EUR/USD rises as the USD rally pauses

- EUR/USD recovered after mixed ECB messages

- US jobless claims are set to rise to 214k from 211k

- EUR/USD recovers from 2024 low

Your U.S. dollar is rising for a second straight day towards 107 as the recent rally in the US dollar pauses and after messaging some less dovish Med messaging from ECB policymakers.

The US dollar is easing away from 5-1/2-month highs, and the 10-year treasury bond yield fluctuates around 4.6%.

The US dollar is experiencing some profit-taking after a strong rally. However, the near-term outlook for the USD remains bullish, supported by signs of a robust U.S. economic economy and rising expectations that the Fed will keep interest rates high for longer.

Today, the attention will be on US jobless claims in Philadelphia-fed manufacturing and several Fed policymakers due to speak in the American session.

Recent Fed policymakers have raised questions over the central bank’s need to cut interest rates anytime soon. More hawkish commentary could boost the USD higher.

Meanwhile, gains in the euro may be limited after ECB Vice President Luis De Gunidos said reducing monetary restrictions could be appropriate if inflation conditions are met.

Data yesterday showed that eurozone inflation cooled to 2.4% year over year in March, down from 2.6% in February. Meanwhile, ECB president Christine Lagarde said earlier in the week that the ECB will cut rates soon, barring any major surprises. Still, she also noted that the region's economy is showing some signs of recovery.

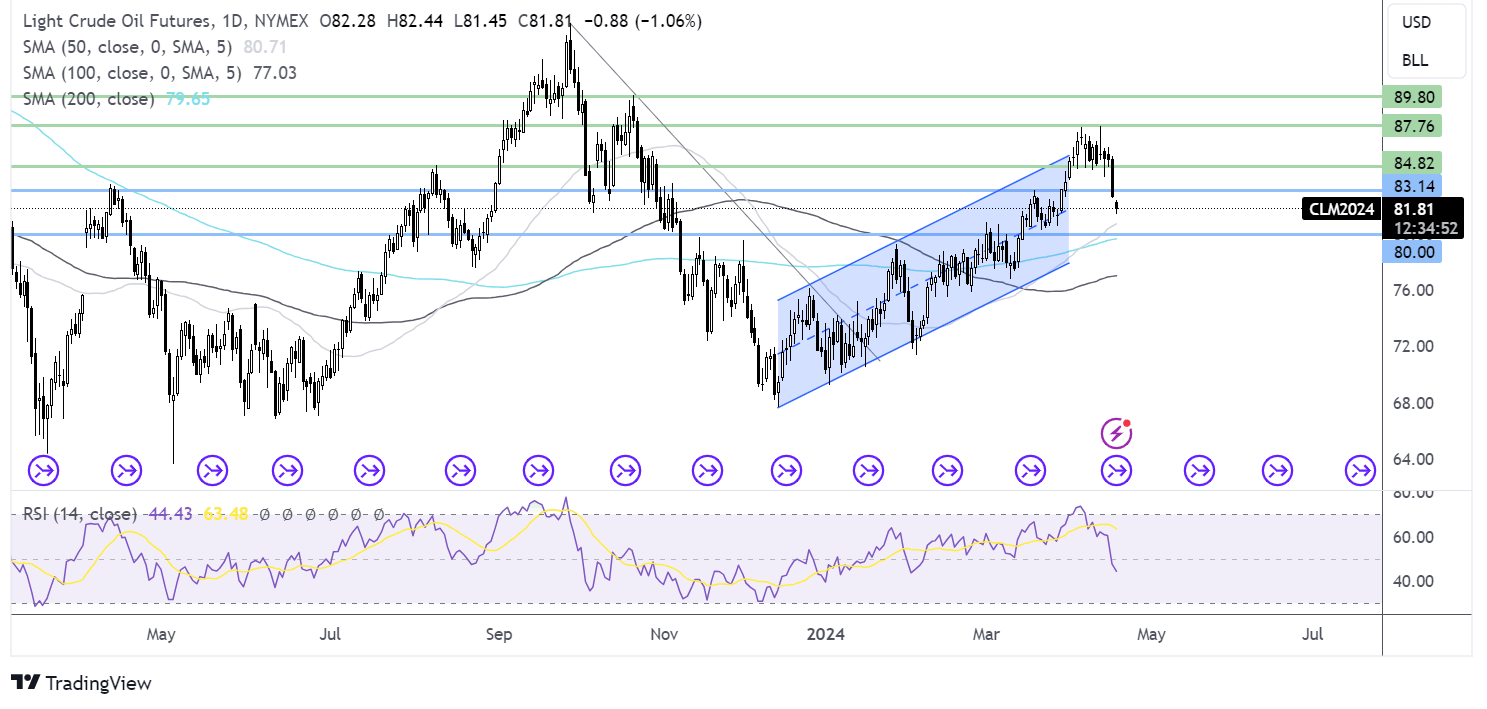

EUR/USD forecast – technical analysis

EUR/USD rebounded off 1.06, the April low, and falling trendline support, retaking 1.0640, the March 2023 low, as it heads towards 1.07.

Should buyers extend this momentum above 1.07, the February low, bulls will test 1.0725, the December low, ahead of 1.08, and the 200 SMA at 1.0840.

