US futures

Dow futures 0.16% at 39123

S&P futures 0.17% at 5093

Nasdaq futures 0.13% at 18018

In Europe

FTSE -0.03% at 7689

Dax 0.10% at 17393

- Indices pause for breath at record highs

- Nvidia looks to add to gains

- Oil is set to fall across the week

Stocks steady after yesterday’s rally

U.S. stocks are set to open in a muted fashion on Friday, pausing for breath after yesterday's spectacular rally inspired by Nvidia to record highs.

The three major indices are on track to post gains across the week, with the S&P and the NASDAQ up 1.6% at 1.7%, respectively. The Dow is up 1.1% so far this week.

The economic calendar is empty on Friday, but investors could focus on comments from Federal Reserve governor Christopher Waller, who said he was in no rush to lower interest rates. His comments echo those of other Fed members who have suggested that persistent inflation and the strength of the labour market means there's no need to start cutting interest rates soon.

These comments align with yesterday's data after jobless claims came in stronger than expected, highlighting the resilience of the jobs market while PMI data also showed growth.

According to the CME Fed watch tool the market is pricing in a 70% probability of a rate cut in June. This has been pushed back from earlier expectations of a rate cut in May or March.

Corporate news

Nvidia is set to rise again after jumping 16% in the previous session after the AI chip designer posted impressive quarterly results and outlook. NVIDIA added $277 billion in market cap on Thursday, setting a record for the most significant one-day jump in history.

Warner Brothers Discovery is set for a 5% drop on the open after the media giant reported Q4 revenue below forecasts but insisted it was now on its way to growth.

Block is set to rise 16% after the payment firm beat quarterly revenue estimates and lifted its annual operating profit outlook.

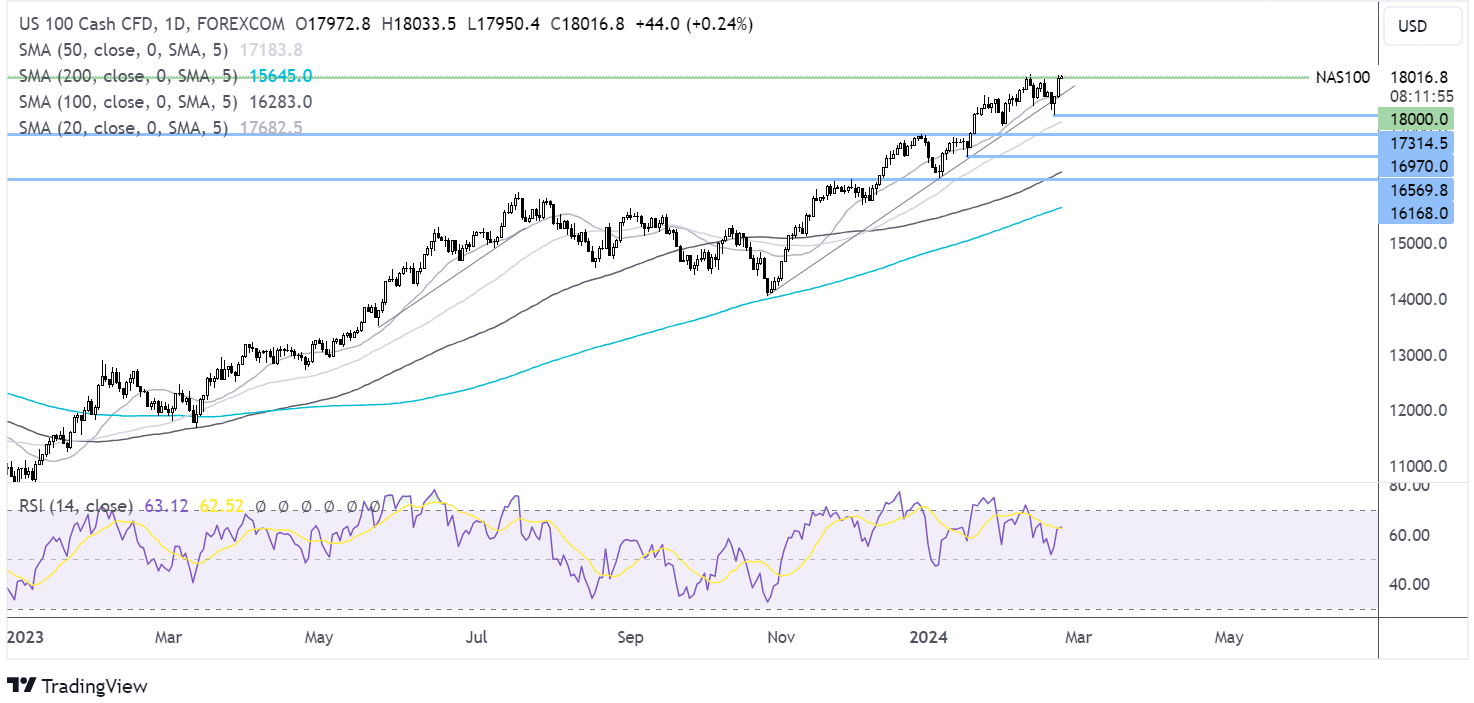

Nasdaq 100 forecast – technical analysis

The Nasdaq 100 rose above its trendline and is hovering around its previous record higher, above 18,000, but has struggled to move past this key level. There could be a period of consolidation after the recent steep run higher. Buyers will look to lift the price into unchartered territory and fresh all-time highs. Support can be seen at 17650 yesterday’s low and 17000 round number.

FX markets – USD is falling, GBP/USD rises

The USD Is falling amid a lack of fresh economic data. The USD is on track for its first weekly fall in 2024 after almost two months of gains on expectations that the Federal Reserve will only start to cut interest rates later in the year.

EUR/USD is rising, capitalizing on the weaker U.S. dollar despite data showing that the German economy contracted -0.3% in the final quarter of last year and after Ifo German business climate ticked higher to 85.5 in line with forecasts.

GBP/USD is rising to 127 despite UK consumer confidence unexpectedly ticking lower in February to -21 amid concerns over persistent inflation. Yesterday, data suggested that the UK was already out of recession, with the PMI rising to a nine-month high.

Oil falls on worries over high rates for longer.

Oil prices are falling over 1.5% and are set to fall 2.5% across the week after two straight weeks of gains.

Data showed that US crude oil stockpiles rose 3.6 million barrels in the week ending February 16th, although gasoline stocks edged lower by 0.3 million barrels.

Oil prices have come under pressure this week amid expectations that the Federal Reserve will keep interest rates high for longer which could hurt the oil demand outlook.

.