- Gold analysis: Metal tests key $2K resistance

- Elevated yields, strong dollar holding gold back

- Focus will turn to FOMC rate decision on Wednesday

In the last couple of sessions, gold has struggled to move north of the key $2000 mark following its recent gains. Though the metal hasn’t exactly sold off or raced away from this level, the bulls would argue that its relative steadiness may be a sign of strength, especially when you consider the fact that dollar has further extended its advance against the yen and made a comeback against most other currencies on Tuesday. We have seen further improvement in US data, and so far, this has also been shrugged off by gold investors looking to push the metal more decisively above the $2K level this time. But it remains to be seen whether they will succeed, with the metal coming off its best levels at the time of writing.

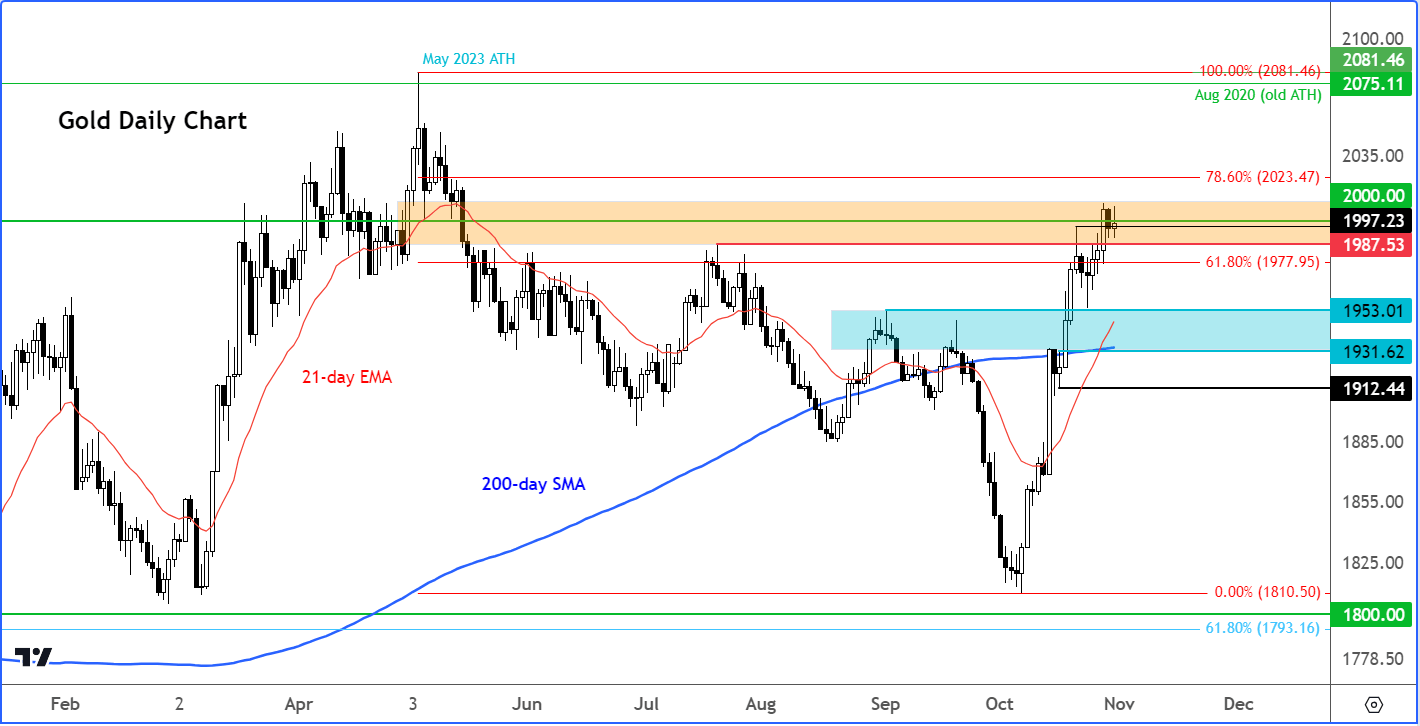

Before discussing the macro factors further, let’s have a quick look at the chart of gold.

Gold analysis: Metal tests key $2K resistance

Source: TradingView.com

Bang in the middle of the 61.8 and 78.6 percent Fibonacci retracement levels, lies the $2K psychologically-important level. I wouldn’t be surprised if the metal were to show some weakness here, given that oil prices have also weakened. A bit of weakness, though, shouldn’t damage the overall bullish price structure. However, if we see a move below $1953, the low from last week, then that would be a bearish development since prices will have formed a short-term lower low.

Elevated yields, strong dollar holding gold back

November is typically not a strong month for gold, and with global interest rates seen remaining high for longer, the opportunity cost of holding onto something that doesn’t pay any interest or dividends is high. This makes it difficult to be positive on gold’s outlook, at these levels.

However, you also have a growing list of concerns that continue to boost the appeal for haven assets like gold. Among them are raised geopolitical risks owing to the situation in the Middle East, while you also have concerns over the health of the US stock markets and ballooning US debt – and their growing servicing costs.

So, it is a question of whether the safe haven appeal of gold will outweigh the negative influences mentioned. But with oil prices having weakened, investors are perhaps focusing less on the Middle East situation. Therefore, for gold to hold its ground, we will need to see the dollar start trending lower again.

Gold bugs are hoping that the sharp repricing of “higher for longer” US interest rates narrative will soon be fully priced in. Judging by the dollar recovery on Tuesday on the back of even more improvement in US data, questions remain over this thesis. What we haven’t seen yet is consistent weakness in US data to completely rule out further rate increases from the Fed and to allow investors to look ahead to the inevitable rate cuts.

Given that that we will have some more important data releases later in the week and the Fed’s rate decision is on Wednesday, the most likely outcome is that gold may weaken a little bit and drop back below the $2K mark. At best, a consolidation around $2K would not disappoint the bulls.

Focus will turn to FOMC

The Fed has kept the door to one more rate hike open. But the market seems convinced there will be no more hikes, certainly not at Wednesday’s meeting. The probability of a hike in the next meeting in December was around 20% last week. Those odds could increase or decrease sharply depending on how hawkish or otherwise the Fed is going to be this week. But a lot will also depend on incoming data.

We have seen plenty of forecasting-beating US data of late. Today, CB consumer confidence, two measures of house prices and Employment Cost Index all came in ahead of expectations. Last week saw the UoM’s consumer sentiment, pending and new home sales, GDP and both manufacturing and services PMIs all top expectations. The week before it was retail sales, industrial production and jobless claims data that had beaten expectations. So, the US economy is showing continued resilience in the face of high interest rates, putting the Fed in a slightly difficult position as to whether it should tighten its belt even further, or just keep rates at these current levels for a longer-than-expected period of time. A growing number of analysts and economists seem to agree with the latter approach. Let’s see if this is something that the Fed alludes to at this meeting.

One reason why the Fed is unlikely to raise rates again is the recent rise in long-term bond yields, which effectively is equivalent to a couple of additional rate hikes. This could all be in the price. Forward-looking investors are perhaps thinking that if interest rates stay high, the eventual rate-cutting cycle that will inevitably follow will be more pronounced than would otherwise be the case.

But let’s not get too ahead of ourselves. Let’s see whether and how the trend of the US data will evolve, starting with the monthly jobs report and ISM services PMI, both due on Friday.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade