After threatening for weeks to generate a sizeable volatility event, the combination of higher bond yields and US dollar looks to have delivered with numerous stock indices breaking down spectacularly, many of them from the outer reaches of the risk asset spectrum. Think Nasdaq, Nikkei and ASX 200. The question many are now asking is just how much lower they can go?

Bondcano eruption arrives

The simultaneous rupturing higher of US bond yields this week has already left its mark. The “bondcano” risk discussed earlier this month has played out. The eruption has begun and now it’s time to deal with the consequences for markets.

Just as important as yields hitting fresh highs is how long they remain here, and how much further they can go? If the thrust higher is brief, the damage should be limited. But if it isn’t, it will bolster the view we’ve entered a new paradigm where capital costs remain elevated for far longer than prior cycles.

Higher yields a negative for asset valuations and real economy

It’s the latter that will be problematic, not only placing downward pressure on asset prices further out the risk spectrum but also increasing borrowing costs for governments and the private sector, creating downside risks for economic activity. What a combo, right?

That’s why the events of the past week should be taken seriously when it comes to future investment decisions. Speculative asset classes heavily reliant upon the kindness of capital markets will feel the full force of an extended bondcano eruption and should be avoided if it plays out. There is no kindness at this point in the cycle. You therefore need to invest accordingly.

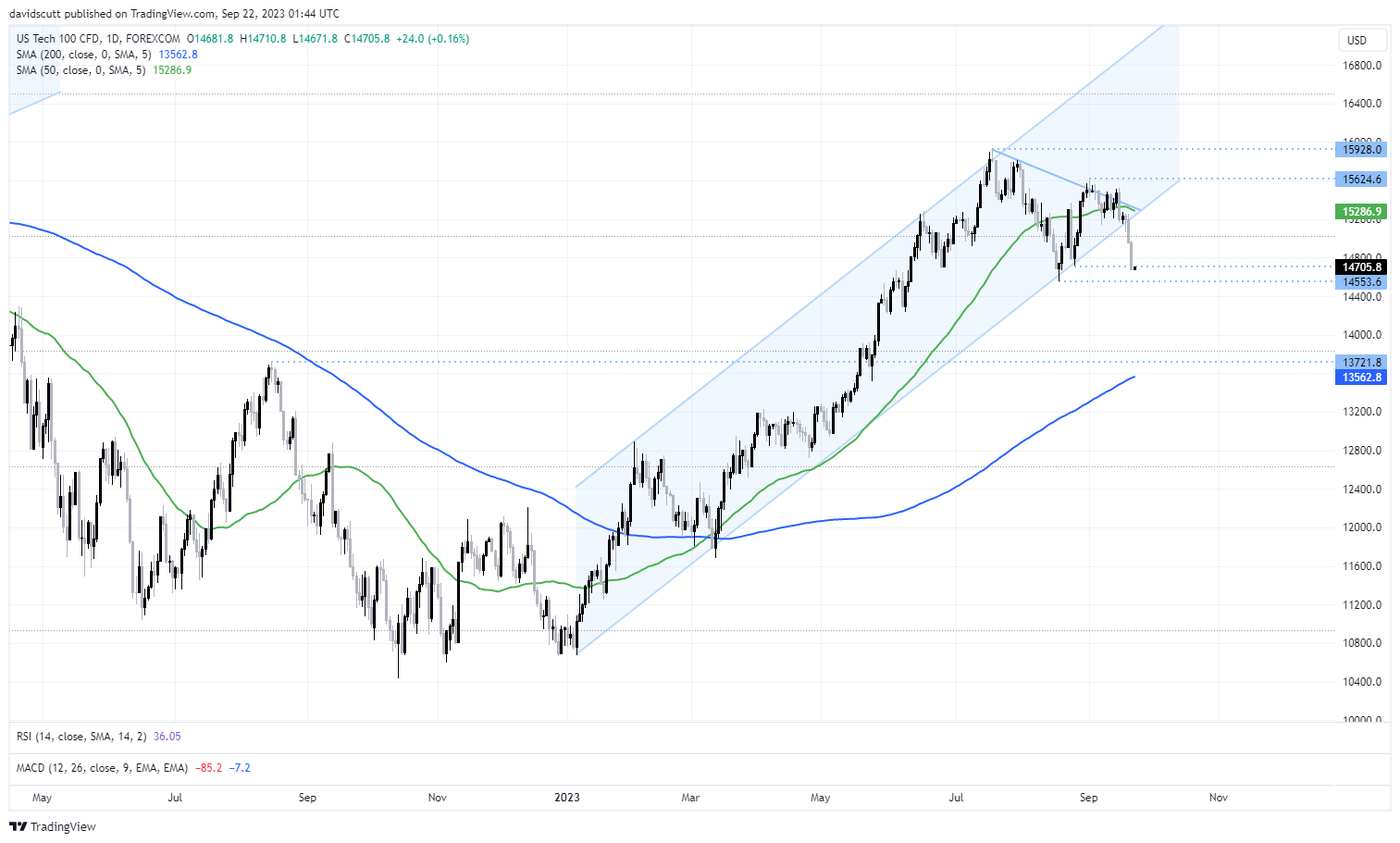

Nasdaq yet to adjust to change of environment

When investors think about speculative assets, it’s a safe bet the Nasdaq would be front of mind. Given the events of this week, and the run-up we’ve seen this year, it’s no surprise it’s copped a shellacking. But when you look at the daily chart over the past few years, the decline is barely noticeable.

