US futures

Dow futures +0.85% at 31312

S&P futures +0.76% at 3891

Nasdaq futures +0.9% at 11613

In Europe

FTSE +0.7% at 7230

Dax +0.8% at 12970

Euro Stoxx +1.1% at 3512

Learn more about trading indices

Fed bets ease, earnings in focus

US stocks are heading for a stronger start, extending gain from the end of last week as investors look ahead to a busy week for earnings.

US indices lost ground across the previous week after hot CPI data lifted expectations of a more hawkish Fed. The market started pricing in 100 basis point rate hike in July.

Towards the end of the week, even hawkish Fed speakers said that they supported a 75-basis point rate hike. The softening of those aggressive Fed bets has lifted the market mood, boosting stocks and pulling the USD lower.

Despite the move higher, recession fears remain high, and this is more likely a bear market rally rather than a deeper fundamental change in the direction of the market.

Earnings season is ramping up with mixed numbers from the major banks and attention than moving towards tech for clues as to whether the worst is past.

In corporate news:

Bank of America is falling pre-market after reporting a fall in Q2 profits. The bank saw a fall in investment banking revenue as underwriting activity slumped.

Goldman Sachs rises pre-market after strong bond market trading results helped lift the stock higher, even as profits halved.

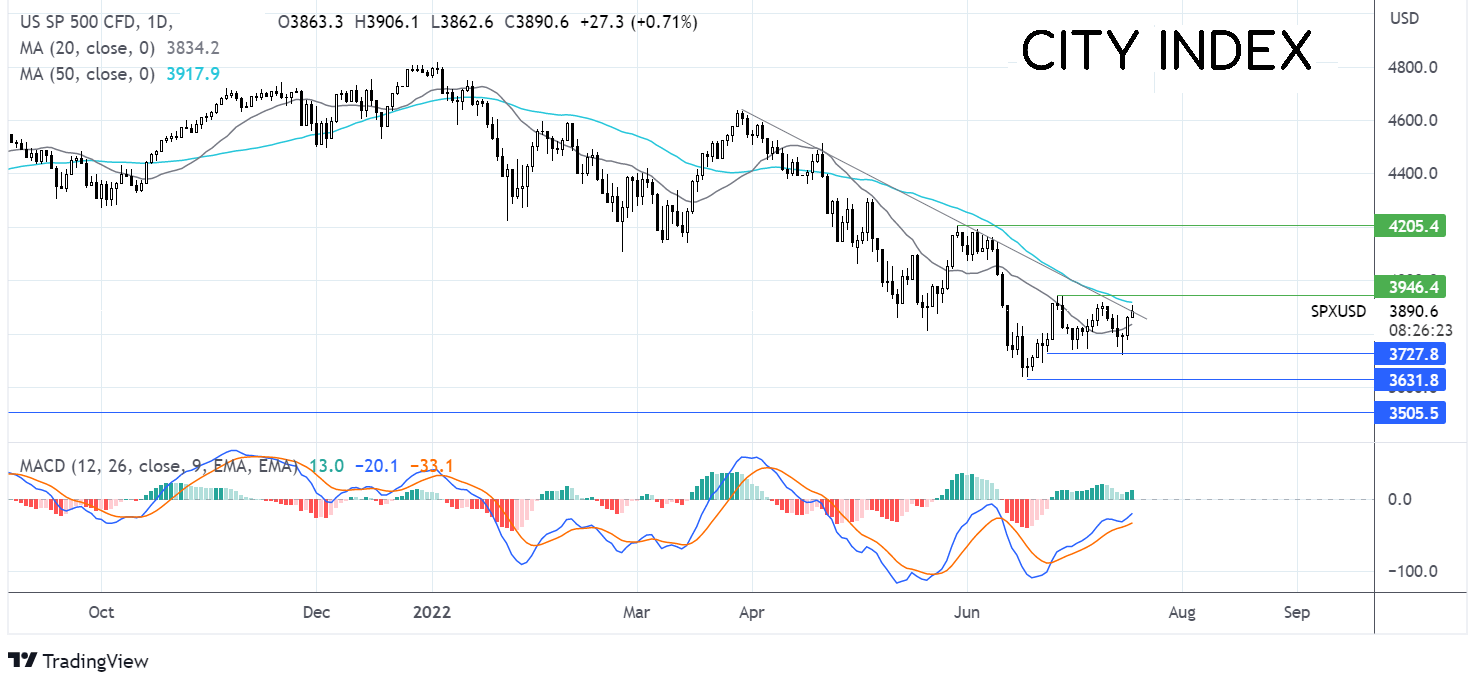

Where next for the S&P500?

The S&P500 rebounded lower from support at 3720, rising above the 20 sma, which combined with the bullish MACD, keeps buyers hopeful of further upside. Buyers need to rise above the 50 sma at 3920 to test resistance at 3940 and create a higher. Failure to retake the 50 sma could see the index fall back towards support at 3720, with a break below here opening the door to 3635, the 2022 low.

FX markets – USD falls, GBP climbs

USD is edging lower as the markets reassess the likelihood of a 100 basis point rate hike and aggressive Fed bets ease. The Fed is now in a blackout period ahead of the FOMC at the end of the month.

EURUSD is rising back above 1.0100 as attention turns to eurozone CPI data and the ECB interest rate meeting later in the week. The ECB is expected to hike rates for the first time in a decade.

GBP/USD is rising towards 1.20, capitalizing on the weaker USD. This week is a busy week for UK macro data with unemployment figures, inflation, and retail sales data due across the week.

GBP/USD +0.76% at 1.1930

EUR/USD +0.3% at 1.0120

Oil rises but down across the week

Oil prices are rising on Monday, boosted by the softer USD and tighter supply. Oil prices are rebounding after falling over 6% last week as recession fears and rising COVID cases in China hurt the demand outlook.

On the supply side, President Biden returned from a risky political trip to Saudi Arabia without any firm agreement from the oil-producing nation to raise output. Biden is keen for the guld nations to raise output to help lower oil prices and inflation.

Attention is also on the repairs of Nord Stream 1 and whether Russia will switch it back online in a few days when the repairs are over. Failure to do so could send oil prices higher by the end of the week.

WTI crude trades +2% at $96.70

Brent trades +2% at $100.5

Learn more about trading oil here.

Looking ahead

N/A