US futures

Dow futures -0.13% at 37623

S&P futures +0.01% at 4780

Nasdaq futures +0.01% at 16820

In Europe

FTSE +0.8% at 7638

Dax +0.01% at 16698

- US PPI rose by less than forecast to 1% YoY vs 1.3% exp.

- Banks fall after disappointing Q4 earnings

- JPMorgan bucks the trend with record full-year profits

- Oil jumps as Mid East tensions offset demand worries

Banks Q4 earnings disappoint

US stocks point to a modestly lower after banks kick off earnings season in a disappointing style and after cooler than expected PPI inflation data.

PPI rose less than expected at 1% in December YoY, up from 0.8% in November. This was short of forecasts of 1.3%, which bodes well for the outlook for U.S. consumer price inflation.

The data comes hot on the heels of yesterday's hotter-than-expected consumer inflation print and as the market tries to assess when the Federal Reserve could start cutting interest rates. The broad trajectory for inflation is still expected to be lower, but the data suggests it might be a bumpy ride to reach the 2% target.

Despite inflation ticking high yesterday, traders' expectations for at least a 25 basis point rate cut in March still stand around 70%, according to the CME fed watch tool.

Looking ahead, investors will be watching comments by Minneapolis Federal Reserve President Neel Kashkari. Yesterday, Cleveland Fed president Loretta Mester said that inflation data shows that the Fed still has more work to do to tame inflation.

Meanwhile, U.S. bank earnings have fully come in weaker than expected, sparking some concerns over the health of corporate America ahead of the Q4 earnings season.

Corporate news

Citigroup is falling after posting a $1.8 billion Q4 loss amid several hefty charges tied to overseas risk, last year's regional banking crisis, and the restructuring program.

Bank of America is set to open 1.4% lower after the lender's Q4 profit shrank as it took a $3.7 billion charge to refill the government Deposit Insurance fund.

Wells Fargo also is set to open over 1% lower after warning that 2024 net interest income would be 7% to 9% lower than a year earlier, even though Q4 profits rose thanks to cost-cutting.

JP Morgan is bucking the trend and is set to rise 1.7% on the open after reporting a record full-year profit, benefiting from rising interest rates and despite a 15% fall in net income in the final quarter.

Tesla is set to fall 3% on the open after the EV maker cut prices of some of its new China models while also suspending car production at its factory near Berlin.

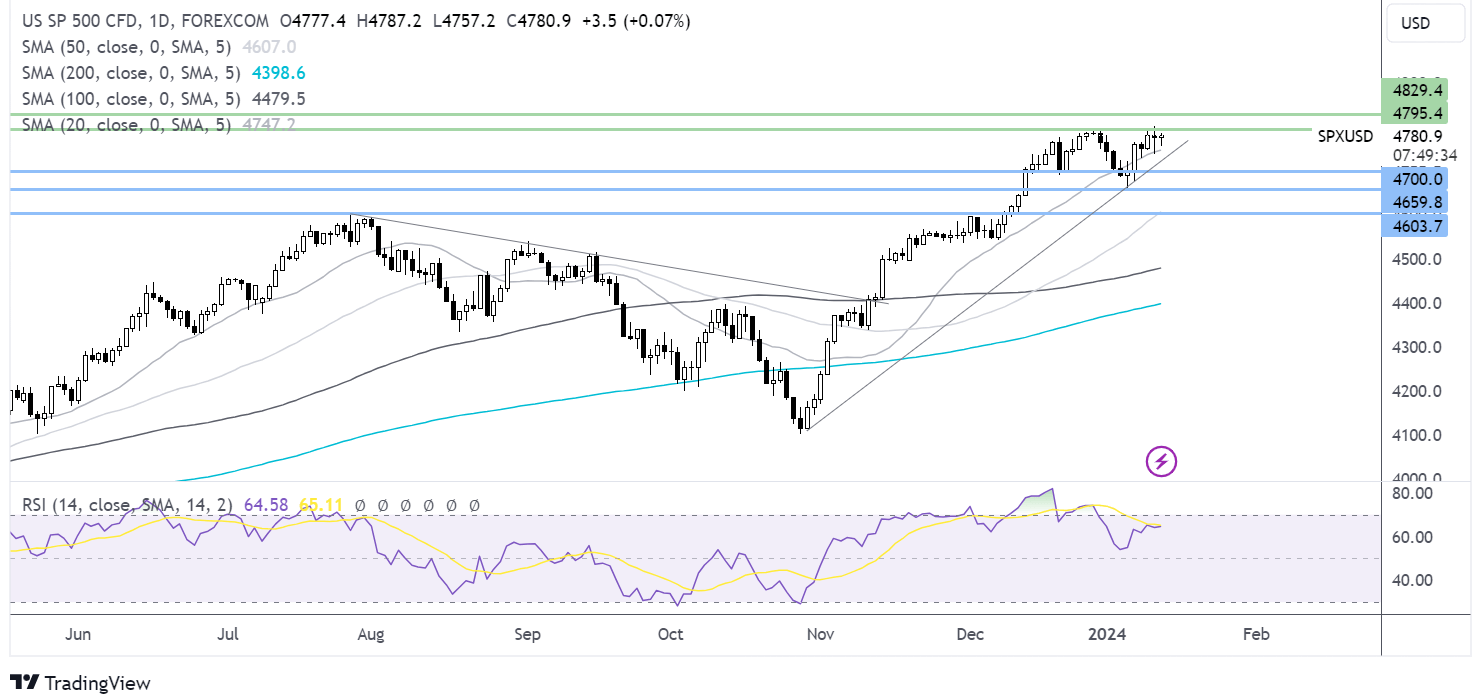

S&P 500 forecast – technical analysis

The S&P 500 has been tracking the 20 SMA higher and is testing resistance just below 4800. Buyers need to rise above here to test 4820 in January 2022, which is high ahead of 4850. On the downside, the 20 SMA at 4750 could offer minor support ahead of 4700.

FX markets – USD rises GBP/USD falls

The USD is rising as investors continue to mull over inflation data and amid safe-haven flows as geopolitical tensions in the Middle East deepen.

EUR/USD is falling but continues to trade within a familiar range around the 1.0950 level. The pair is on track to be unchanged across the week.

GBP/USD is rising after UK GDP came in slightly better than expected at 0.3% MoM in November after falling 0.3% in October. While the figure was better than expected, it doesn't remove the risk of recession. UK GDP will need to be at least 0% in order to avoid a recession at the end of 2024. Looking ahead, there is plenty of UK data for investors to sink their teeth into next week, including inflation and unemployment data.

Oil rises after US UK military strikes in Yemen.

Oil prices have jumped higher and are rising for a second straight day after geopolitical tensions in the Middle East deepened.

The US and UK carried out military strikes on Houthi targets in Yemen as tensions in the Red Sea escalated.

Supply isn't being affected, but the heightened geopolitical tensions are adding a risk premium to oil prices heading into the weekend.

Meanwhile, oil is also supported by signs of recovery in China. The exports rose by more than expected, and inflation cooled by less than forecast.