Meanwhile, immediate support can be seen at 1.0640, and a break below 1.06 creates a lower low.

Oil steadies after a sharp drop

- US oil inventories rose by 2.7 million barrels.

- Middle East risk premium has eroded.

- Oil falls below 83.10 support.

Oil prices have stabilized after a steep sell-off in the previous session as concerns over the demand outlook grow and on signs that the broader conflict in the Middle East may be avoided.

Oil fell 3% due to concerns about slowing oil consumption and a shaky demand outlook after rising US crude oil inventories amid signs of flagging economic growth in China.

The US crude oil inventories rose by 2.7 million barrels in the week ending April 12th, double analysts forecast of a 1.4 million barrel rise.

Meanwhile the prospect of high US interest rates for longer as the Fed struggles to contain persistent inflation also hurts the oil demand outlook.

Oil consumption so far in April is around 200,000 barrels per day, below the forecast of 101 million barrels per day.

At the same time, the risk premium on oil prices is falling as investors see a lower probability that Israel will retaliate against Iran's attack last weekend. The attack was in response to an attack on the Iranian consulate in Syria at the start of April.

Oil prices are now back to levels before the April 1st attack on the Iranian consulate, suggesting that the oil risk premium has been removed.

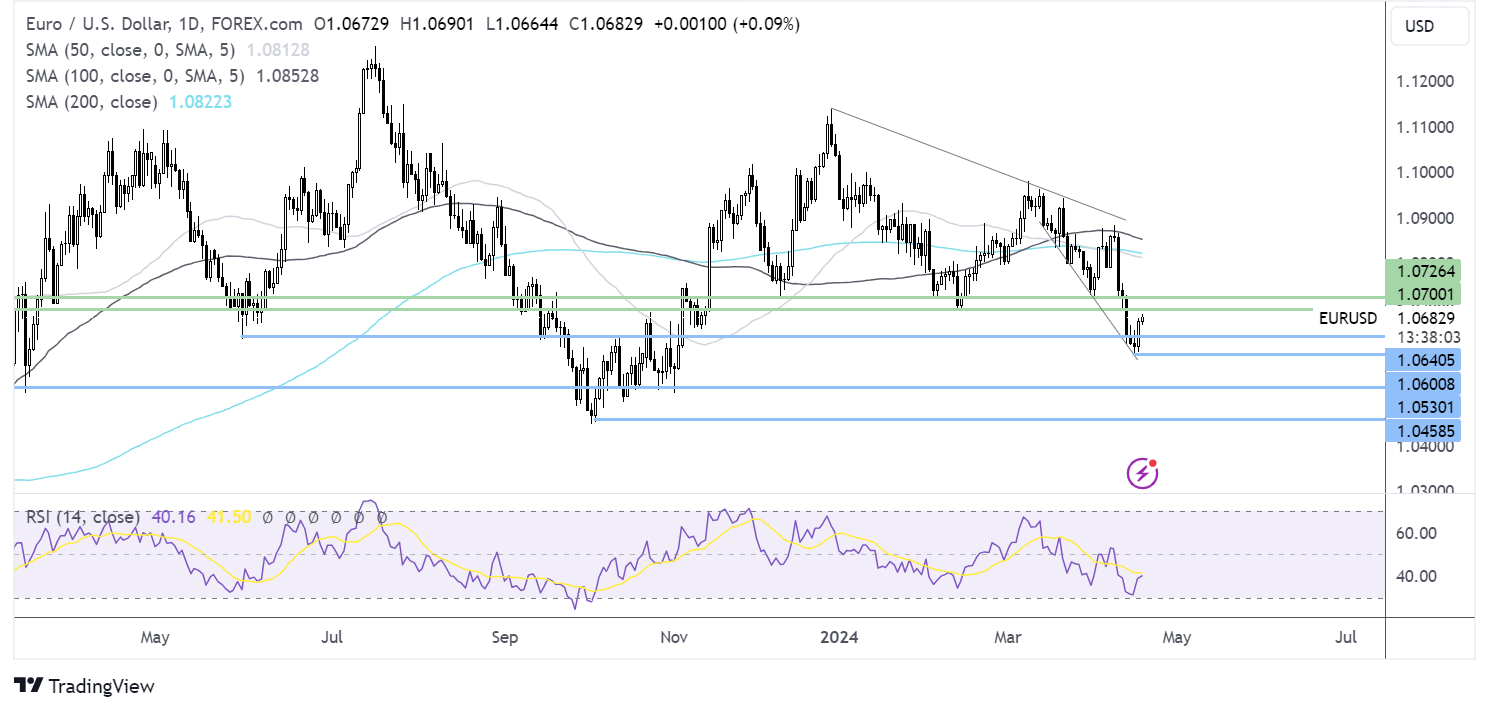

Oil forecast - technical analysis

After a period of consolidation, oil has broken down support at 85.00, the lower bottom of the holding pattern, and 83.10, the April 2023 high. This, combined with the bearish crossover on the MACD, keeps sellers hopeful of further losses.

Sellers will look to test 80.00, the psychological level, and the 200 SMA.

On the flip side, any recovery will look to rise above 83.10 to extend gains back up to 85.00.