US futures

Dow futures 0.18% at 38960

S&P futures 0.26% at 5216

Nasdaq futures 0.35% at 18159

In Europe

FTSE 0.5% at 7940

Dax +0.9% at 18321

Yields rise to a 4-month high

Fed rate cut expectations are pushed back

Boeing flies into another FAA investigation

Oil falls as Middle East tensions ease.

Yields rise, Fed rate cut expectations are pushed back

US stocks are set to inch higher on the open after booking losses across the previous week. However, gains could be muted as treasury yields rise on expectations that the US Federal Reserve could delay cutting interest rates this year.

Stronger-than-expected data and hawkish comments from Fed officials last week pointed to a resilient U.S. economy, allowing the Federal Reserve to be patient with cutting rates.

The market has pared back expectations for rate cuts to fewer than three this year, and the probability of a June rate cut has been downwardly revised to 49% from 58% just a week earlier.

U.S. Treasury yields rose to 4.45%, its highest level since November, keeping pressure on equities.

Today, the US economic calendar is quiet, and instead, attention will be on comments from Minneapolis Fed President Neel Kashkari later in the day.

Looking ahead across the week, US inflation and the minutes from the March Fed meeting could provide further clues about when the Fed might start to cut rates and the scale of those cuts. Inflation is expected to tick higher to 3.4%, up from 3.2%, highlighting the sticky nature of consumer prices.

Looking ahead to the end of the week, first-quarter earnings are due to kick off, with JP Morgan, Citigroup, and Wells Fargo officially kicking off the Q1 earnings season.

Corporate news

Boeing is flying lower after an engine cover fell off during takeoff, prompting another US investigation. The FAA will investigate the incident which took place on a Southwest Airlines flight. This latest incident comes as Boeing prepares for a major shakeup in its leadership, as the company’s safety record has come under scrutiny in recent years.

Tesla is set to open higher after CEO Elon Musk said the company will unveil Robotaxi near the start of August. This opens up the potential for more demand for its services.

Coinbase rose 5.7%, benefiting from gains by Bitcoin after an uncharacteristically strong weekend for the cryptocurrency and ahead of the halving event in under two weeks.

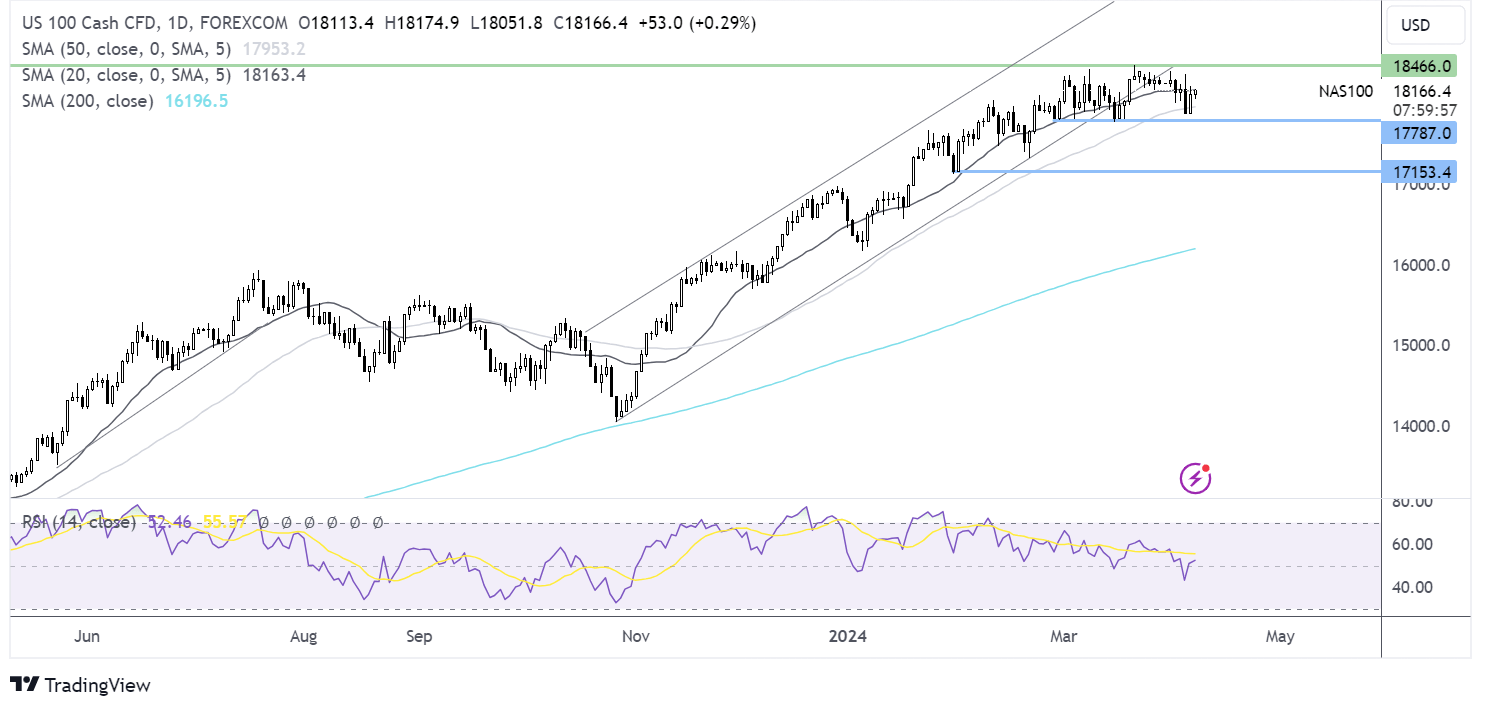

Nasdaq 100 forecast – technical analysis.

The Nasdaq has fallen away from the all-time high of 18466 reached in March but continues to trade within range. The price found support at 17860, just below the 50 SMA, and the mid-March low of 17760, and it rebounded higher, testing the 20 SMA resistance at 18260. A rise above here needs to be retested for the ATH. Meanwhile, a break below the 17860 - 17760 zone could support a steeper selloff to 17160, the February low.

FX markets – USD rises, EUR/USD falls

The U.S. dollar is rising, adding to gains on Friday and tracking treasury yields higher. Yields have risen to a four-month peak after stronger-than-expected US non-farm payrolls on Friday, adding to the view that the Fed may not cut rates in June.

EUR/USD is inching lower despite upbeat data from Germany. The eurozone's largest economy saw industrial production rise to a 13-month high in February, suggesting that the industrial stagnation ended in the first quarter. Meanwhile, the eurozone Sentix index rose to -5.9 in April, up from -10.5 in March, taking investor morale to its highest level in two years.

GBP/USD is struggling after data showed that UK wages grew at the slowest pace in almost three years. Meanwhile, the firm’s spending on temporary workers also dropped to an almost four-year nadir. Industry figures point to underlying inflationary pressures in the UK economy easing, which will be welcome news for the Bank of England as it struggles to bring inflation back to the 2% target.

Oil falls as Middle East tensions ease

Oil prices are falling lower as tensions in the Middle East appear to be easing, removing some of the risk premiums on oil.

Israel said it withdrew more soldiers from southern Gaza on Sunday amid growing pressure from allies to improve the humanitarian situation in the region. Ceasefire talks were revived last night as both Israel and Hamas sent teams to Egypt for further discussions ahead of the Eid holiday.

Meanwhile, last week’s upbeat US data means that the Fed may not cut rates until later in the year. Whilst, on the one hand, a strong economy is an encouraging sign, it does also mean that the the Federal Reserve will likely keep interest rates high for longer in order to slow economic growth, which is a negative for the oil demand outlook.