I know there are some great companies listed on the Nasdaq, but can the index continue to defy gravity when capital costs are elevated while downside risks to the economy are building? Probably not. In this environment, the path of least resistance appears lower, not higher.

Right now, haven broken the uptrend from the start of the year, the move has stalled in a minor support zone starting around 14700. While MACD is signalling downside, RSI is nearing oversold levels, hinting we may do some work at this level. As a short idea, consider selling rallies towards 15000 targeting a move down to 13700, coinciding with the August 2022 high and 200-day MA. Given its struggles above 15600 recently, that would be a suitable location to place a stop-loss for protection.

Alternatively, traders could wait for a potential break of the lower rung of the support zone located around 14550 to go short targeting the same downside target as the first trade idea. A stop above 14750 would present decent risk reward given apparent trend change.

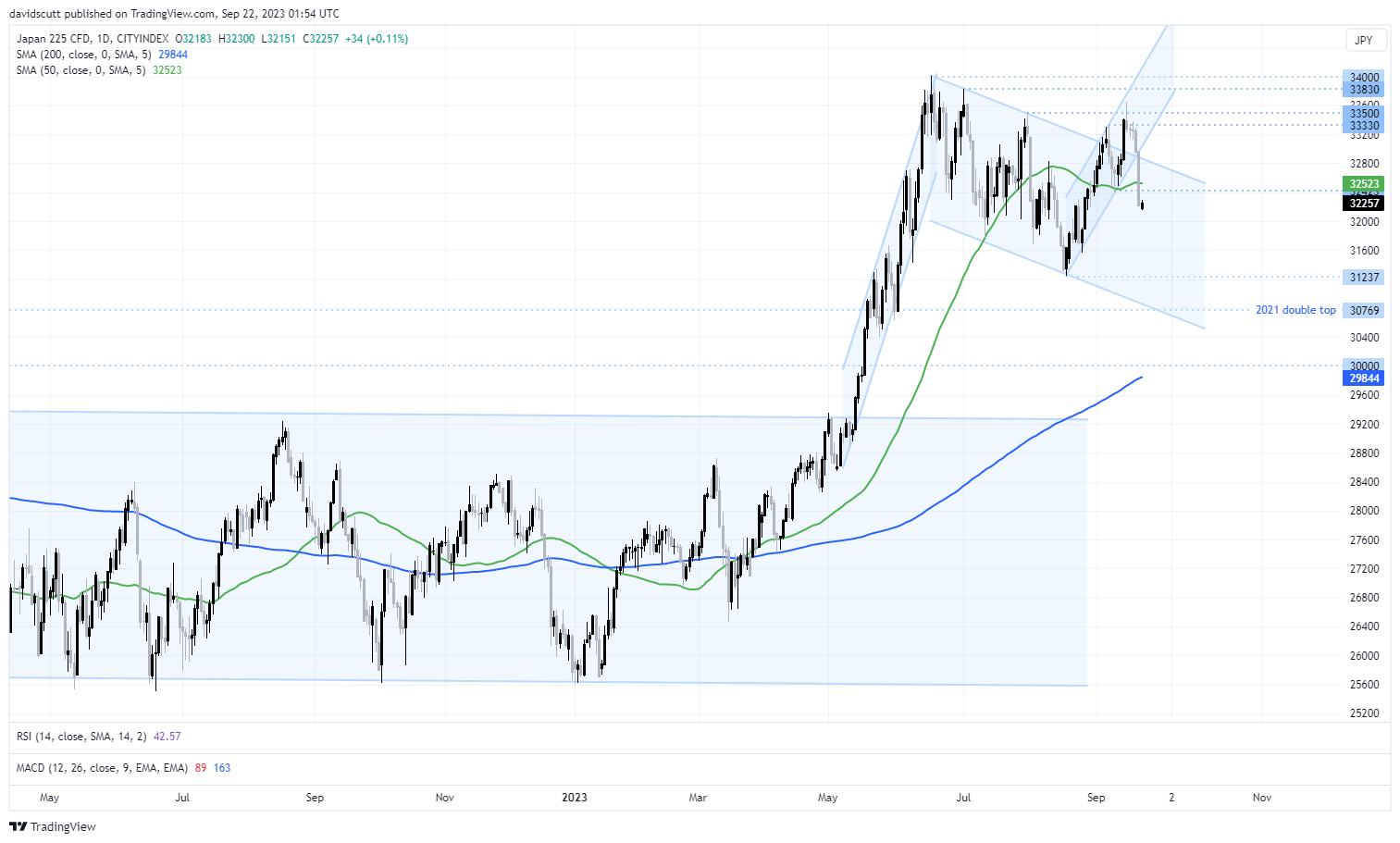

Nikkei 255 uptrend under threat

Outside of the Nasdaq, the Nikkei is another interesting short prospect where the risk-reward has quickly shifted from the upside to the downside this week, not only impacted by the change in bond yields but also signs of fatigue in the USD/JPY rally. Like the Nasdaq, it too has had a stellar year until this point.

