US futures

Dow futures 0.13% at 37847

S&P futures 0.40% at 5071

Nasdaq futures 0.38% at 17775

In Europe

FTSE 0.8% at 7876

Dax 0.8% at 17882

- Stocks inch higher ahead of Fed speakers & after corporate earnings

- Federal Reserve Chair Jerome Powell dampened rate cut expectations

- United Airlines flies higher after forecasting a stronger-than-expected current quarter

- Oil falls as demand concerns overshadow Middle East tensions

Fed Powell dampens rate cut expectations

US stocks are Pointing to a higher start, with corporate updates in focus, after Federal Reserve chair Jerome Powell raised doubts over the Fed's ability to cut rates this year.

In a speech yesterday, Federal Reserve Jerome Powell warned that interest rates may need to stay high for longer amid a lack of progress in cooling inflation to the 2% target. His comments come after US inflation data last week rose for a third straight month, and U.S. economic data continues to come in stronger than forecasts.

Attention will now turn to Fed speaker Governor Bowman and Cleveland Fed president Loretta Mester, who could sound hawkish today. Given the light U.S. economic calendar, more comments pushing back rate cut expectations could affect market sentiment.

The CME fed watch tool sees the market pricing in around a 40% chance of the central bank cutting interest rates in July.

Corporate news

United Airlines is flying higher after forecasting stronger-than-expected earnings in the current quarter and after reporting a narrower-than-forecast loss in Q1 thanks to robust travel demand.

ASML ADRs are falling after the Dutch equipment supplier to chipmakers reported a weaker-than-expected Q1. Net sales reached €5.29 billion, below €5.39 billion expected. New bookings also disappointed, falling 4% annually but dropping over 65% from the December quarter.

Eli Lilly rose 1.9% after the pharmaceutical giant said its popular weight loss drug Zepbound also showed potential to treat patients with sleep apnea in late-stage clinical trials.

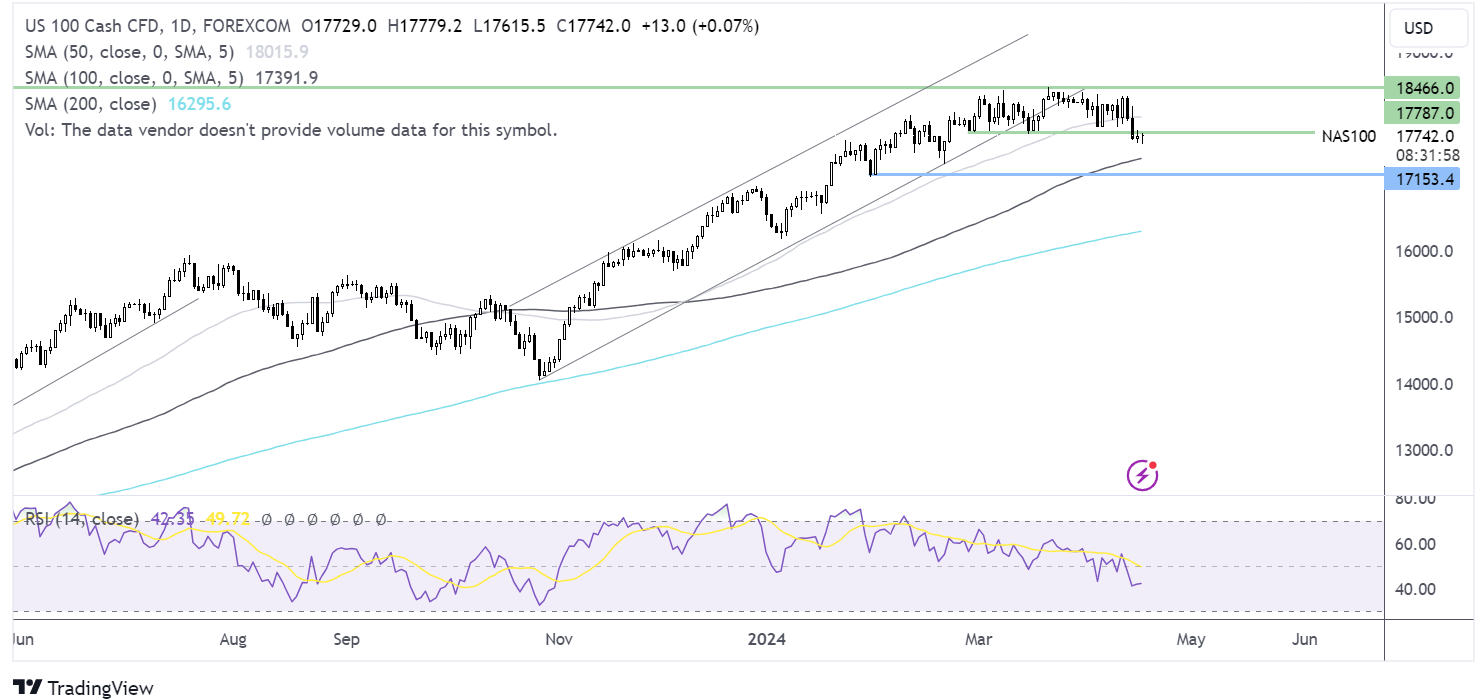

Nasdaq 100 forecast – technical analysis.

Nasdaq 100 is attempting to break out of its recent holding pattern. The price broke below 17800, the March low, and continues to hover just below here. Sellers, supported by the RSI below 50, could look to extend the selloff to the 100 SMA at 17400. A break below here opens the door to 17160, the February low. Any recovery would need to rise above 17800 resistance and 18000 at the 50 SMA to extend gains towards 18466 and fresh all-time highs.

FX markets – USD slips, GBP/USD rises

The USD is lower after hitting a fresh five-month high above 1.06 in the previous session. The U.S. dollar index has tipped into oversold territory on the char, so this could be a technical selloff that we're seeing.

EUR/USD is rising amid a weak U.S. dollar and after eurozone inflation cooled in line with forecasts to 2.4%. The data supports the view that the ECB could cut interest rates as soon as June. ECB president Christine Lagarde is due to speak later today, and investors will be looking for further clues on the likelihood of a rate cut soon.

GBP/USD is rising after UK inflation cooled by less than expected in March, easing to 3.2% YoY in March, down from 3.4% but ahead of the 3.1% forecast. The market has sharply reassessed Bank of England rate cut expectations, with just one rate cut now being priced in this year and a 30% chance of a second; this was down from 2 rate cuts previously.

Oil slips on demand worries

As demand concerns overshadow Middle East tensions, oil prices are slipping for a third straight session.

Oil prices are falling after US crude oil stockpiles increased more than expected. Weaker economic data from China and the prospect of higher interest rates for a longer time hurt the outlook for global oil demand.

Federal Reserve chair Jerome Powell's more hawkish comments yesterday dampened expectations for meaningful rate cuts this year. This means that economic growth could slow, negatively impacting the outlook for oil demand. Meanwhile, the US dollar rose to a fresh five-month high, making oil more expensive for buyers with foreign currencies.

According to the API report, US crude oil stockpiles rose by 1.4 million barrels last week. EIA data is due later today.

Still, losses in oil are being limited by ongoing geopolitical tensions in the Middle East as the markets keep an eye on Israel and how it may respond to Iran's weekend attacks.