US futures

Dow futures +0.04% at 38980

S&P futures +0.18% at 5094

Nasdaq futures +0.14% at 18061

In Europe

FTSE +0.3% at 7661

Dax 0.28% at 17762

June rate cut June 70% priced in

U.S. stock point to a quiet open after yesterday's record highs, boosted by enthusiasm for AI and after US U.S. PCE cooled in line with the forecast.

The tech-heavy Nasdaq 100 closed at a record high on Thursday thanks to gains in AI stocks such as Nvidia and Advanced Micro Devices. These stocks are pointing to more gains ahead of the open.

The rally found further legs after the Federal Reserve's preferred gauge for inflation, the PCE report, came in as expected booking the smallest annual inflation growth in three years. Following the data, bets were raised that the Fed would start cutting interest rates by June, which fueled a rally on Wall Street.

However, there are signs that inflation is sticky in some areas with services PCE at a 12-month high, which could mean that the timing of the Fed’s starting to loosen monetary policy remains uncertain.

The market is pricing in a 70% probability of a 25 basis point rate cut or more in June.

Elsewhere, concerns over the global economic recovery are limiting any upside after Chinese manufacturing activity shrank for a fifth straight month in February. The weak data put pressure on Beijing to come forward with more stimulus measures ahead of key government meetings next week.

Corporate news

Dell is set to jump Percent on stronger than expected earnings and guidance thanks to solid demand for its AI-optimized servers, which offset weakness in personal computing.

NYC Community Bancorp slumped 25% after the regional lender said it had found a material weakness in internal controls relating to loan rev. It revised Q4 loss tenfold.

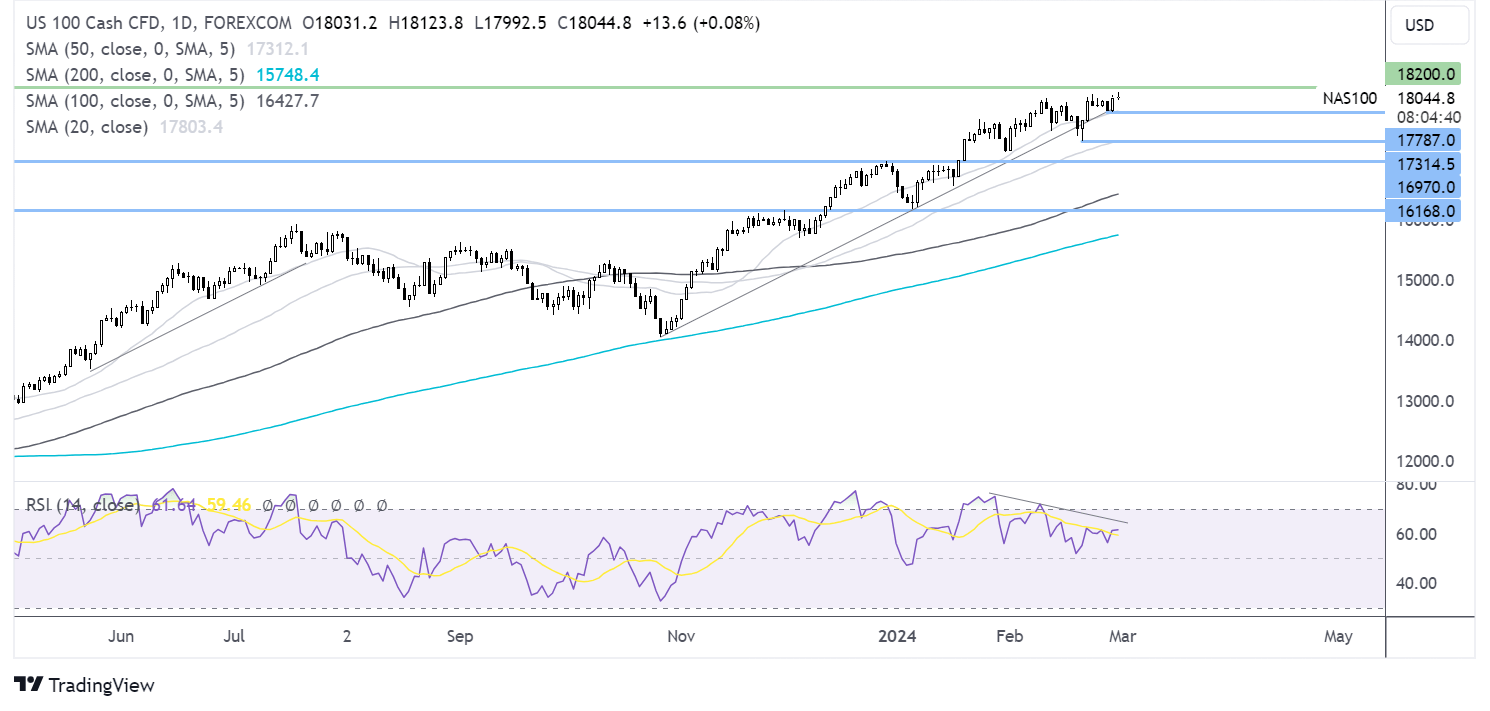

Nasdaq100 forecast – technical analysis

The Nasdaq has risen to a fresh record high at 18100, bringing 18200 as the next minor resistance on its way toward 18500. The bearish RSI divergence could suggest that the run higher could struggle. Sellers look to support at 17787, the weekly low. Below here, 17315 comes into play.

FX markets – USD falls, EUR/USD falls

The U.S. dollar is falling against its major peers ahead of the ISM manufacturing and Michigan consumer confidence. The US dollar is giving back some of yesterday's gains as investors continue to weigh up the inflation data.

EUR/USD is falling after eurozone inflation calls to 2.6%, down from 2.8% in January. While this was slightly above the 2.5% forecast, it suggests that inflation is steadily cooling towards the ECB's 2% target. The data release didn't move ECB rate cut expectations. The data comes ahead of the ECB meeting next week, where the central bank is expected to leave interest rates on hold but could begin discussions around when the right cut may be required.

USD/JPY has rebounded higher after the Bank of Japan governor Ueda said that more evidence is needed that inflation is returning to the central bank's 2% target before the central bank will consider hiking interest rates. His comments came after BoJ's Takata said yesterday that to be AG, one should consider hiking rates.

Oil set for weekly gains

Oil prices are rising on Friday and are set for a weekly gain as investors weigh up mixed Chinese data and ahead of an OPEC decision regarding supply next week.

US crude oil is on track to gain 3.4% across the week on rising expectations that OPEC will continue with its supply cuts beyond the first quarter of 2024 and potentially until the end of this year, a move that could keep oil prices above $80.00 a barrel.

A decision from OPEC is expected in the first week of March.

On the demand side, Chinese manufacturing activity shrank for a fifth straight month, raising some concerns about the fragile economic recovery in the world's largest importer of oil.