Having broken out of an uptrend from August, the Nikkei has now fallen into a former downtrend running from June. As an idea, a short around these levels could be placed targeting a move back towards 31230 or even 30770 where the double top of 2021 and bottom of the range is located. A stop around 32500 should offer some protection.

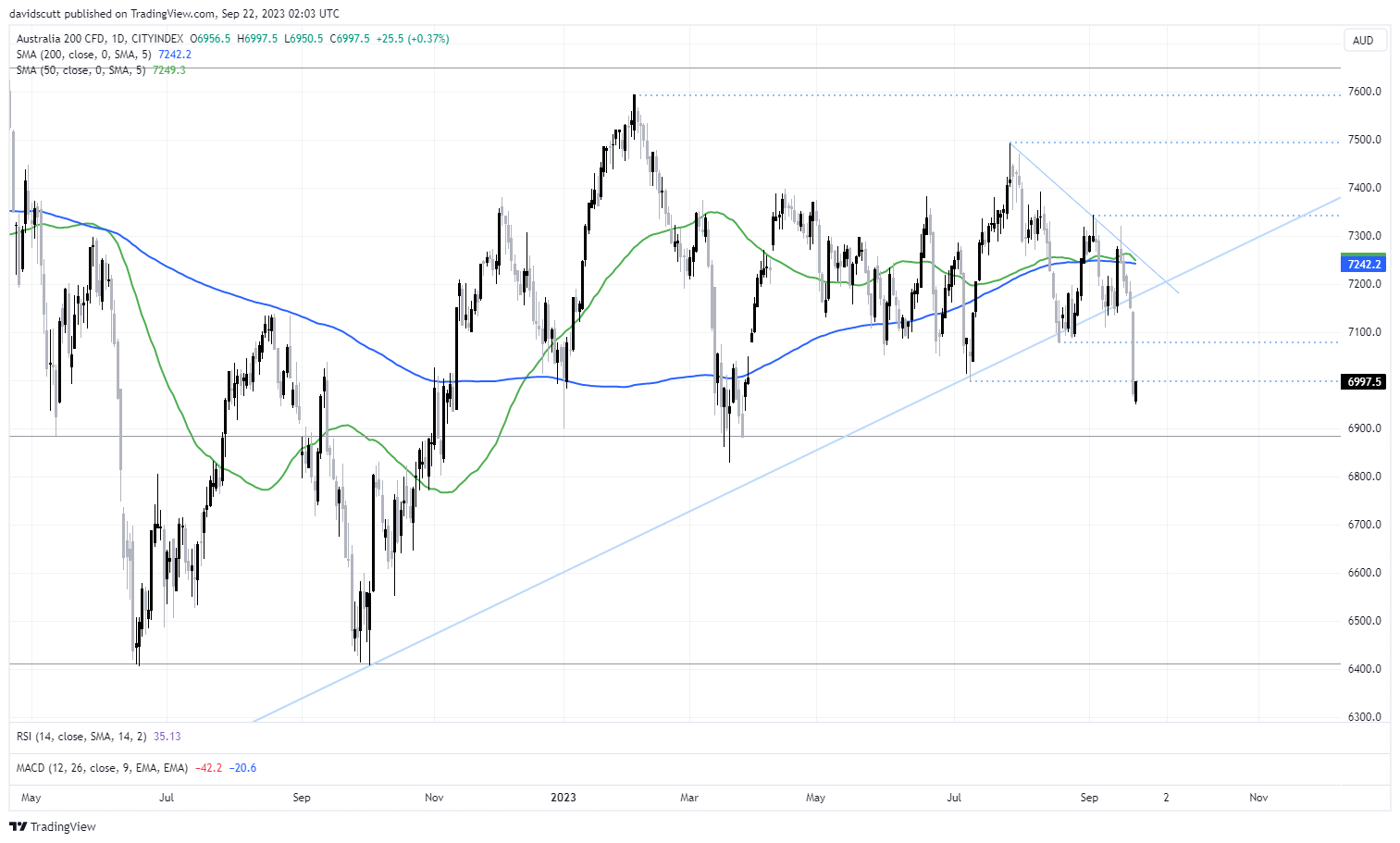

ASX 200 busts key, long-term support

While it has not had the stellar run of the Nasdaq or Nikkei this year, Australia’s ASX 200 is an index that has broken down spectacularly this week, breaking through the uptrend it’s been in since the start of the pandemic. Nearing oversold levels, rallies above 7000 will provide opportunities to establish short positions targeting continued downside. While the index has attracted support below 6900 previously, that was in a far more placid environment where cyclical and value names were buoyant. The potential turn in the economic outlook makes this time appear different. 6400 is a target many shorts will be eyeing off. A stop above 7100 would offer protection.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade