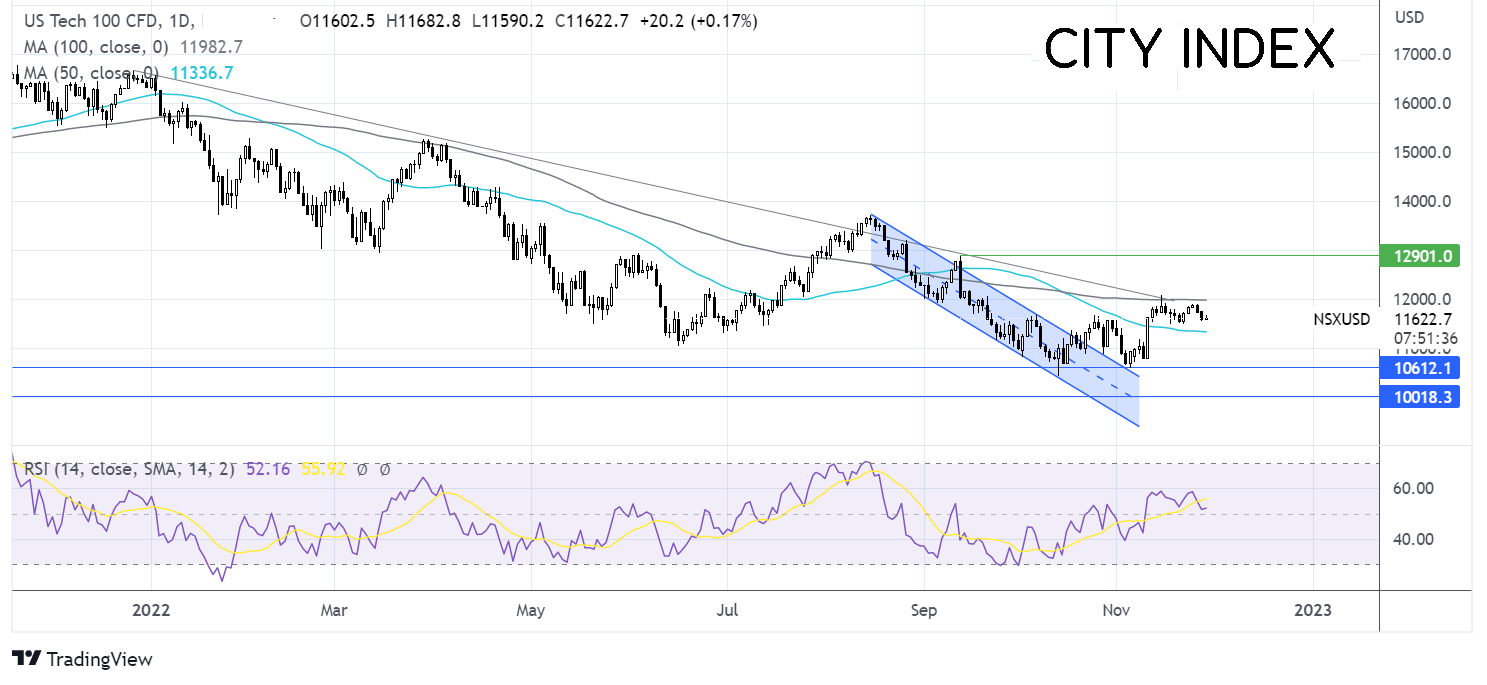

Where next for the Nasdaq?

The Nasdaq is consolidating, caught between the 100 sma, which is capping gains, and the 50 sma, limiting losses. The RSI is approaching neutral. A breakout trade could be considered. Buyers will look for a rise over the 100 sma at 12030 to bring 12900, the September high, into focus. Sellers could look for a move below 11380, the 50 sma, to open the door to 10600, the November low.

FX markets – USD falls, EUR rises

The USD is falling as the market mood improves and investors digest Fed officials' latest commentary. Attention is now turning toward Jerome Powell’s speech tomorrow.

EURUSD is rising after stronger-than-expected economic sentiment data and after German inflation cooled to 11.3%, down from the record high of 11.6% in October. The data comes after ECB President Lagarde warned that inflation in the region could still push higher. Her comments fueled bets of more interest rate hikes.

GBP/USD is holding over 1.20 but trades off its daily high after disappointing data. UK mortgage approvals fell sharply to 58.9k, the lowest level since June 2020, as interest rates rise. BoE’s Andrew Bailey is due to speak later.

GBP/USD +0.3% at 1.12

EUR/USD +0.05% at 1.0330

Oil rebounds

Volatility in oil prices continues on Tuesday. After touching a new year-to-date low yesterday, oil prices have rounded, trading some 3% higher on optimism that China could soon ease its zero-Covid measures.

The prospect of a return to normality in China, the world’s largest oil importer, is good news for the demand outlook and has fueled the first decent rebound in oil prices in over two weeks.

Also supporting the oil price is speculation that OPEC+ could cut production further to support the price of oil. The oil cartel cut production in October, and the price now trades below where it was at that meeting.

WTI crude trades +2.03% at $78.80

Brent trades at +2.3% at $85.12

Learn more about trading oil here.

Looking ahead

15:00 US consumer confidence

21:30 API crude oil stockpiles